How to get URL link on X (Twitter) App

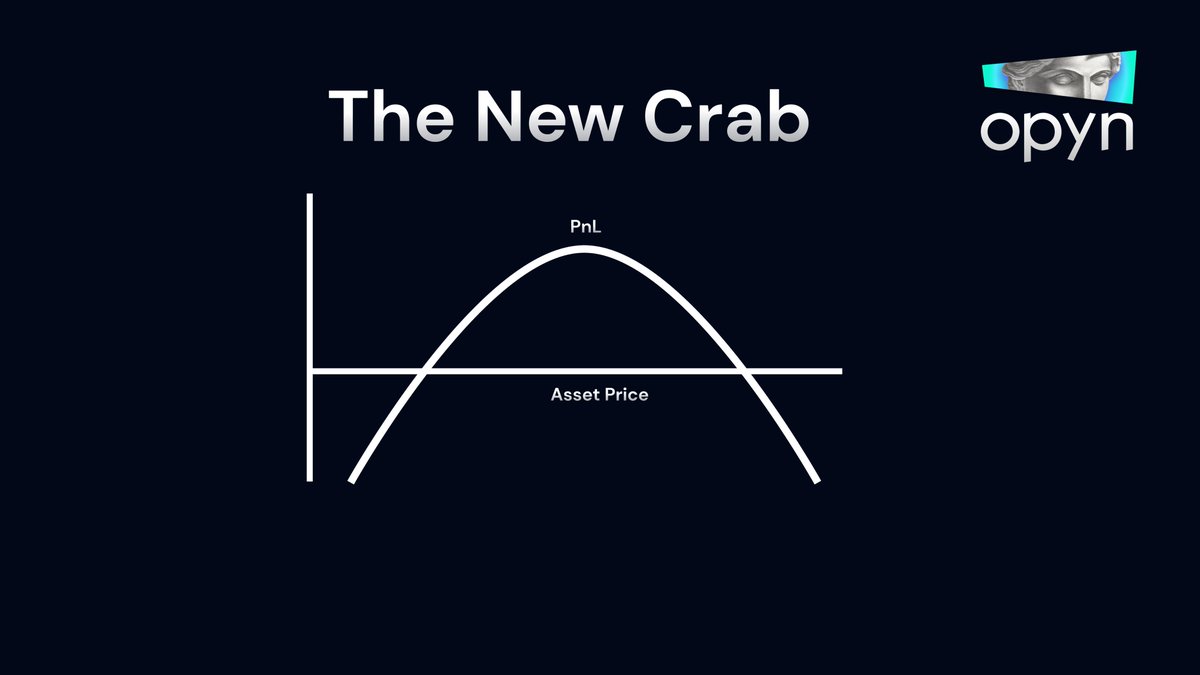

