Deputy Director @DelorsBerlin | Think-tanking on European fiscal, industrial and economic policy | PhD alumnus @IPZuser

How to get URL link on X (Twitter) App

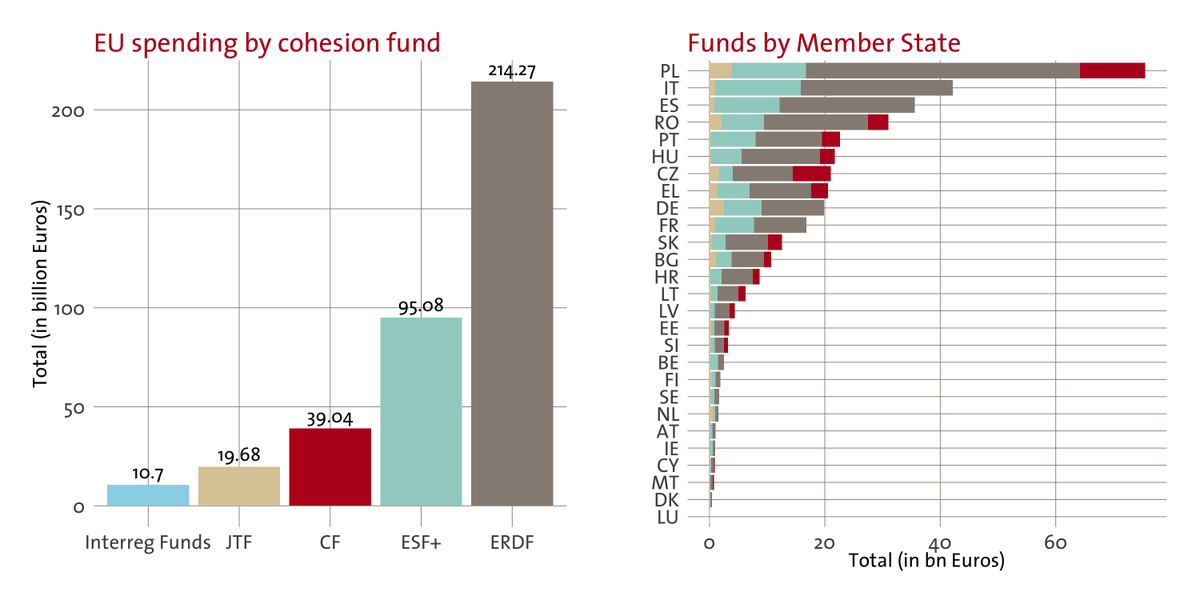

https://twitter.com/Mij_Europe/status/1504870236620787753First, what are the goals of more EU spending? So far, there are two. In the short-term, the EU needs to safeguard a joint position toward Putin. Since the costs of sanctions etc. are going to be split unevenly, pandemic-like burden-sharing may be needed. shorturl.at/mMVX7