How to get URL link on X (Twitter) App

IRS projected to get $8.63 per $1 (with some uncertainty) for highest income taxpayers.

IRS projected to get $8.63 per $1 (with some uncertainty) for highest income taxpayers.

https://twitter.com/nberpubs/status/1559342991692767232

New paper with @Dan_M_Sullivan @pascaljnoel @JoeVavra using #JPMCInstitute data

New paper with @Dan_M_Sullivan @pascaljnoel @JoeVavra using #JPMCInstitute data

The large raw differences are mostly about differences in borrower characteristics, particularly about *place* of purchase.

The large raw differences are mostly about differences in borrower characteristics, particularly about *place* of purchase.

What makes today special? BLS releases state employment data, so we can compare July employment in states that cut off benefits and states that did not.

What makes today special? BLS releases state employment data, so we can compare July employment in states that cut off benefits and states that did not.

^ Spending very similar for

^ Spending very similar for

The plot above shows that for people who got regular UI in 2019, non-UI income falls at exactly the same time that UI kicks in (green line).

The plot above shows that for people who got regular UI in 2019, non-UI income falls at exactly the same time that UI kicks in (green line).

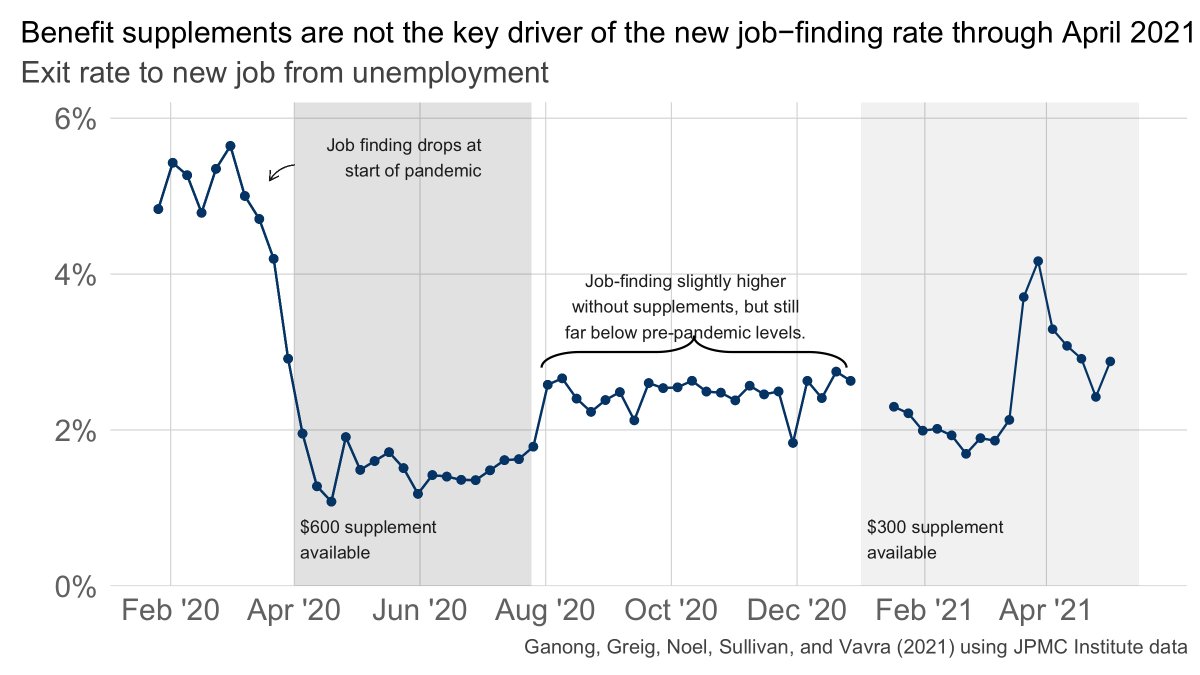

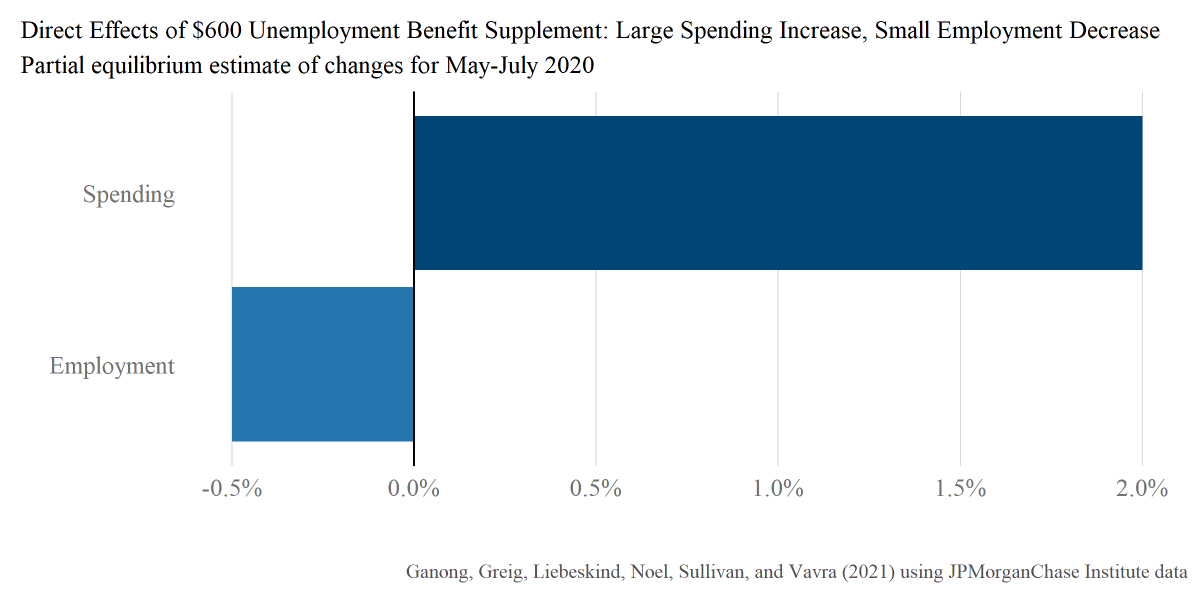

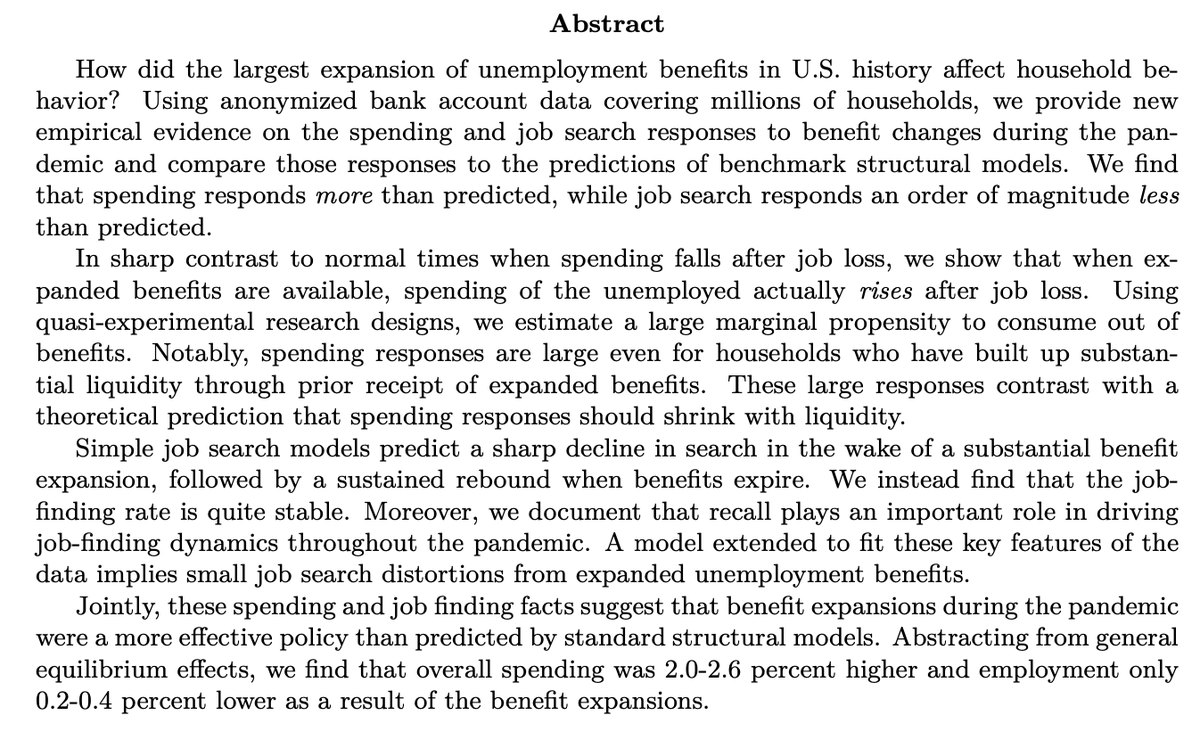

An overarching theme of the pandemic has been to view the supplements as responsible for the biggest problems (slow employment recovery, usually conservatives) and the biggest successes (rising wages at the bottom, usually liberals).

An overarching theme of the pandemic has been to view the supplements as responsible for the biggest problems (slow employment recovery, usually conservatives) and the biggest successes (rising wages at the bottom, usually liberals).

I think of this as the academic paper which captures @IndivarD's political economy model of a major problem with the UI system

I think of this as the academic paper which captures @IndivarD's political economy model of a major problem with the UI system

So far, 26 governors have announced plans to cut off at least some federal benefits. 20 are cutting off all benefits by July 5. This is where we might expect to see the biggest effects.