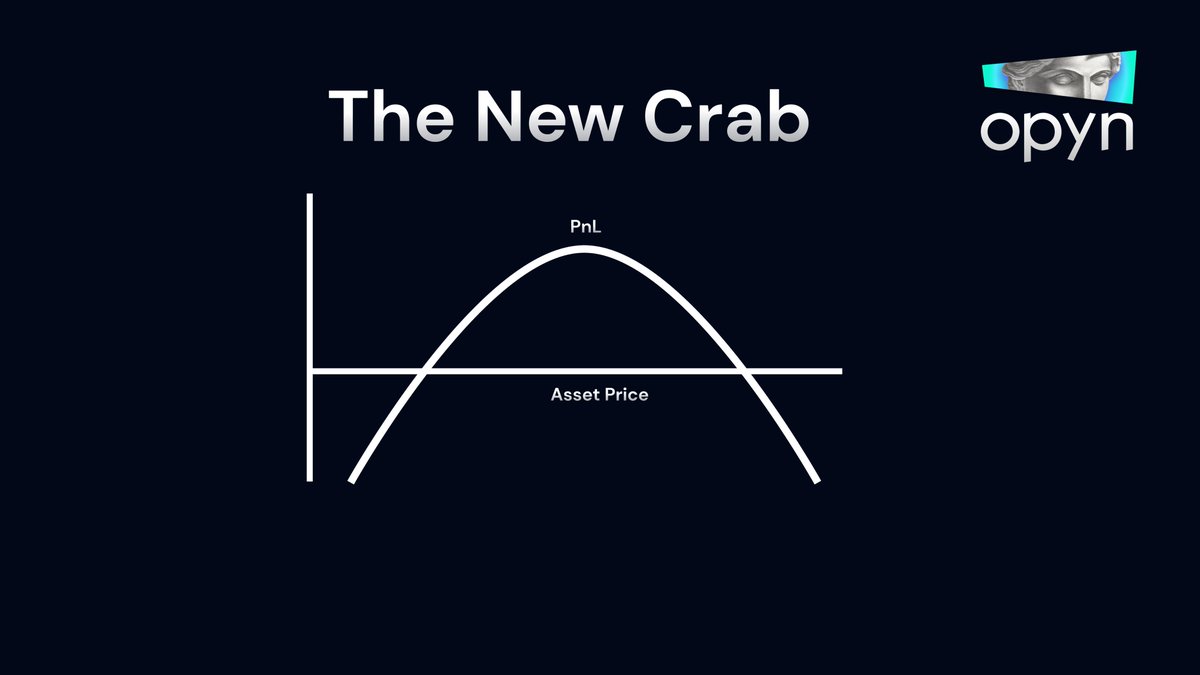

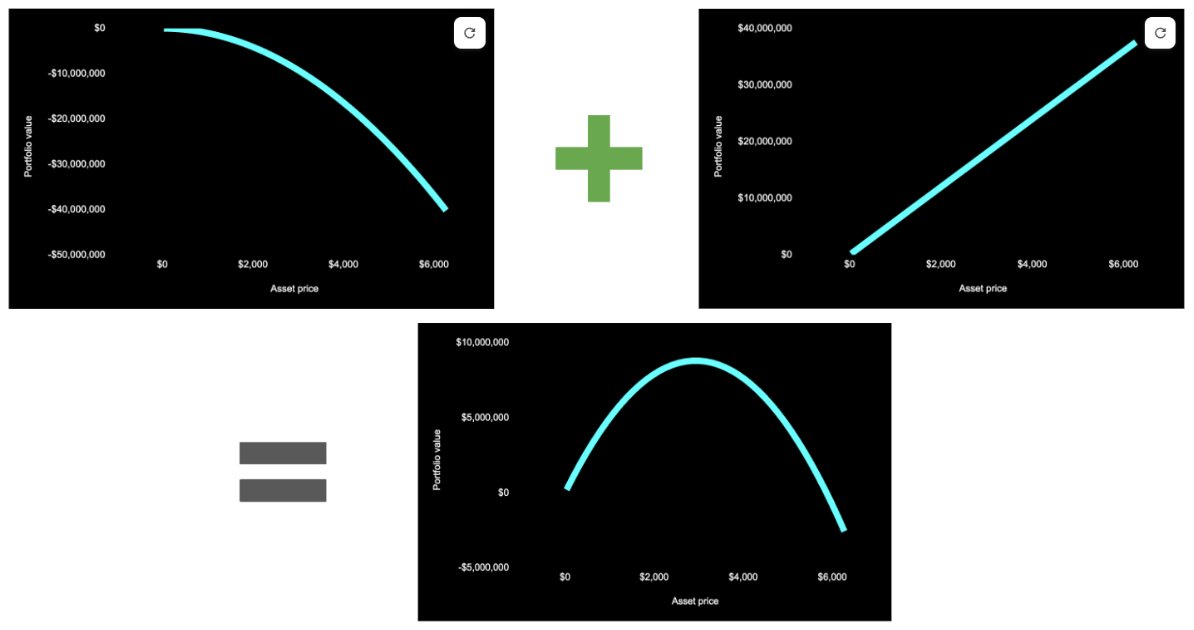

