How to get URL link on X (Twitter) App

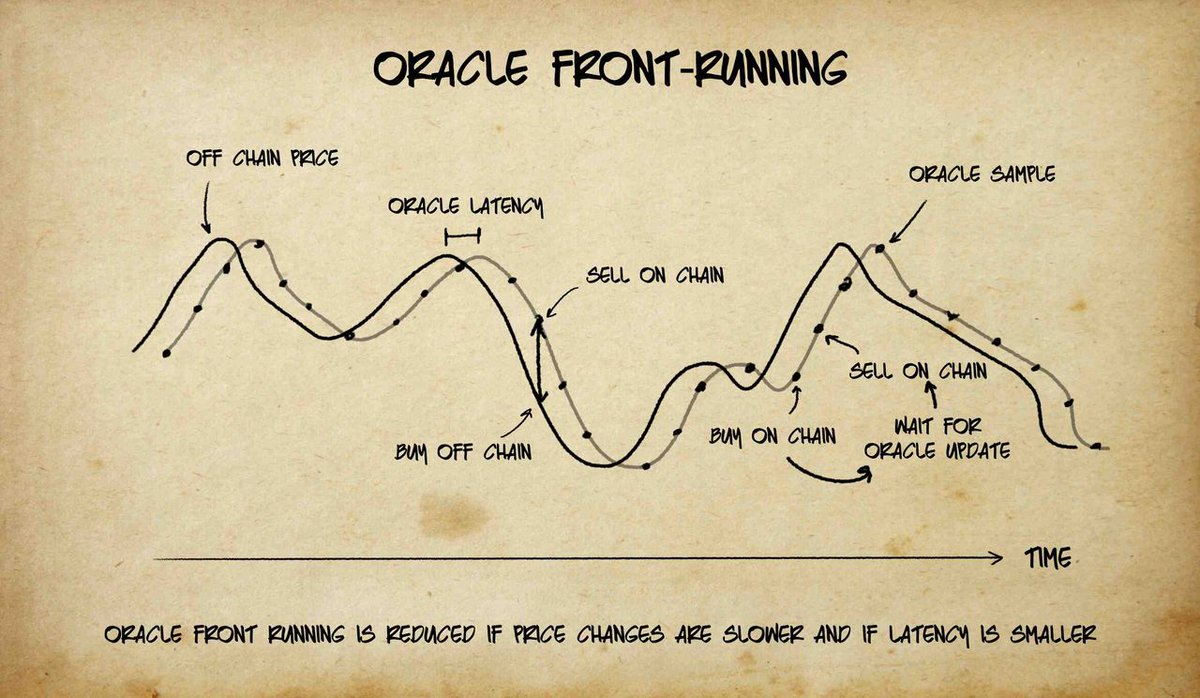

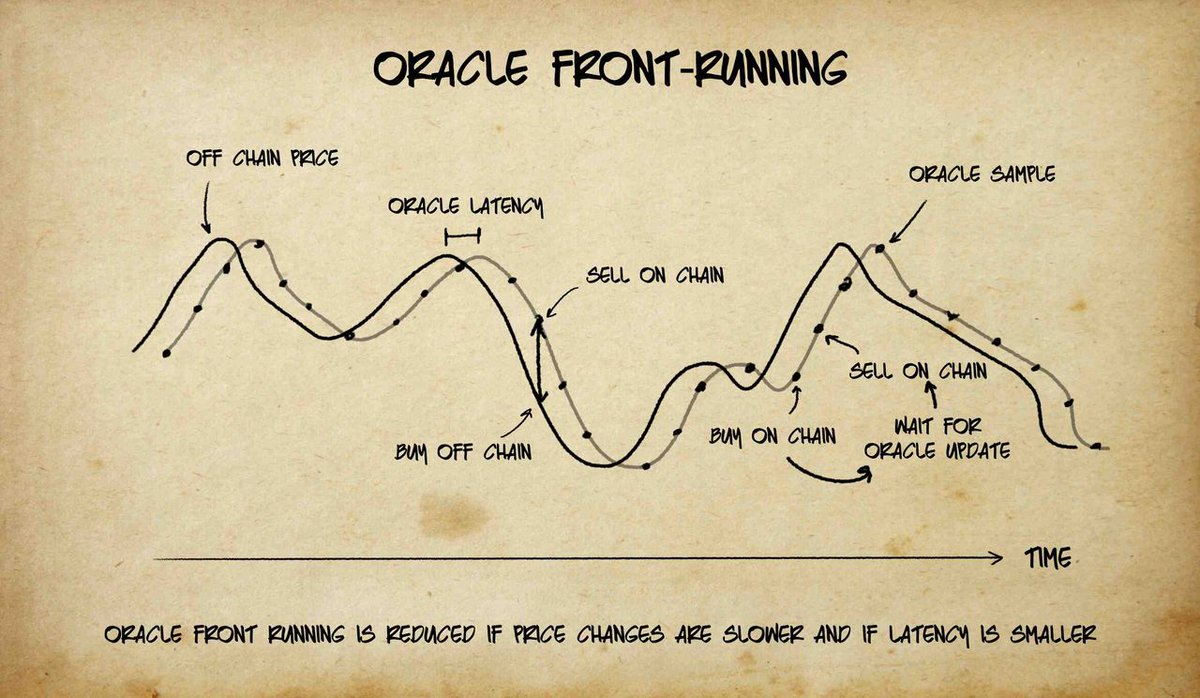

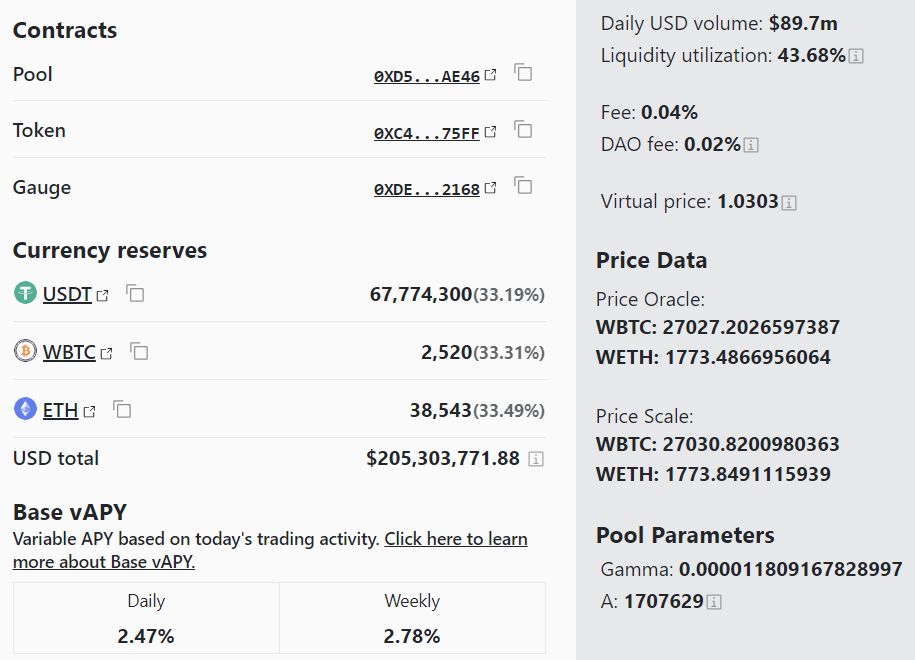

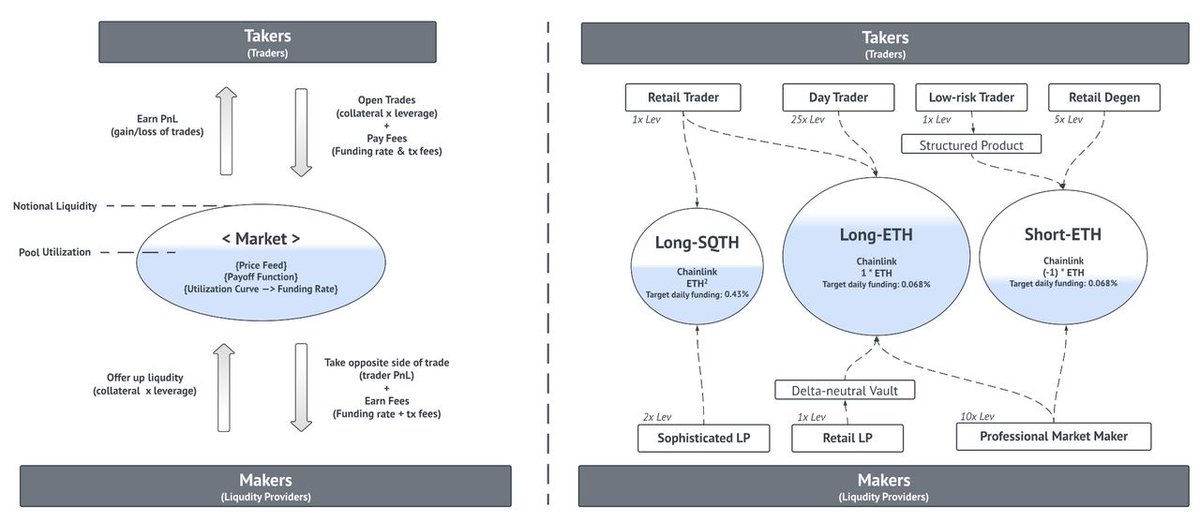