So far, 26 governors have announced plans to cut off at least some federal benefits. 20 are cutting off all benefits by July 5. This is where we might expect to see the biggest effects.

https://twitter.com/RyanReedHill/status/13824184641707253811) Research is emotionally difficult, at least for me. I *hated* working alone. I was on leave when @pascaljnoel and I started working together in earnest. There’s a good chance I would not have finished my PhD if we hadn’t started working together.

“Spending and Job Search Impacts of Expanded Unemployment Benefits: Evidence from Administrative Micro Data”

“Spending and Job Search Impacts of Expanded Unemployment Benefits: Evidence from Administrative Micro Data”

(Dana's thread on the paper is here)

(Dana's thread on the paper is here)https://twitter.com/danascoot/status/1346508771586174976?s=20

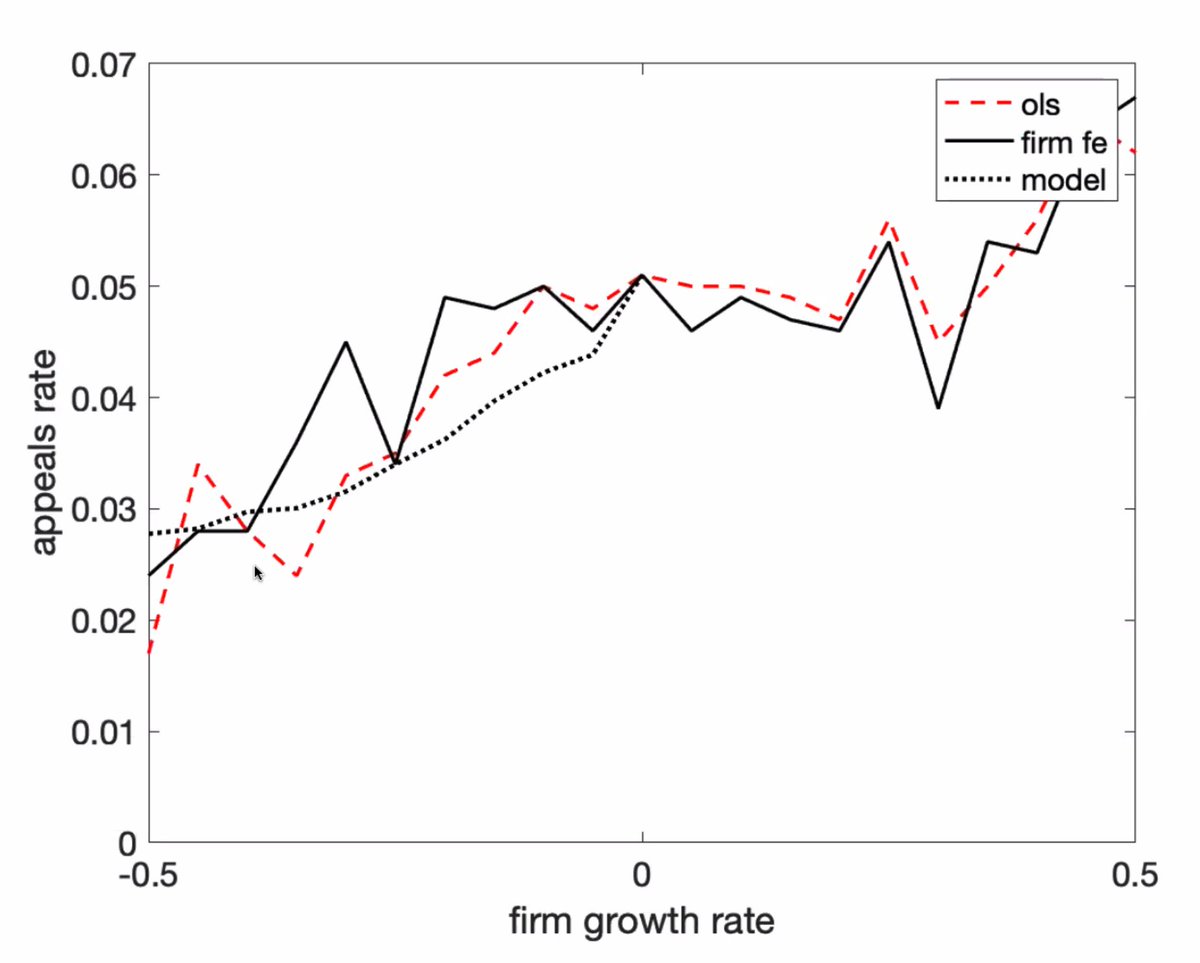

@pascaljnoel and I have a July 2019 AER paper about this using pre-covid data

@pascaljnoel and I have a July 2019 AER paper about this using pre-covid data