Forbes 1 under 1.5B | Mercenary @1deltaDAO | Contributor @actualonexyz | Prev. @HashedEm x @W2_Community

How to get URL link on X (Twitter) App

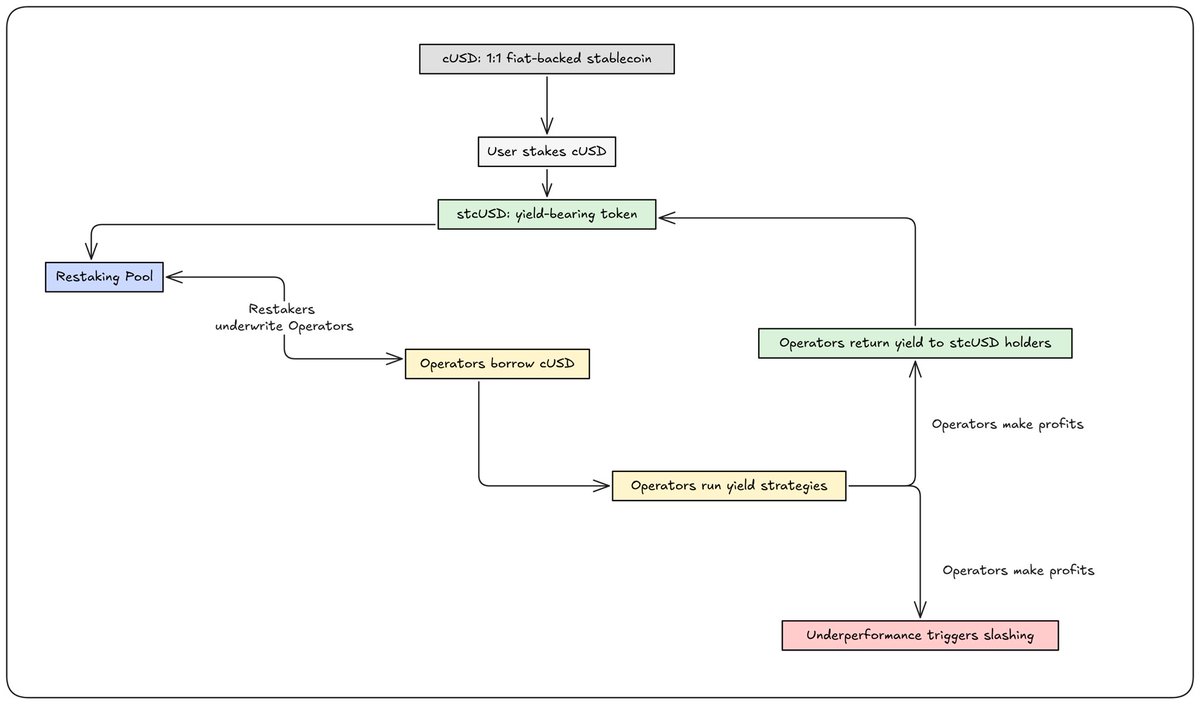

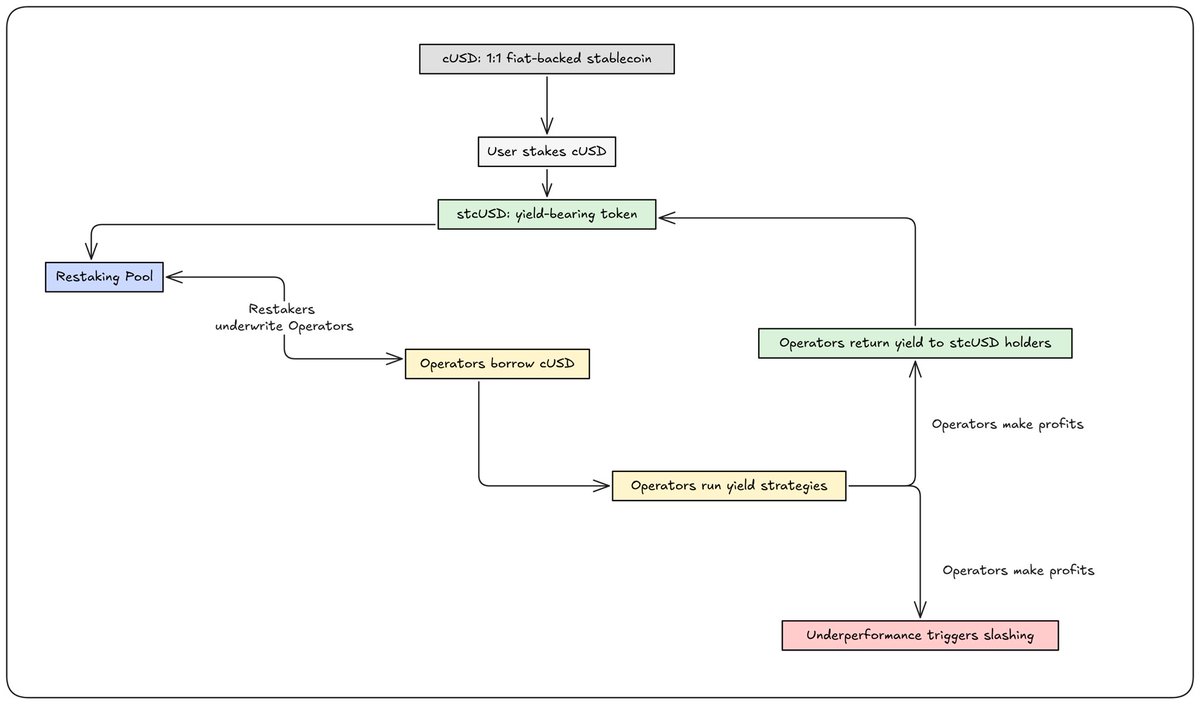

Institutions are watching yield-bearing stablecoins. Closely.

Institutions are watching yield-bearing stablecoins. Closely.

https://twitter.com/capmoney_/status/1925928875000742390

Why are they building this? I think it's because:

Why are they building this? I think it's because:

So, what is Polymarket? If you haven’t heard of it, you’re about to.

So, what is Polymarket? If you haven’t heard of it, you’re about to.