An almost passive parasite.

Rajinikanth, Kingfisher, & masala peanuts. I'm in ❤️ with a low-cost broadmarket index fund: https://t.co/HX9ZEUUJbv.

4 subscribers

How to get URL link on X (Twitter) App

If a person takes a loan, he cannot keep taking new loans to pay the old ones. It's the same with countries too.

If a person takes a loan, he cannot keep taking new loans to pay the old ones. It's the same with countries too.

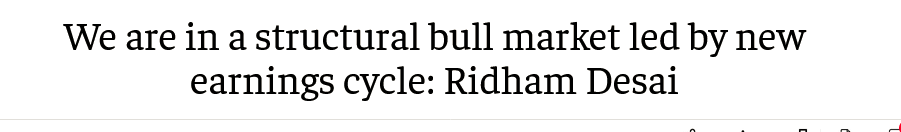

To being with you need at least 6 underwears, which means, you'll have to spend Rs 1470. If you had invested at 12% in an index fund, you would've saved ₹ 44,048!!!!!

To being with you need at least 6 underwears, which means, you'll have to spend Rs 1470. If you had invested at 12% in an index fund, you would've saved ₹ 44,048!!!!!

https://twitter.com/StableInvestor/status/1528973040188391424Yarn is much weaker than thread. So even if you wanted to circle the solar system with yarn, you can't, it will snap. It's science.

We're not bullish, but we're not bearish either

We're not bullish, but we're not bearish eitherhttps://twitter.com/KalpenParekh/status/1351225929981456385I don't think this number will dramatically change until we have a mega market crash. Crashes are the only things that seem to remind investors how most actively managed mutual funds are useless.

Although ETFs are orphan products in India, one day in the next 7 to 10 years, ETFs will surely see growth in India. Won't happen before the next beat market happens though.

Although ETFs are orphan products in India, one day in the next 7 to 10 years, ETFs will surely see growth in India. Won't happen before the next beat market happens though.

https://twitter.com/aditipar/status/1348965653206630402The product sellers are partially to blame. The nonsense they spew in the name of "financial education" is an insult. All those god awful videos and nonsensical garbage masquerading as "content" is enough to make you wanna gouge your eyes out.

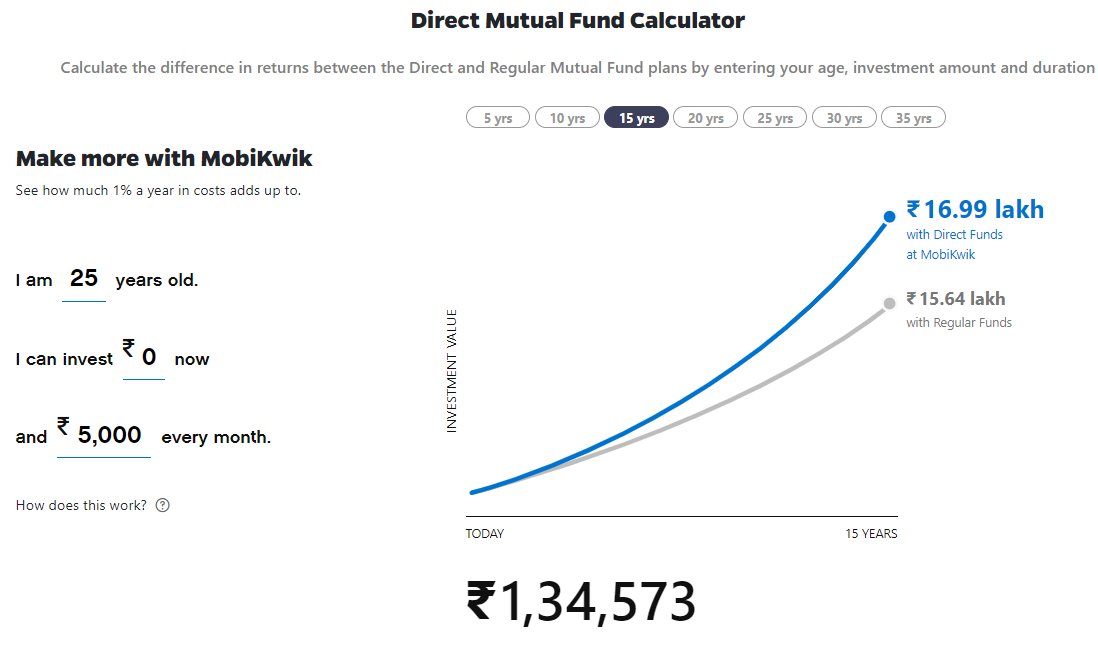

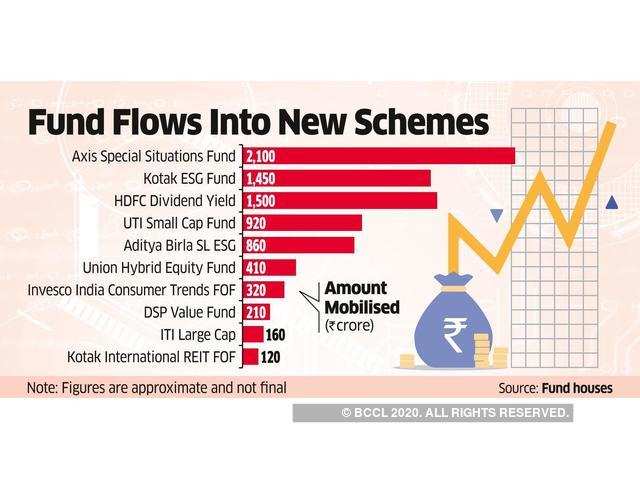

If you look closely, 4 out of the 6 top NFOs in terms of money raised are from bank owned NFOs. These AMCs are notoriously skilled at selling garbage funds through their banking channels. They've turned mis-selling into an art. They're are Picasso's of mis-selling

If you look closely, 4 out of the 6 top NFOs in terms of money raised are from bank owned NFOs. These AMCs are notoriously skilled at selling garbage funds through their banking channels. They've turned mis-selling into an art. They're are Picasso's of mis-selling