Macro Strategist | Econ, macro & home cooking | Prev @Canada, @DukeFOOTBALL | Even the blind squirrel get a nut sometime | Long Live Jail Support

How to get URL link on X (Twitter) App

Revisions to GDI by category show that 2020 GDI was much higher than expected primarily thanks to higher non-wage business spending, higher corporate profits, and higher subsidies paid out during the pandemic. But the divergence between GDI and GDP was close for 2021 forward.

Revisions to GDI by category show that 2020 GDI was much higher than expected primarily thanks to higher non-wage business spending, higher corporate profits, and higher subsidies paid out during the pandemic. But the divergence between GDI and GDP was close for 2021 forward.

Upward revisions to real durable goods spending, structures investment (partially a seasonality thing), nondefense federal government spending, and services trade (both exports and imports).

Upward revisions to real durable goods spending, structures investment (partially a seasonality thing), nondefense federal government spending, and services trade (both exports and imports).

https://twitter.com/JHWeissmann/status/1506005588051910664The FOMC is saying they're going to crush inflation and that's far more important than the other side of their policy mandate. That's very different from "we can engineer a soft landing with a few rate hikes to calm things down and get to equilibrium".

Rejoinder 1: deaths lag cases! yes, so that's why we're looking at the same windows of prior waves. Given speed of growth in Omicron, we still could be about to see a huge surge in deaths. But it just hasn't showed up, not even a little bit.

Rejoinder 1: deaths lag cases! yes, so that's why we're looking at the same windows of prior waves. Given speed of growth in Omicron, we still could be about to see a huge surge in deaths. But it just hasn't showed up, not even a little bit.

SF permits were basically the same in April as February, when all of Texas was basically a black hole. And this isn't about bottlenecks...permits shouldn't be impacted by immediate input availability.

SF permits were basically the same in April as February, when all of Texas was basically a black hole. And this isn't about bottlenecks...permits shouldn't be impacted by immediate input availability.

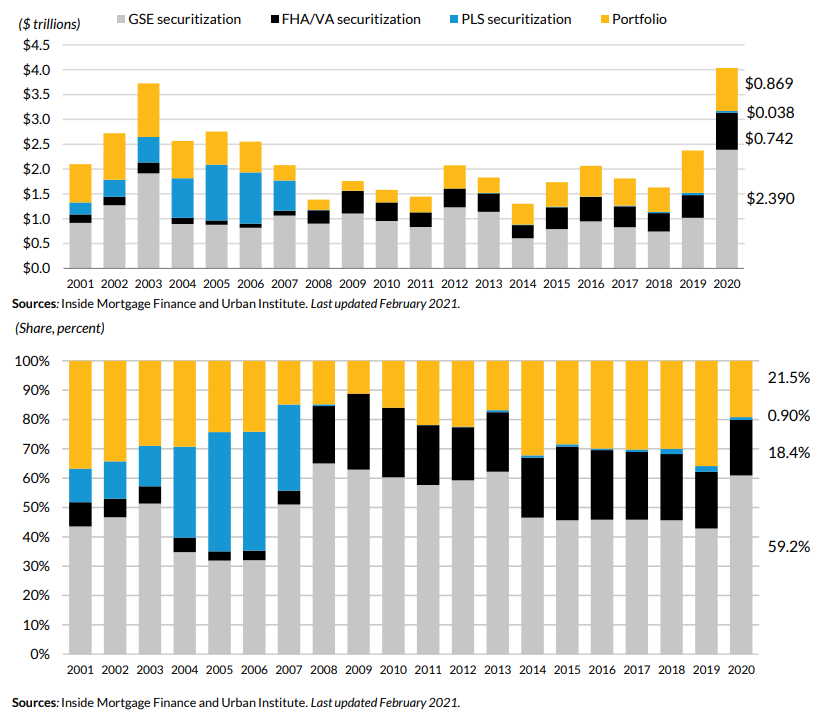

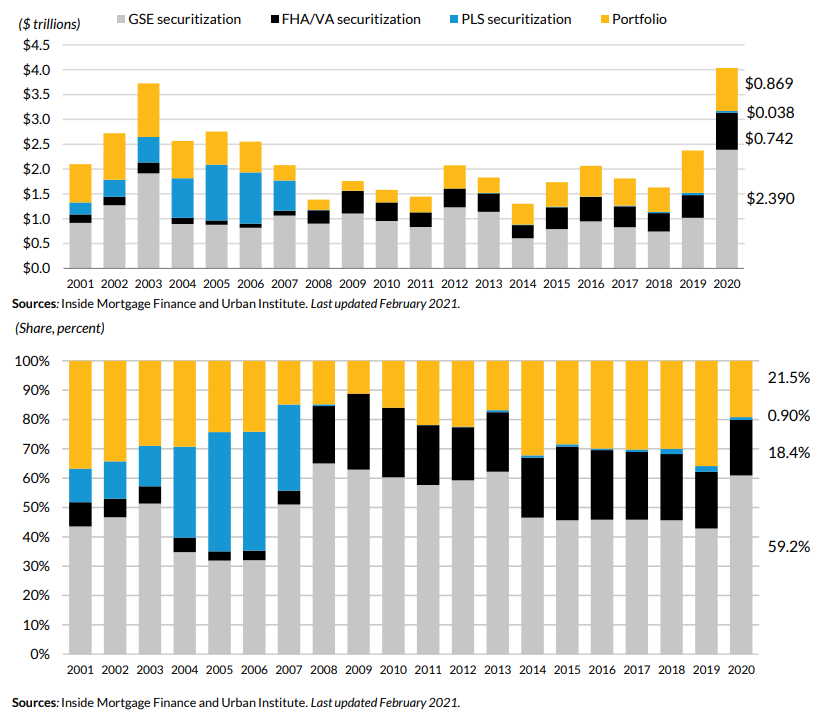

https://twitter.com/LumberTrading/status/1387488620865413121When you borrow to purchase a home, the lender has basically two options: hold the mortgage ("portfolio") or sell it. If selling, there are two further options: sell to one of the government-sponsored entities or gov't (GSE & FHA/VA securitizations), or someone else (PLS).

https://twitter.com/theobserver/status/1353854218348630016Just last night at Tent City @CMPD sent a man to the hospital, kneeling on his neck as they arrested him. It’s only a matter of time before they kill someone. facebook.com/10000692388089…

https://twitter.com/ByTylerEstep/status/1315662020453240833Fulton:

https://twitter.com/elizabethR927/status/1315692944100413442