Flaneur: probability (philosophy), probability (mathematics), probability (real life),Phoenician wine, deadlifts & dead languages. Greco-Levantine.Canaan. #RWRI

598 subscribers

How to get URL link on X (Twitter) App

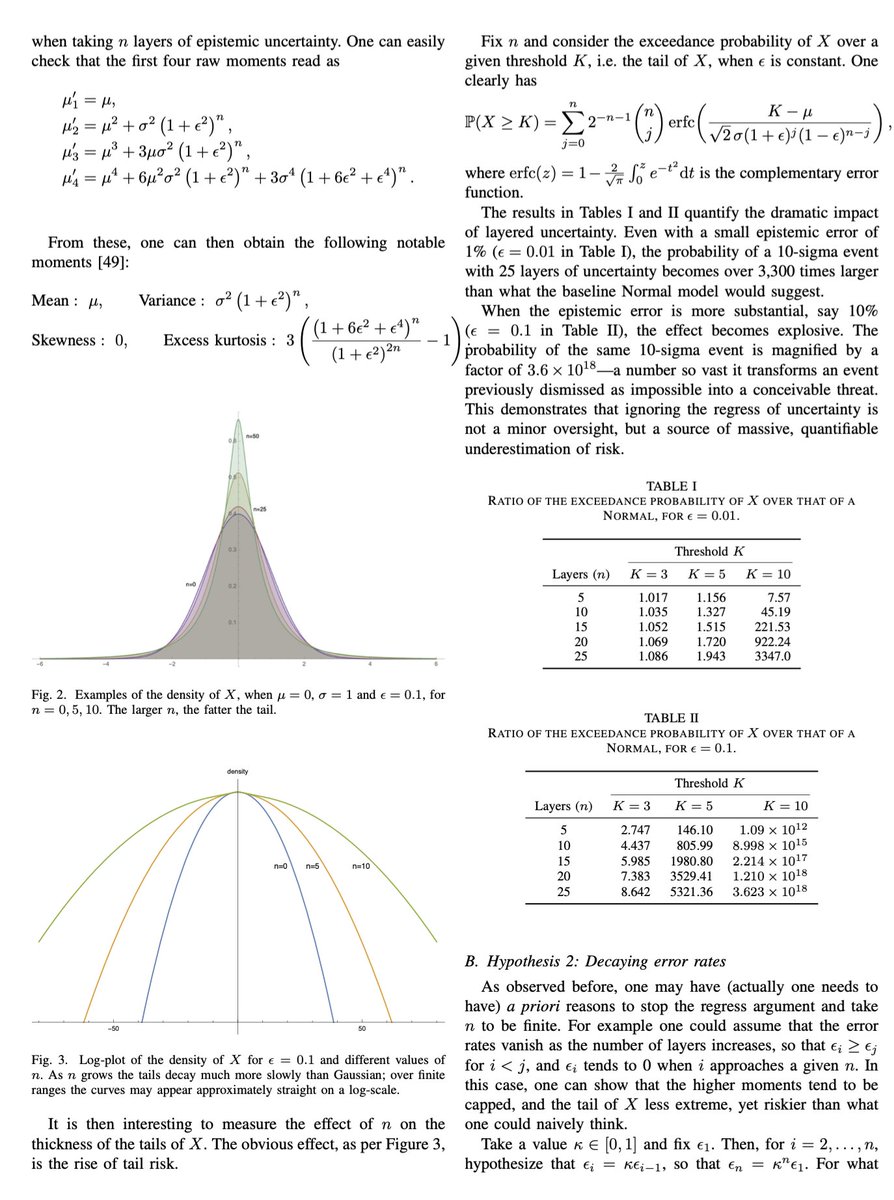

2/My most important paper ever: How uncertainty (errors on errors) fattens the tails. Connects to all epistemological traditions. w/@DrCirillo

2/My most important paper ever: How uncertainty (errors on errors) fattens the tails. Connects to all epistemological traditions. w/@DrCirillo