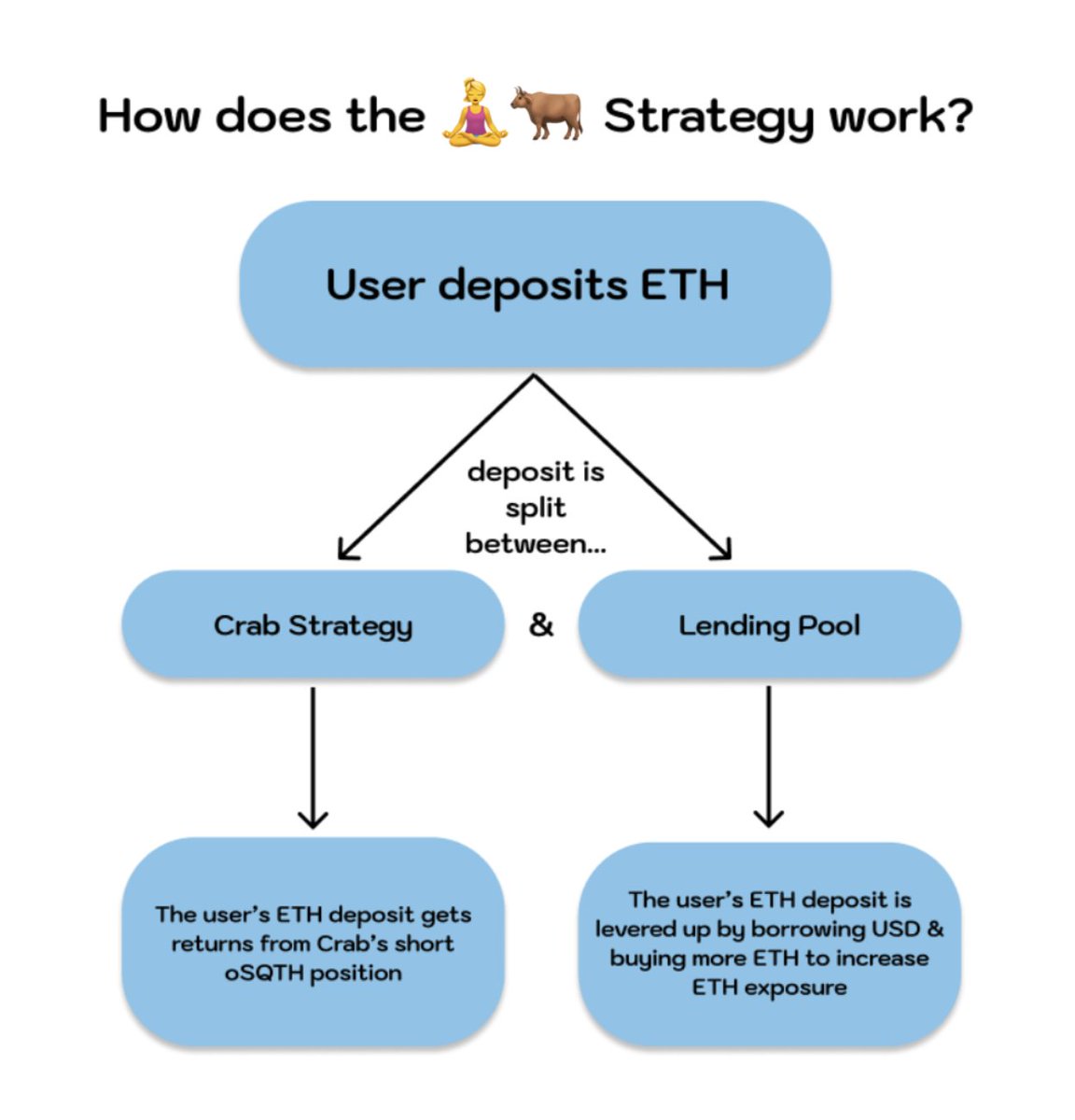

What is a Crab made of?

What is a Crab made of?

