Formerly Better Trader Academy. The home of "Mr Breakouts". Algo Breakout Trading Specialists. Follow for tips and strategies on algorithmic breakout trading.

How to get URL link on X (Twitter) App

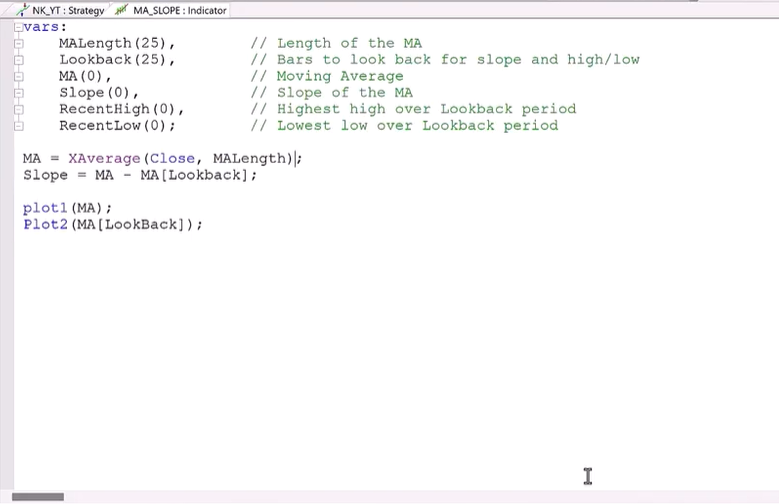

In the video, I show how I build simple foundational breakout models.

In the video, I show how I build simple foundational breakout models.

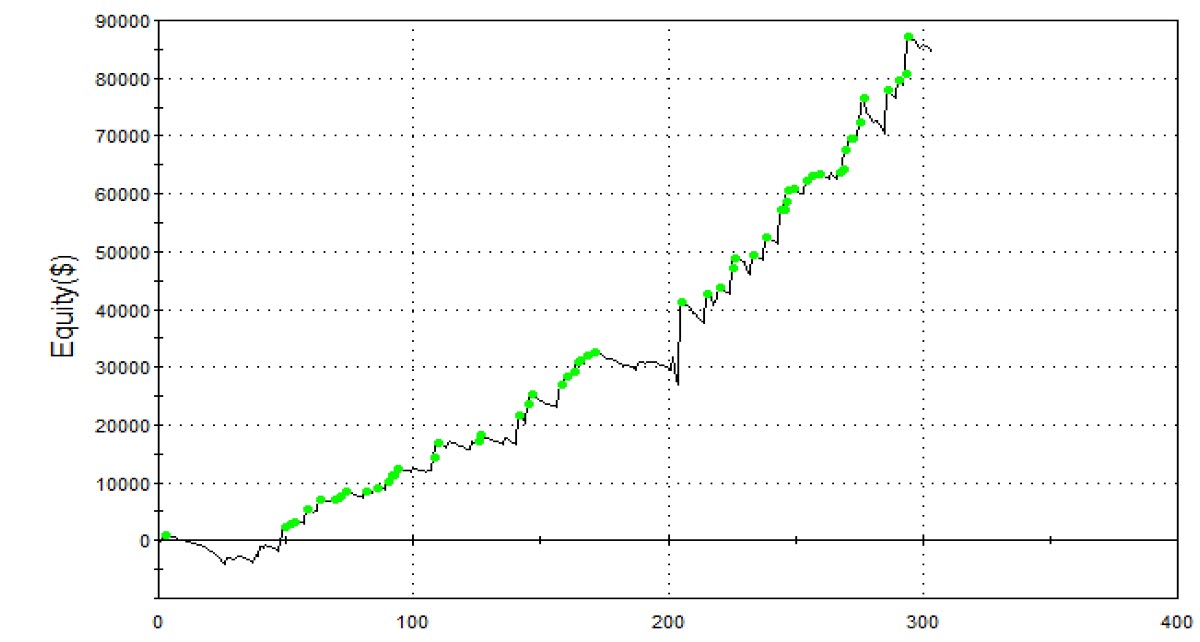

Full demo of how I turned the slope filter into a real Nasdaq weapon.

Full demo of how I turned the slope filter into a real Nasdaq weapon.

This video walks you through our ADX research.

This video walks you through our ADX research.

Here’s the video where I break everything down how we use ATR to structure entries, filter out noise, and manage exits with real volatility logic.

Here’s the video where I break everything down how we use ATR to structure entries, filter out noise, and manage exits with real volatility logic.