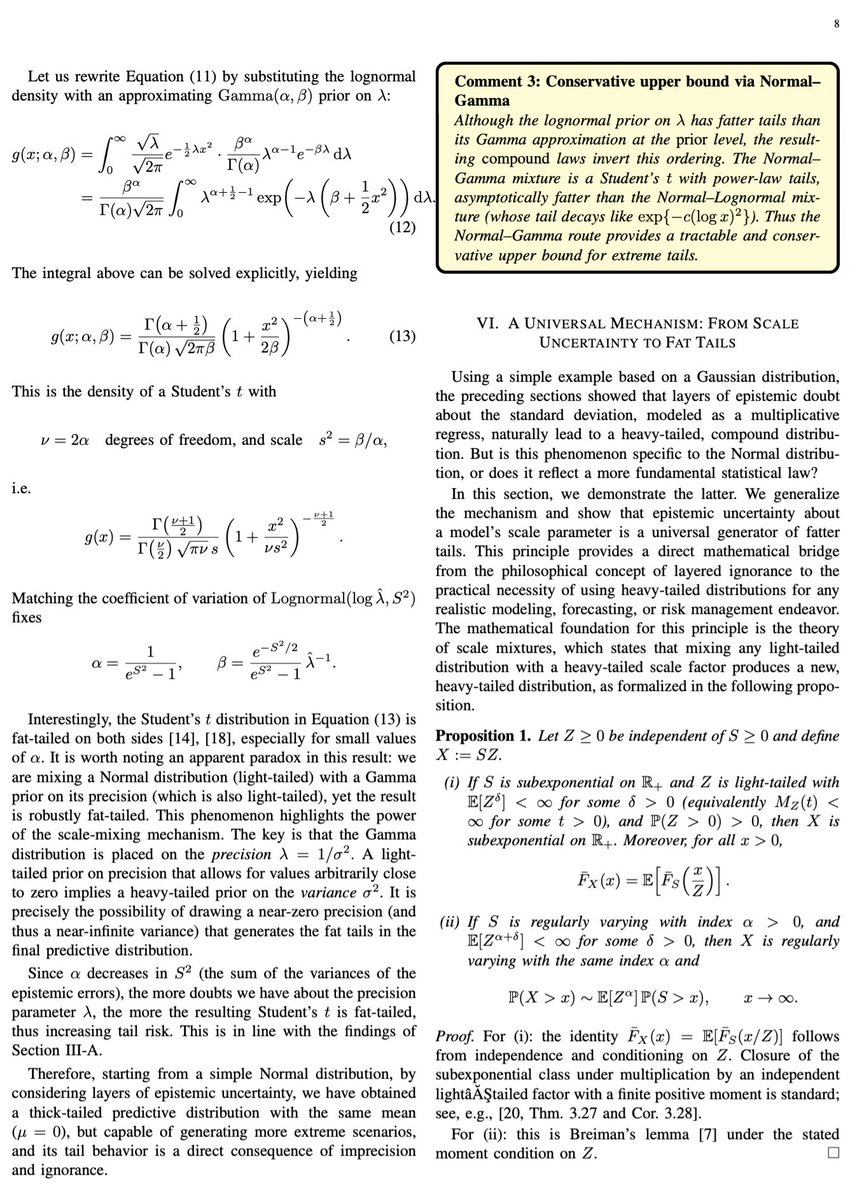

https://twitter.com/krish_bohra/status/1945088163908653254Caveat: many great writers don't necessarily have 5 great books, often because their books are long (Tolstoi, Proust, depending on how you count) or they are, like Borges, so great, that they have ~~1 or 2 great books (depending again how you aggregate the short stories).