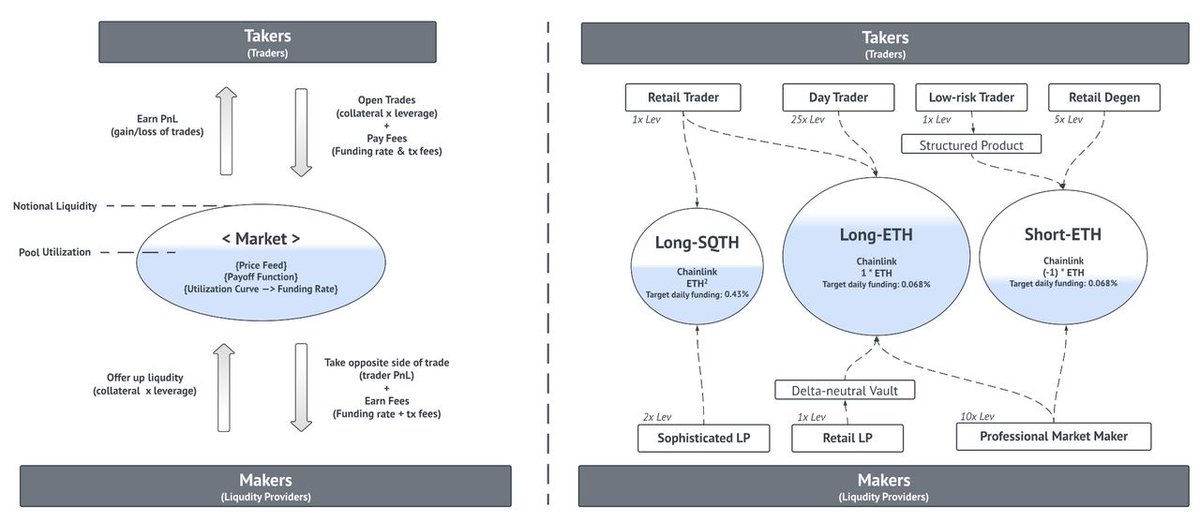

https://twitter.com/ologai/status/1653761374282039296An oracle-based AMM sets the exchange rate based on prices coming off-chain.

If you want to know the basics about oracles, check my thread about it.

