Founder & CIO IKIGAI Asset Manager || Ex Sr Fund Manager(Equity)@KotakMF, passionate about investing. These are my personal views.

How to get URL link on X (Twitter) App

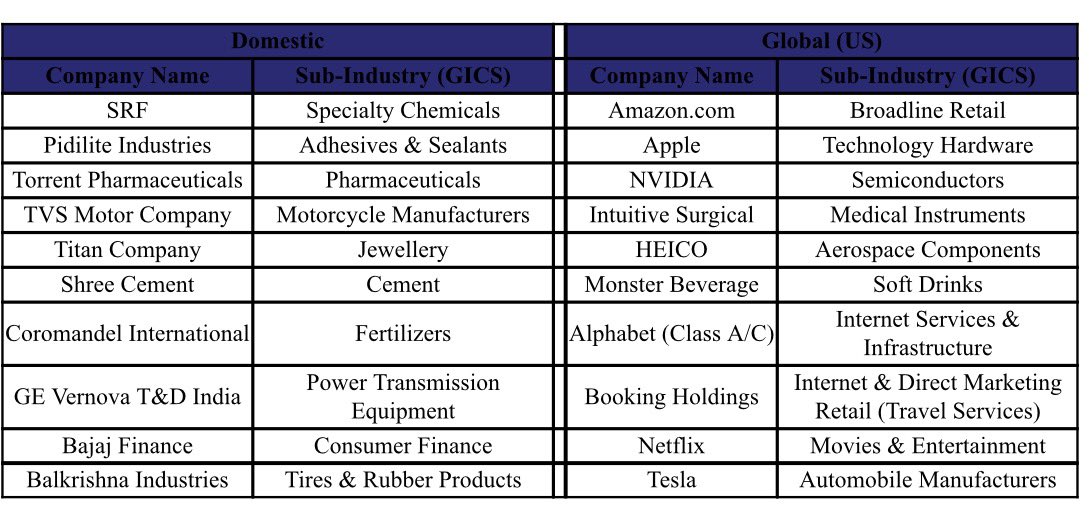

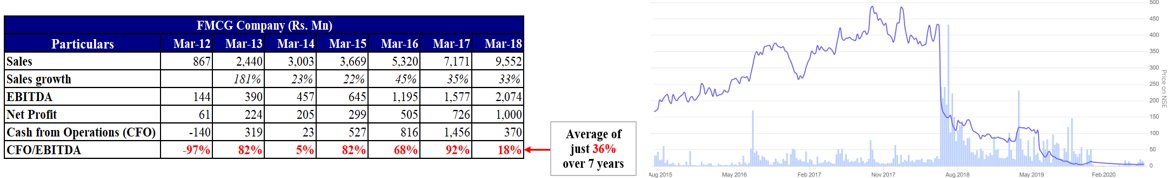

What all 100-baggers have in common?

What all 100-baggers have in common?

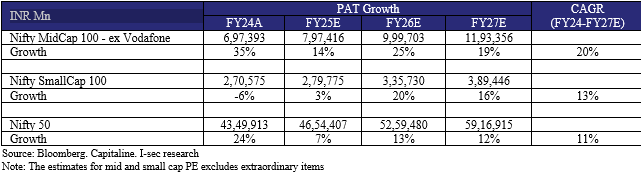

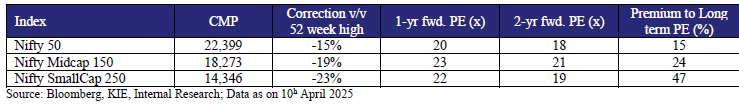

1. 𝗖𝗮𝗻 𝗠𝗶𝗱 𝗮𝗻𝗱 𝗦𝗺𝗮𝗹𝗹 𝗰𝗮𝗽𝘀 𝗲𝗮𝗿𝗻𝗶𝗻𝗴𝘀 𝗼𝘂𝘁𝗽𝗮𝗰𝗲 𝗟𝗮𝗿𝗴𝗲 𝗖𝗮𝗽 𝗲𝗮𝗿𝗻𝗶𝗻𝗴𝘀 𝗴𝗿𝗼𝘄𝘁𝗵?

1. 𝗖𝗮𝗻 𝗠𝗶𝗱 𝗮𝗻𝗱 𝗦𝗺𝗮𝗹𝗹 𝗰𝗮𝗽𝘀 𝗲𝗮𝗿𝗻𝗶𝗻𝗴𝘀 𝗼𝘂𝘁𝗽𝗮𝗰𝗲 𝗟𝗮𝗿𝗴𝗲 𝗖𝗮𝗽 𝗲𝗮𝗿𝗻𝗶𝗻𝗴𝘀 𝗴𝗿𝗼𝘄𝘁𝗵?