Head Macro Strategy @SwissRe. Former World Bank, SNB and UBS. Views are my own/personal.

4 subscribers

How to get URL link on X (Twitter) App

CHF typically rallies in "risk-off" environments which is why it's considere a "safe haven". But that isn't the case currently and yet, the currency keeps strengthening.

CHF typically rallies in "risk-off" environments which is why it's considere a "safe haven". But that isn't the case currently and yet, the currency keeps strengthening.

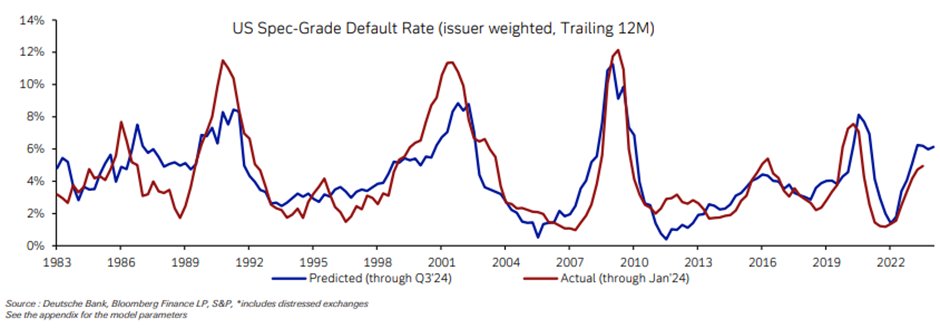

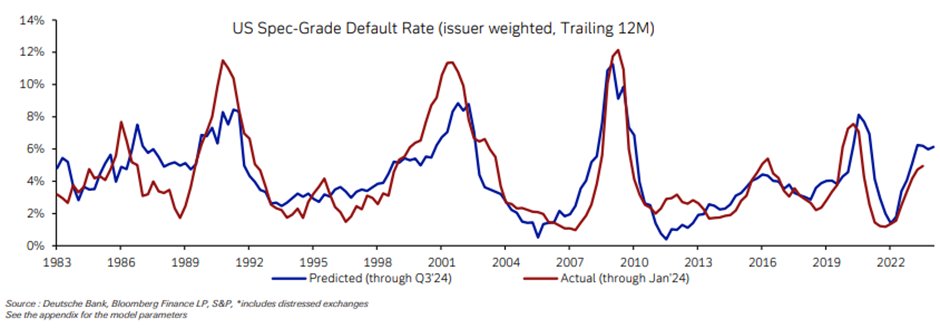

Some of the default increase has arguably been more of a "normalization" at the index level so far.

Some of the default increase has arguably been more of a "normalization" at the index level so far.

https://twitter.com/PauloMacro/status/1709068808806375483The US term premium has increased/"normalized", though from absurdly low levels.

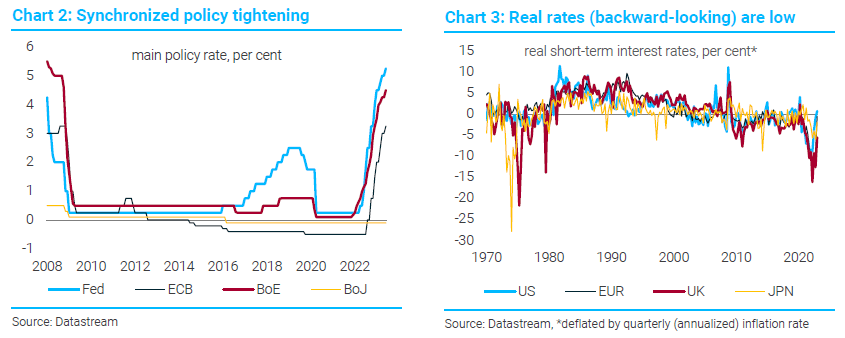

First, rate cuts in the immediate future are very unlikely. The inflation backdrop is simply too severe. By year-end, however, the story might look different. Most econometric models as well as market pricing from CPI swaps suggest inflation to be between 3-3.5% by YE.