If you want to know the basics about oracles, check my thread about it.https://twitter.com/ologai/status/1549688860996689920

https://twitter.com/ShivanshuMadan/status/1629405908391325697@ShivanshuMadan Edgy explains how to find gems using DefiLlama.

https://twitter.com/thedefiedge/status/1629508371987693568

https://twitter.com/DeFiMinty/status/1610690107136262145

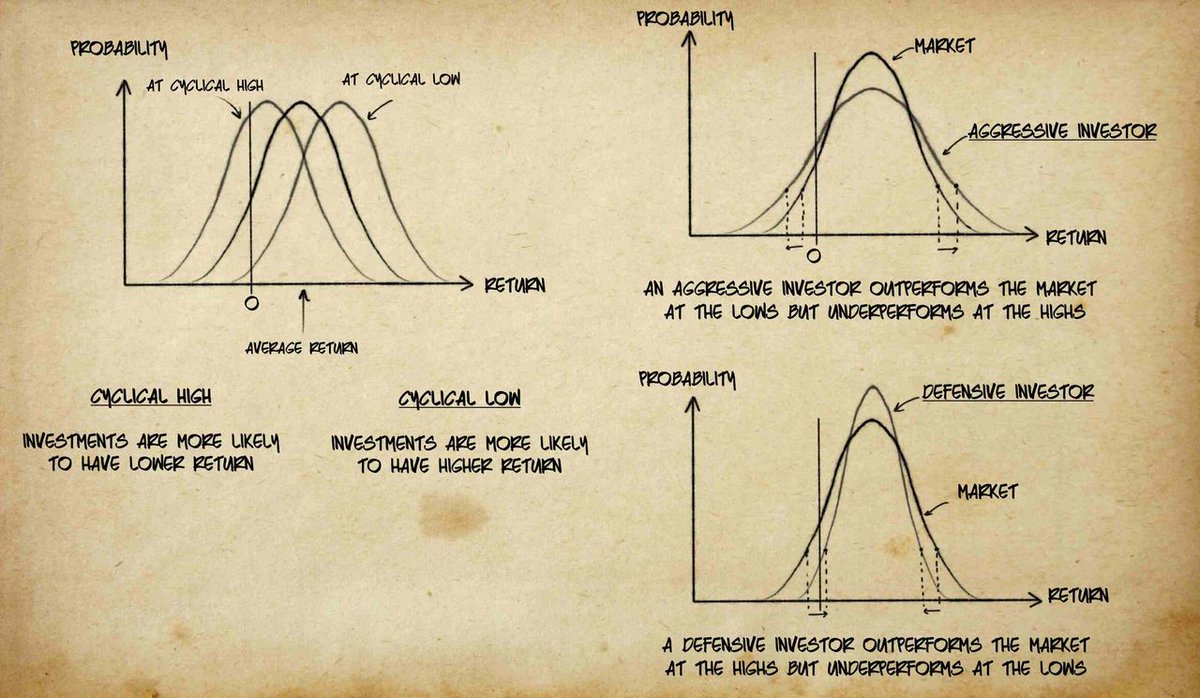

https://twitter.com/ologai/status/1610652318592126979🔷 How to know where we are?

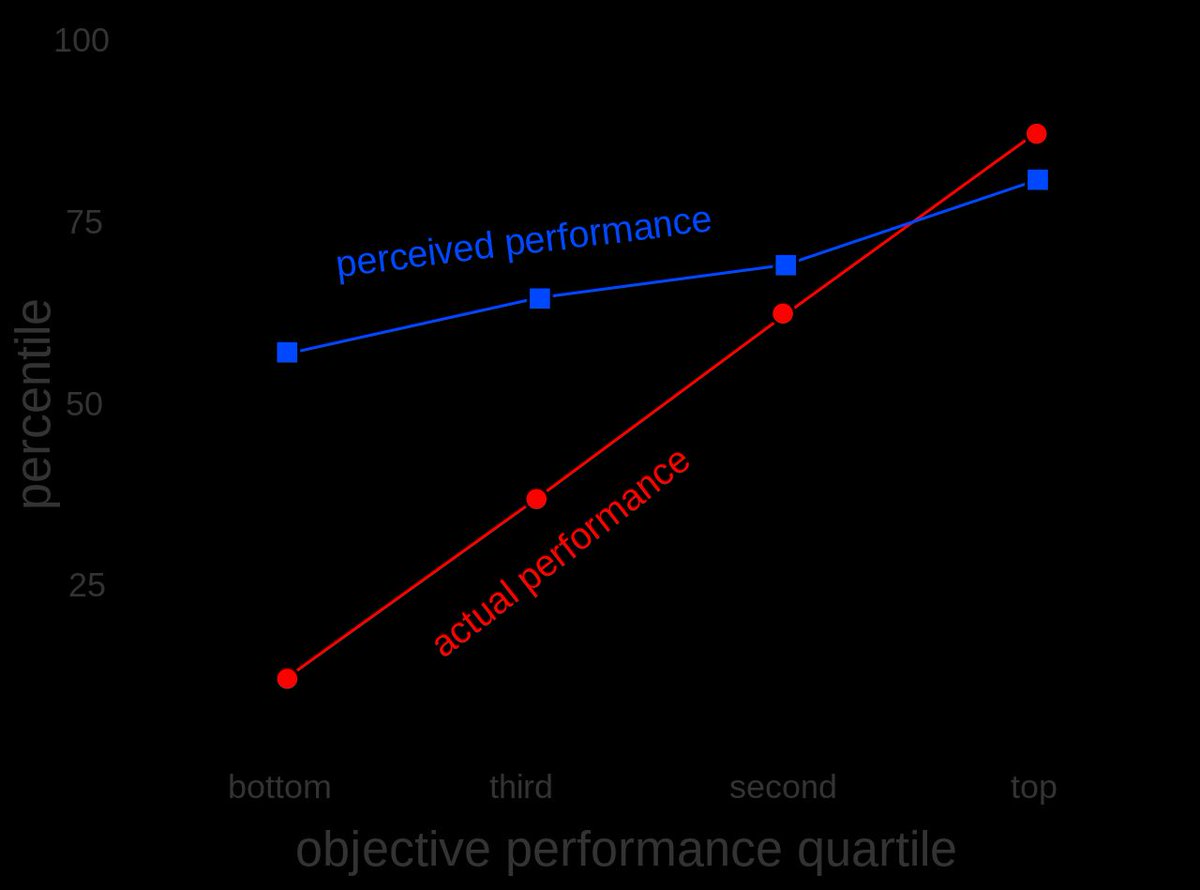

The efficient market hypothesis states that any investment with a return above average will be exploited by participants, leading to more competition and eliminating that above-average return.