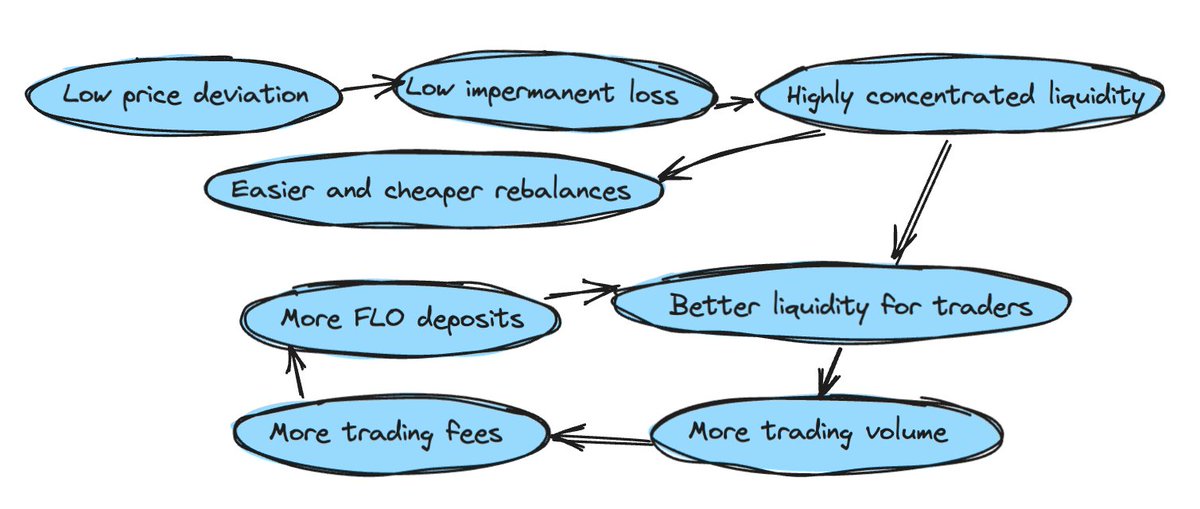

What is crab v2?

What is crab v2?