First, rate cuts in the immediate future are very unlikely. The inflation backdrop is simply too severe. By year-end, however, the story might look different. Most econometric models as well as market pricing from CPI swaps suggest inflation to be between 3-3.5% by YE.

The market environment for fixed income is now far more benign than even three years ago. Not only in terms of nominal yields, but especially also in real yields which are really important for long-term oriented investors like insurers.

The market environment for fixed income is now far more benign than even three years ago. Not only in terms of nominal yields, but especially also in real yields which are really important for long-term oriented investors like insurers.

https://twitter.com/patrick_saner/status/1612709118023794688

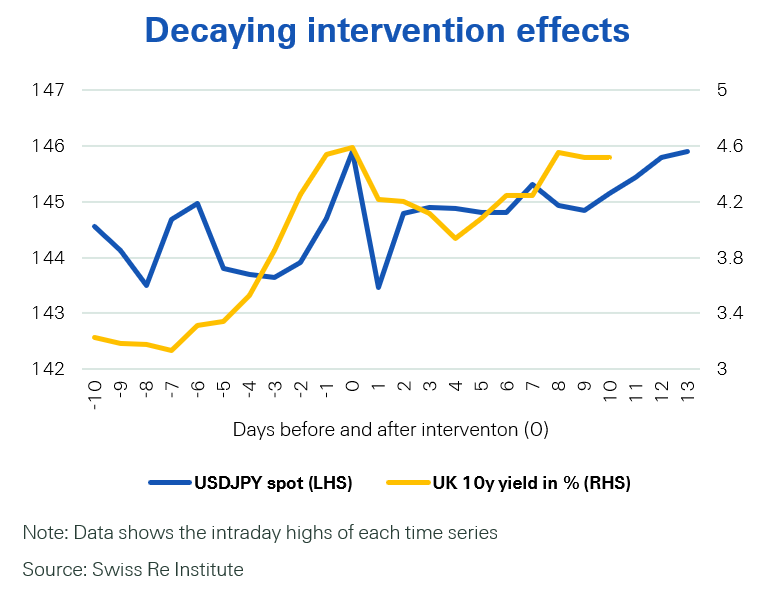

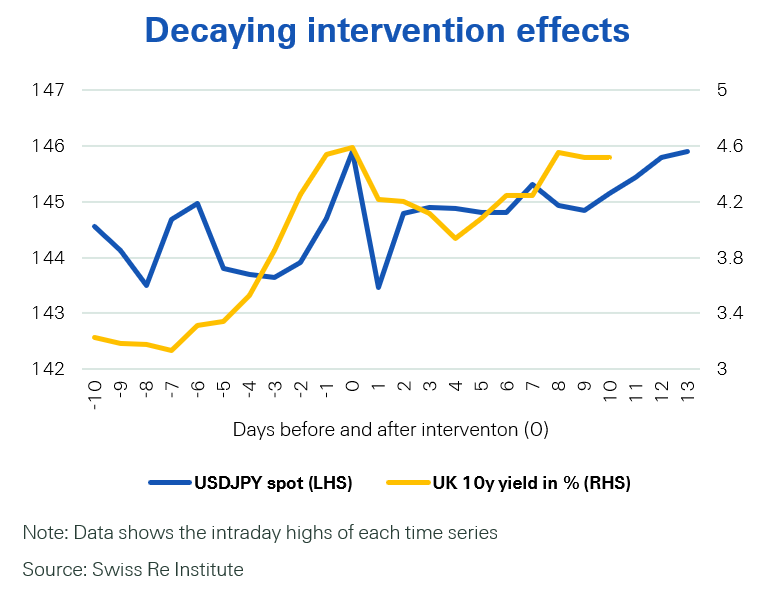

Chart above shows the Yen and 10y Gilts before and after recent market interventions. Both JPY and 10y gilts have shown some relief after intervention (as expected), but both at are now either higher than when the intervention happened (Yen) or creeping back to the highs (Gilts)

Chart above shows the Yen and 10y Gilts before and after recent market interventions. Both JPY and 10y gilts have shown some relief after intervention (as expected), but both at are now either higher than when the intervention happened (Yen) or creeping back to the highs (Gilts)