The efficient market hypothesis states that any investment with a return above average will be exploited by participants, leading to more competition and eliminating that above-average return.https://twitter.com/ologai/status/1598693532067299329

https://twitter.com/milesdeutscher/status/1608447206683709440@milesdeutscher And another 22 from @thedefiedge?? Some overlap though.

https://twitter.com/thedefiedge/status/1605915718716772352

A bottom-up approach is one where a protocol provides a liquidity layer from where other DEXes can fetch.

A bottom-up approach is one where a protocol provides a liquidity layer from where other DEXes can fetch.https://twitter.com/perenniallabs/status/1600511485150580736

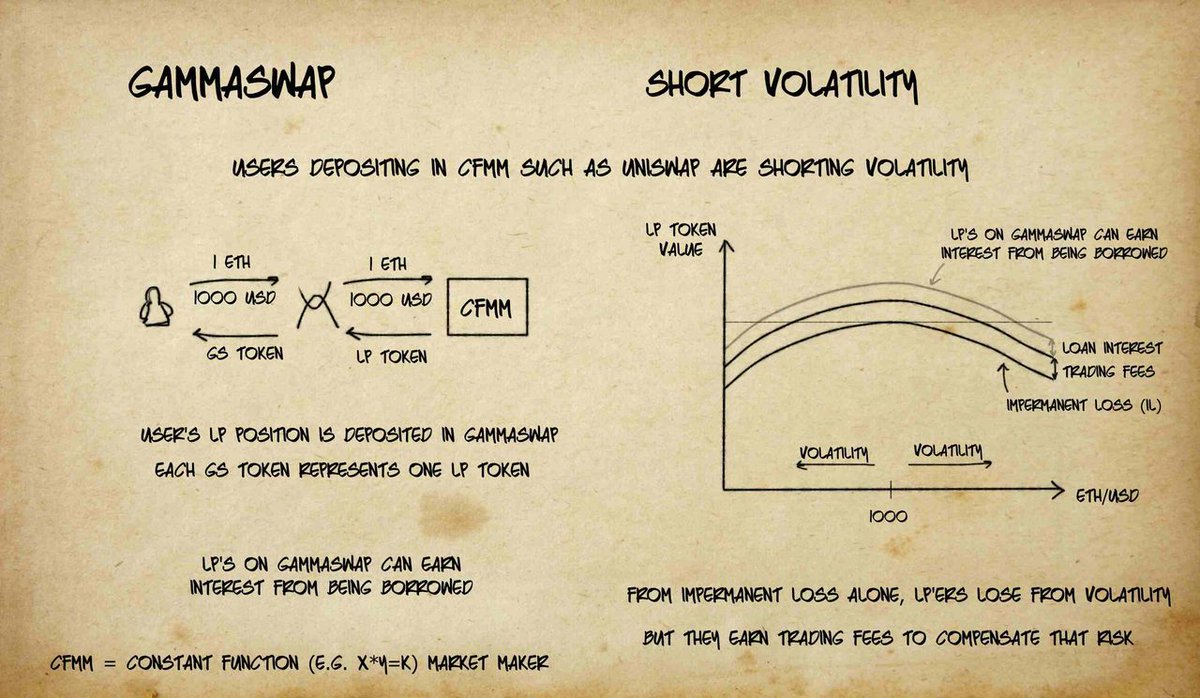

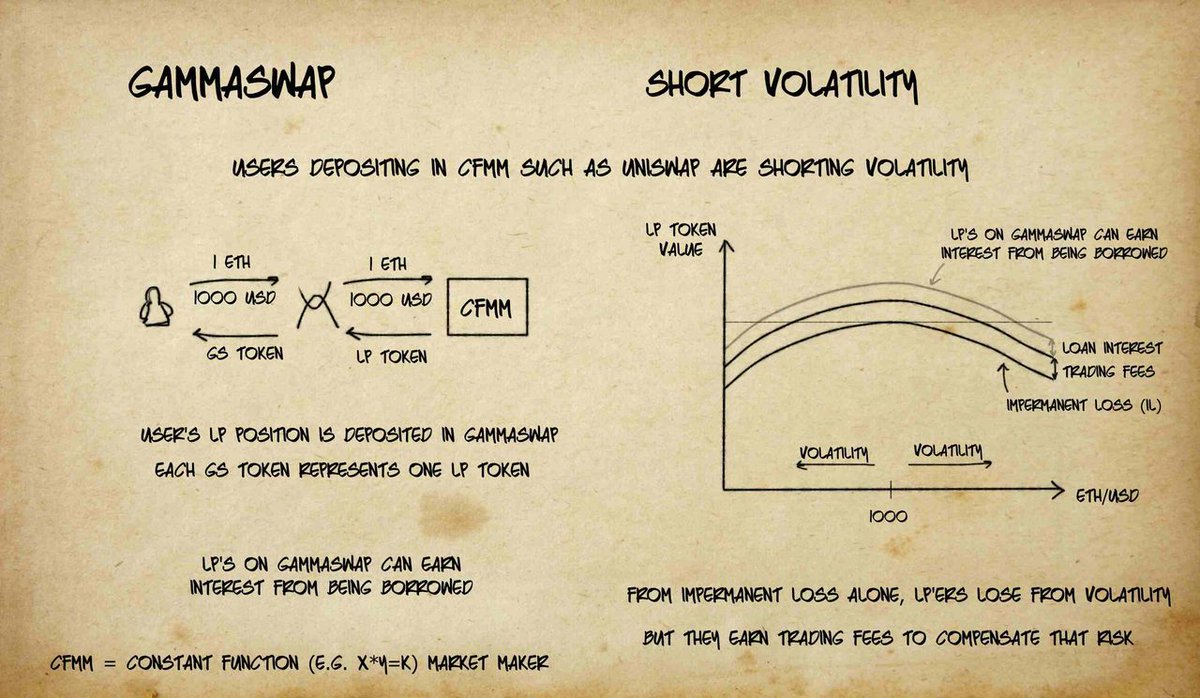

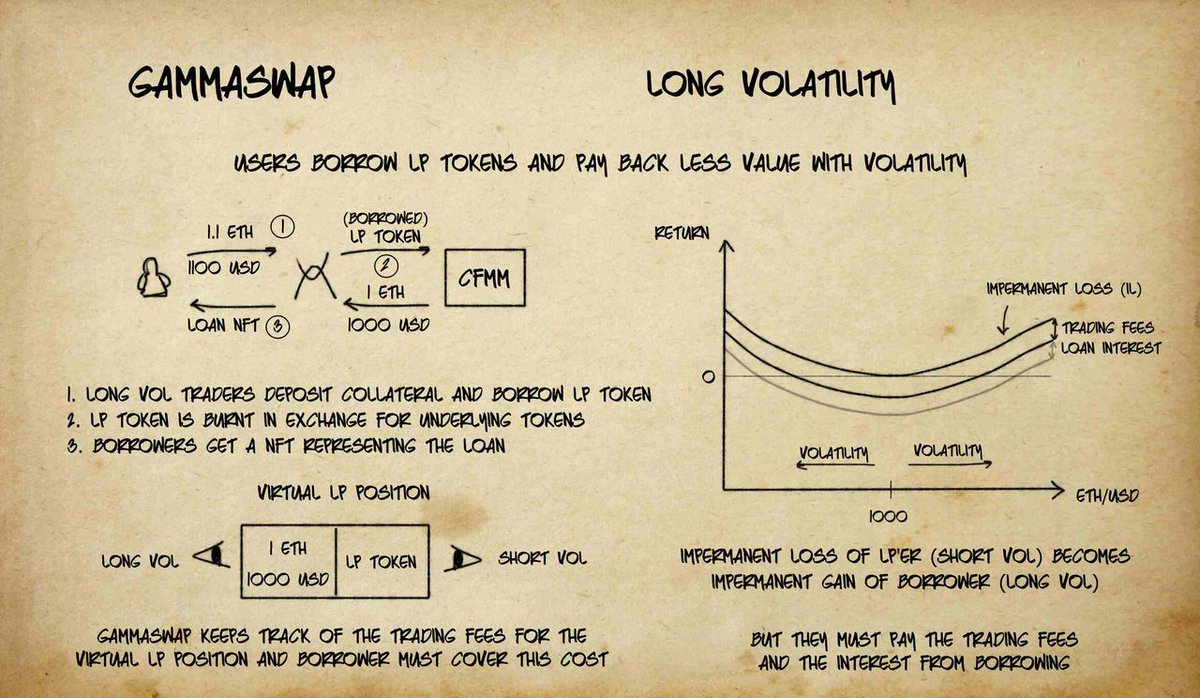

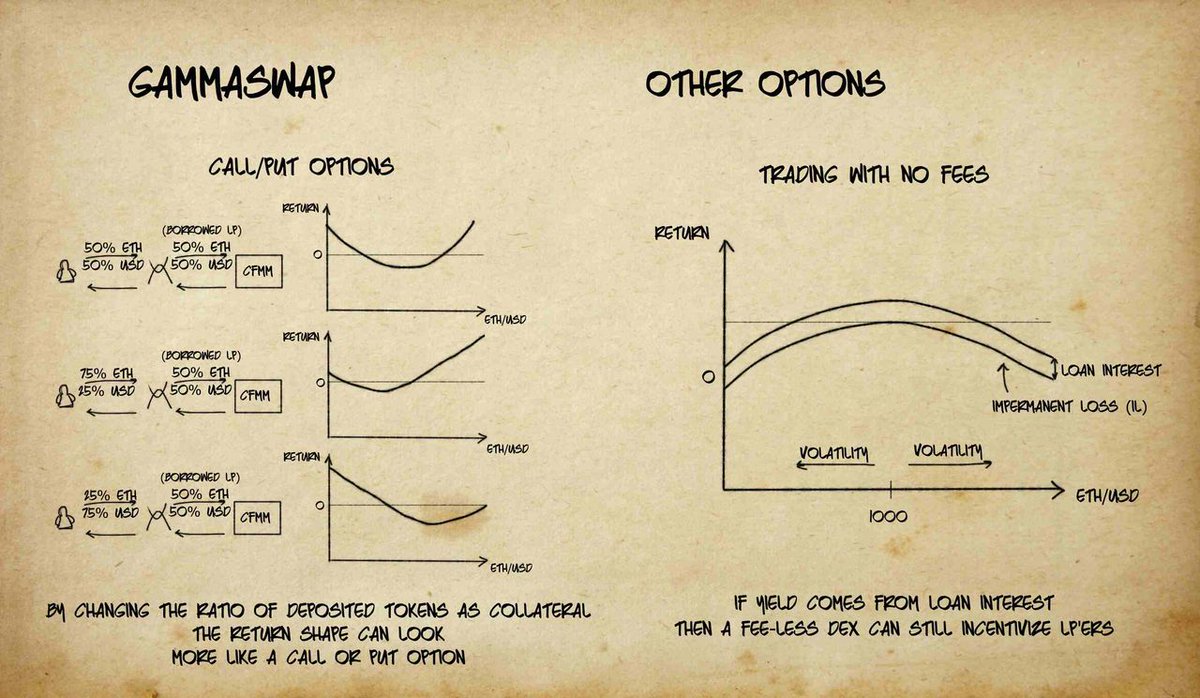

@GammaSwapLabs GammaSwap is a volatility DEX.