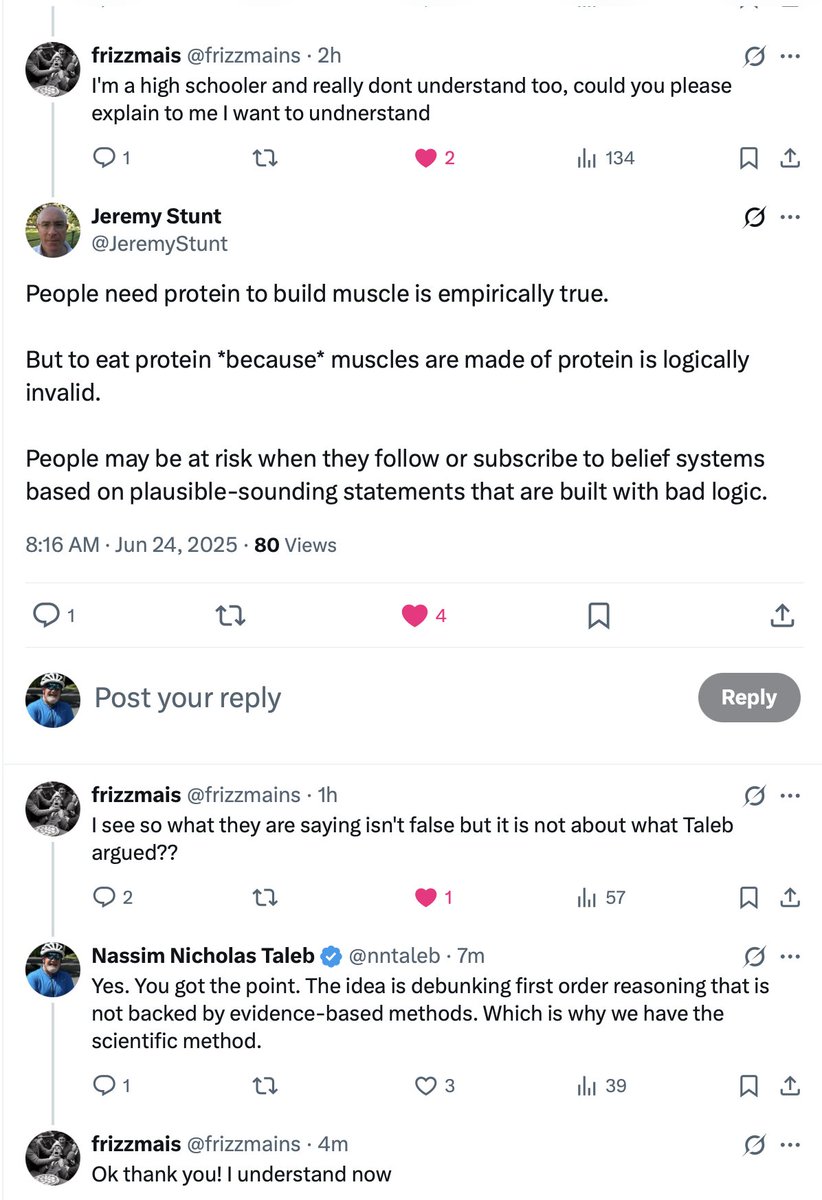

2) Sometimes the protein thing can be too obvious to bust. These "protein chips" have a lower proportion of protein than... bread.

2) Sometimes the protein thing can be too obvious to bust. These "protein chips" have a lower proportion of protein than... bread.

https://twitter.com/Paddy_Barrett/status/19337972016390554002) h/t @alexbakus

https://x.com/EricTopol/status/1920888866372022464

https://x.com/ishirubi/status/1887064343398822240

https://twitter.com/SwipeWright/status/18584037798104024282) The asymmetry: it is when you go against time that you must prove reliability, not the reverse. Why? Because nature & time have near infinite stat significance.

In their criticism of Attia in the New Yorker, both Emanuel and Dhruv did not seem to understand the data (nor its properties above).

In their criticism of Attia in the New Yorker, both Emanuel and Dhruv did not seem to understand the data (nor its properties above).

https://twitter.com/CensoredMen/status/17403839907781430222) My nightmare. Because I argued it was fake news like the fake protocol.

https://twitter.com/richarddawkins/status/12289436869536645122/My point is that it is not just immoral to breed humans; it is ineffective principally because humans are not just animals!

I am using entropy in a broader sense, focusing on ignorance.

I am using entropy in a broader sense, focusing on ignorance.

https://twitter.com/ThomasSowell/status/1612969551947530240Misinformation: propagandists present a partial piece of information, factually correct, as a general attribute of the system.