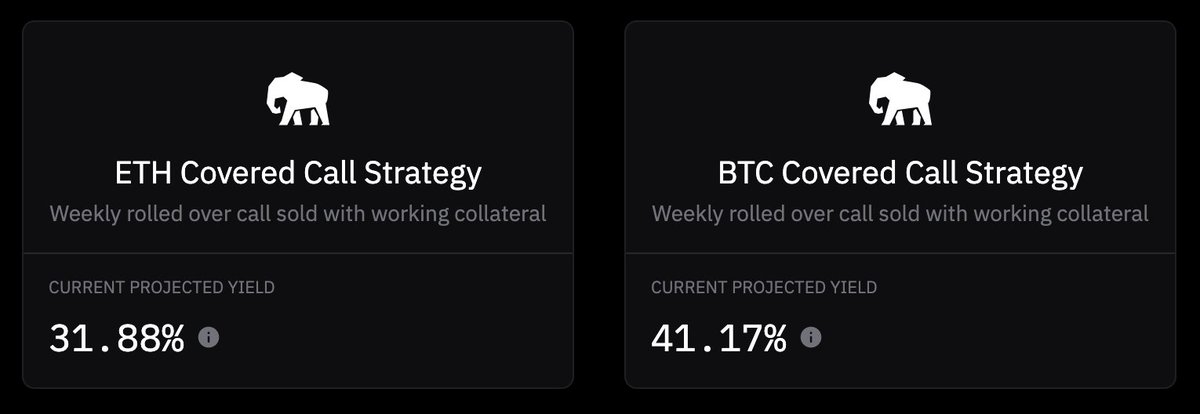

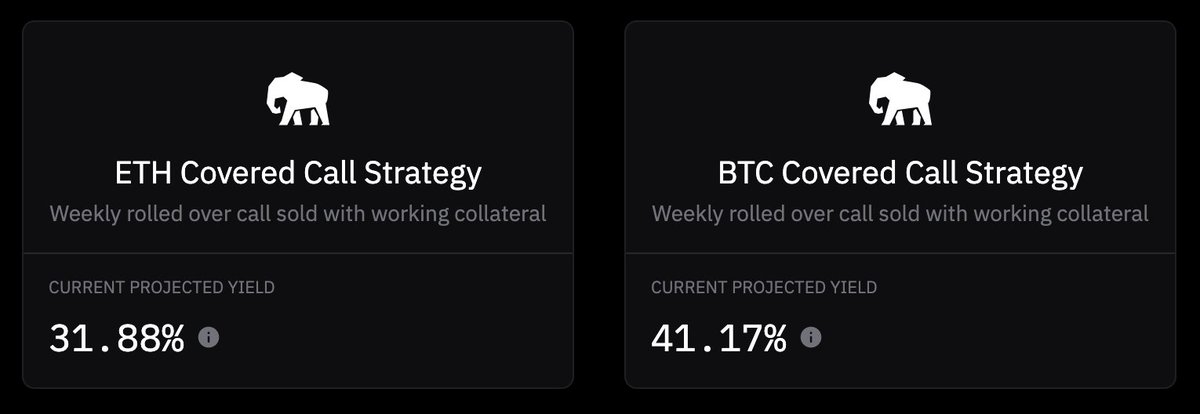

A covered call is an options strategy used to generate yield when traders believe the underlying asset price is unlikely to rise above the strike price before the expiration date.

A covered call is an options strategy used to generate yield when traders believe the underlying asset price is unlikely to rise above the strike price before the expiration date.

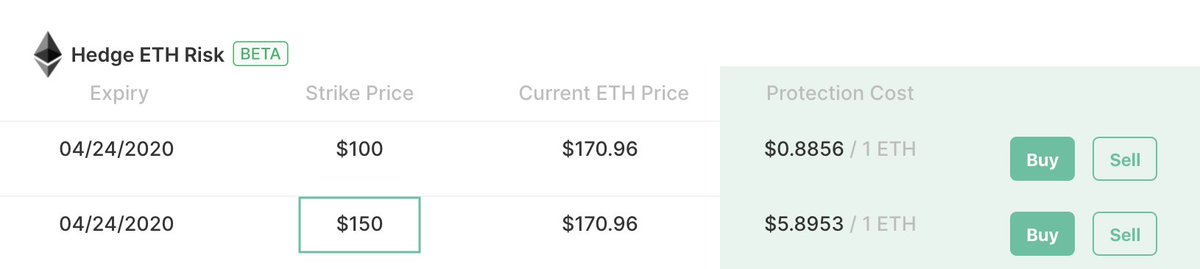

Reasons to BUY a PUT option:

Reasons to BUY a PUT option:https://twitter.com/opyn_/status/1407065064117579779For calls, less than 1 underlying asset can be posted as collateral

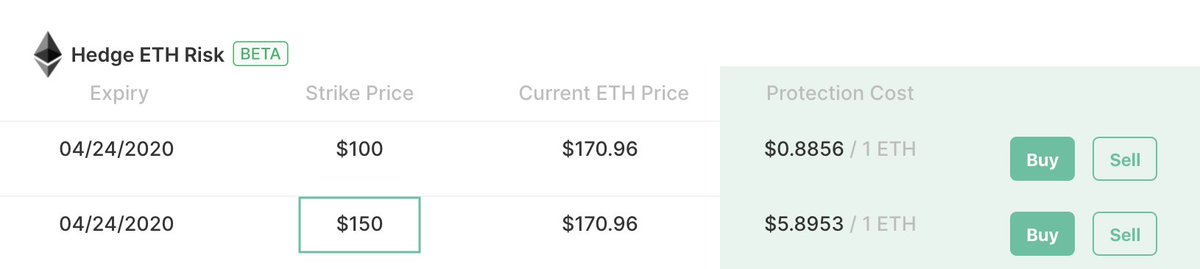

2/ What does ETH protection give you?

2/ What does ETH protection give you?