@GammaSwapLabs GammaSwap is a volatility DEX.https://twitter.com/CryptoKaleo/status/1598413205864259584@CryptoKaleo A comprehensive thread exposing the case that a stock market crash may be imminent and bonds may rally.

https://twitter.com/leadlagreport/status/1598784326056873986

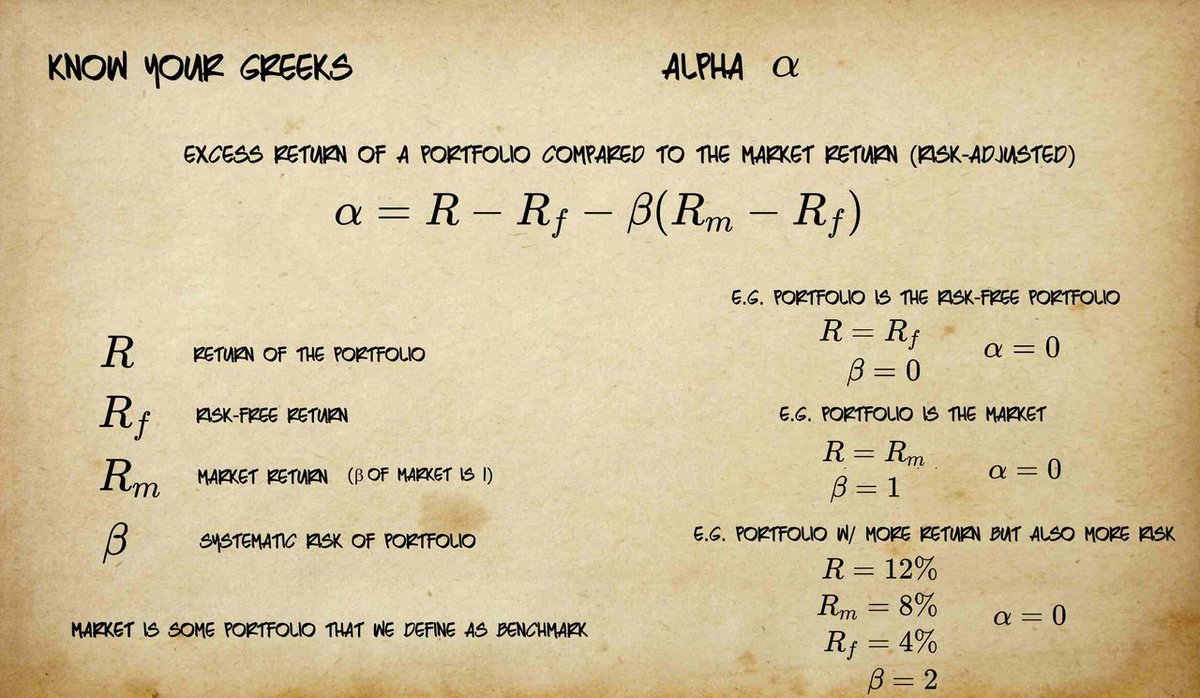

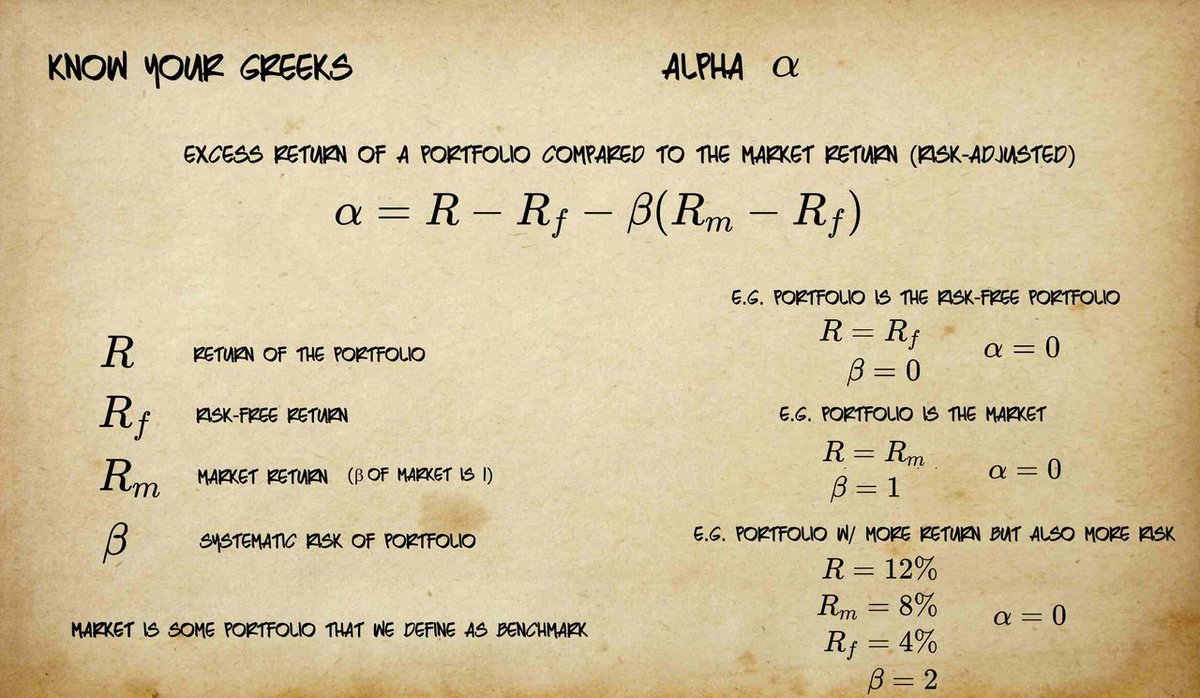

🔷 Alpha

🔷 Alpha

https://twitter.com/CapDotFinance/status/1597234346473426944

@CapDotFinance CAP v4 is a complete revamp of v3.

