Investor | Entrepreneur | Startup Co-founder funded by Google & Govt. of India 🇮🇳 | Non-SEBI | 15+ years of Mistakes | Risk Taker

Avoid DMs | No Tips

2 subscribers

How to get URL link on X (Twitter) App

For such concall insights, you can join us here

For such concall insights, you can join us here

P N Gadgil Jewellers | IPO Interview + KYC

P N Gadgil Jewellers | IPO Interview + KYC

TRIL was trading at 174 then back then

TRIL was trading at 174 then back then https://x.com/niveyshak/status/1723330421440524479

Modi's Speech COP 2026 | Why is it ‘Panchamrit’

Modi's Speech COP 2026 | Why is it ‘Panchamrit’

Bharat Heavy Electricals

Bharat Heavy Electricals

Aggressive Purchase from promoters and non-promoters

Aggressive Purchase from promoters and non-promoters

https://twitter.com/niveyshak/status/1662802250467627014

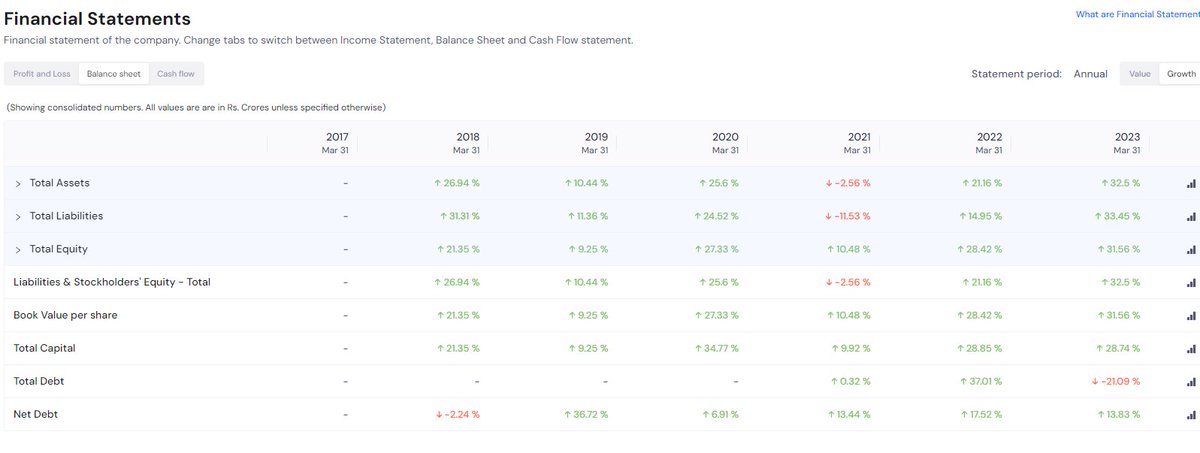

👉Financials have improved further

👉Financials have improved further

https://twitter.com/niveyshak/status/1565726758631903232

Attaching update from @Nigel__DSouza

Attaching update from @Nigel__DSouza https://twitter.com/Nigel__DSouza/status/1650711906657894402?s=20

https://twitter.com/niveyshak/status/1631752499765059584Cocoblu Retail Ltd., a wholly owned subsidiary of RattanIndia Enterprises Limited, is one of the largest online sellers in India across multiple product categories and committed to scaling up brands and helping them reach their true potential through digital channels.

- PnL

- PnL