@CapDotFinance CAP v4 is a complete revamp of v3.

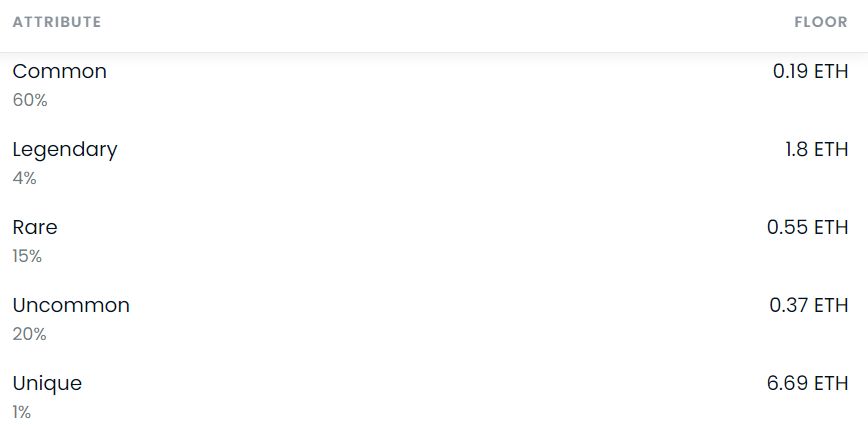

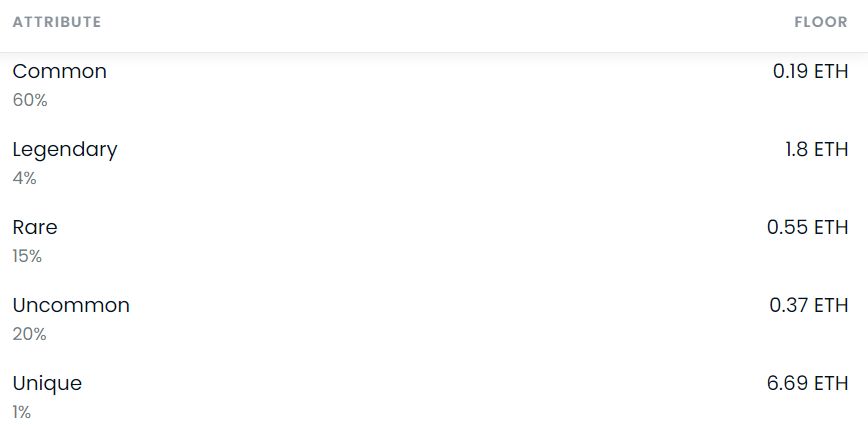

https://twitter.com/ologai/status/1575773241922260992@insrtfinance If you minted one NFT and you were one of the lucky 40%, you would actually be in profit.

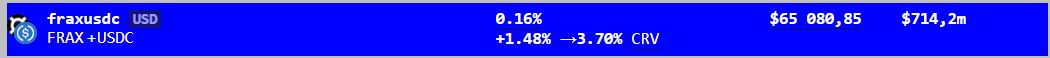

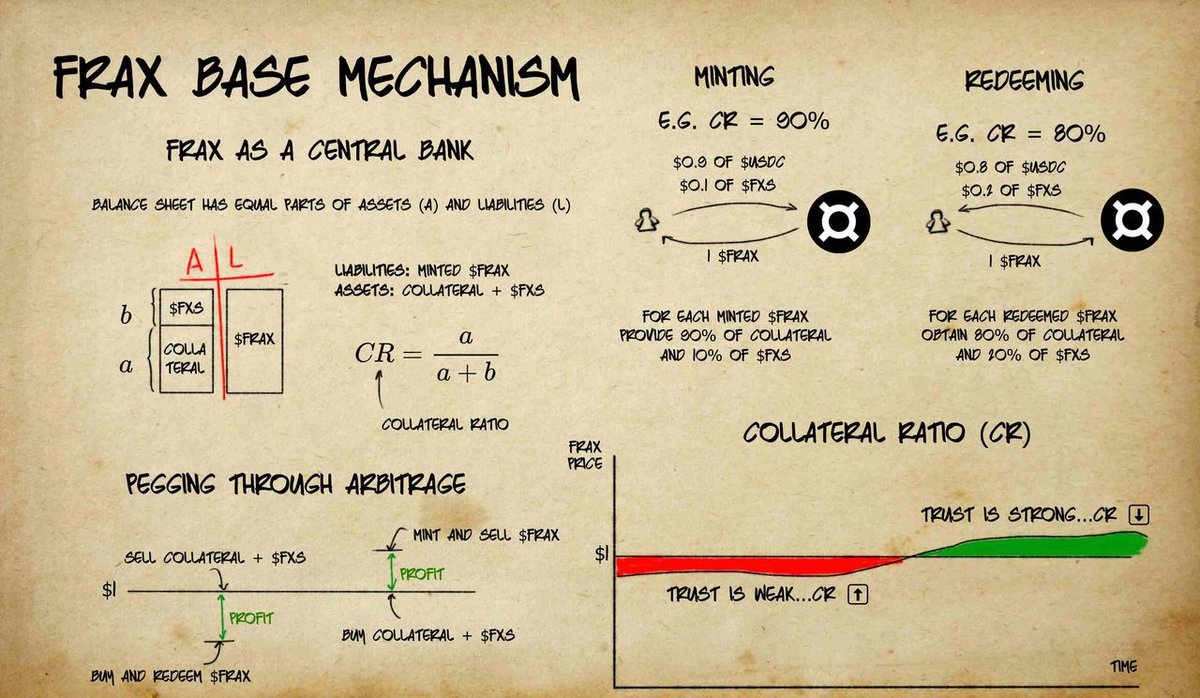

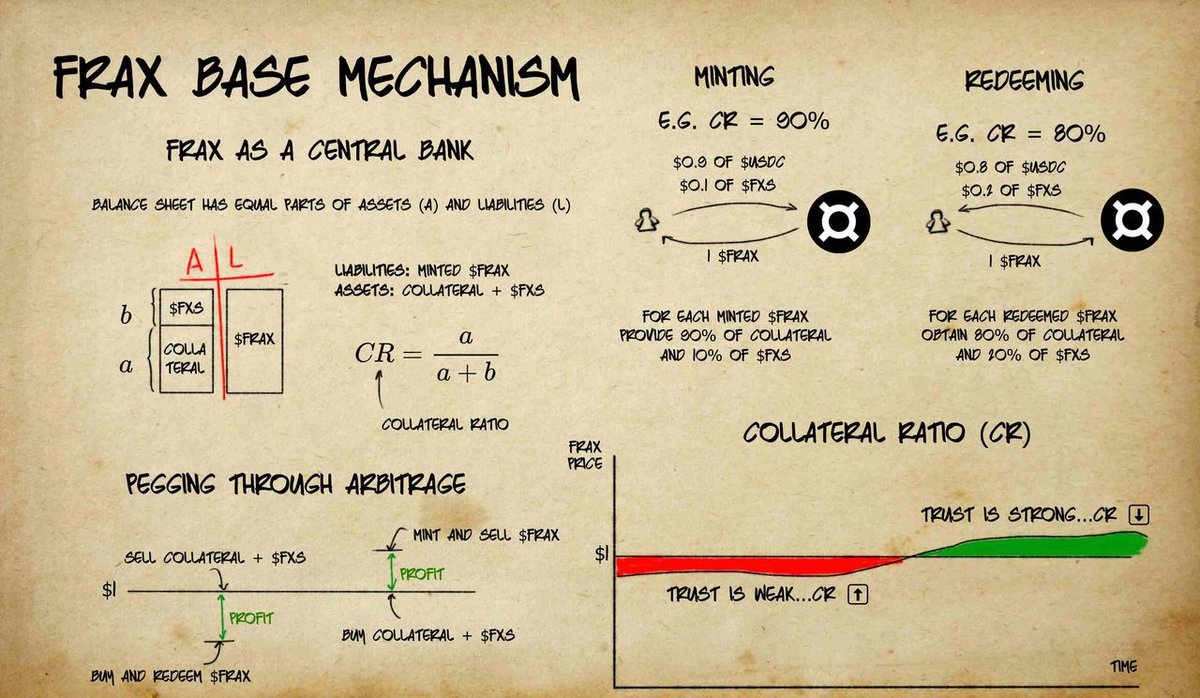

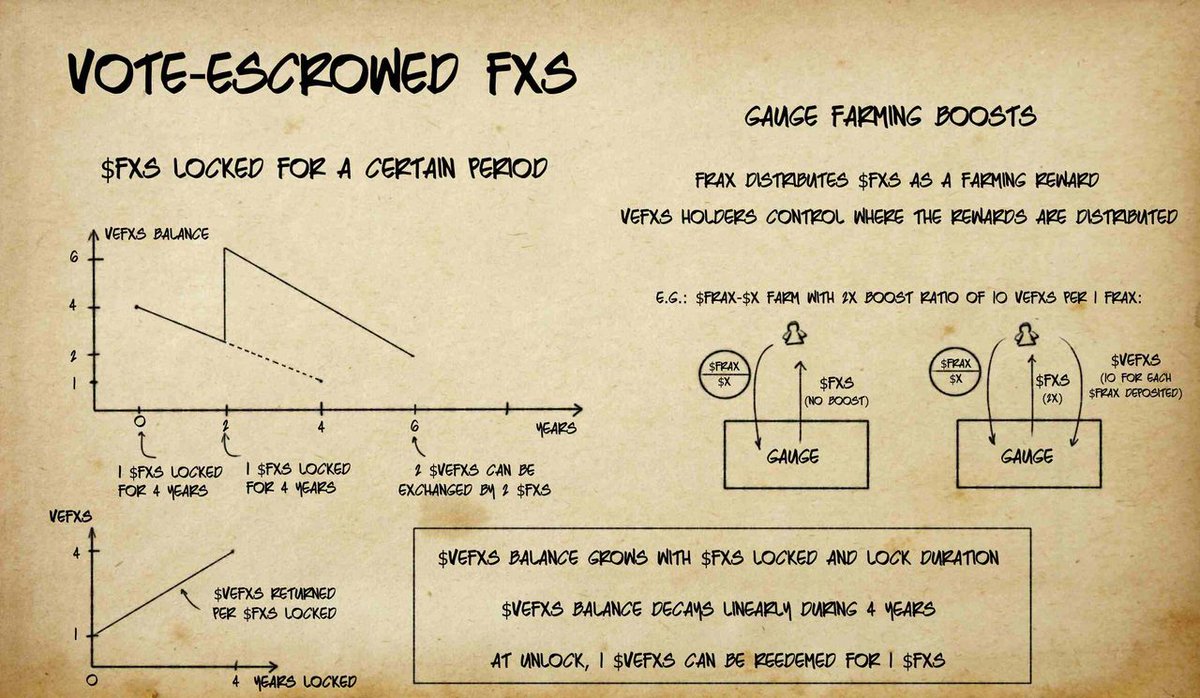

https://twitter.com/ologai/status/1585919349285691393I explained that $FRAX is the stablecoin of @fraxfinance.

@fraxfinance On another thread I’ll cover the other parts of the FRAX ecosystem:

@fraxfinance On another thread I’ll cover the other parts of the FRAX ecosystem:https://twitter.com/thedefiedge/status/1566049764906373121Talking about research, this thread is a massive one but it covers how to find gems and how to find out if they are going to pump or die.

https://twitter.com/CryptoDamus411/status/1507051848334598148