@TheHavenCrypto - NFA - just shitposting and sharing some thoughts about markets sometimes https://t.co/edH3I1EL0z

9 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/pierre_crypt0/status/1836803949912858808

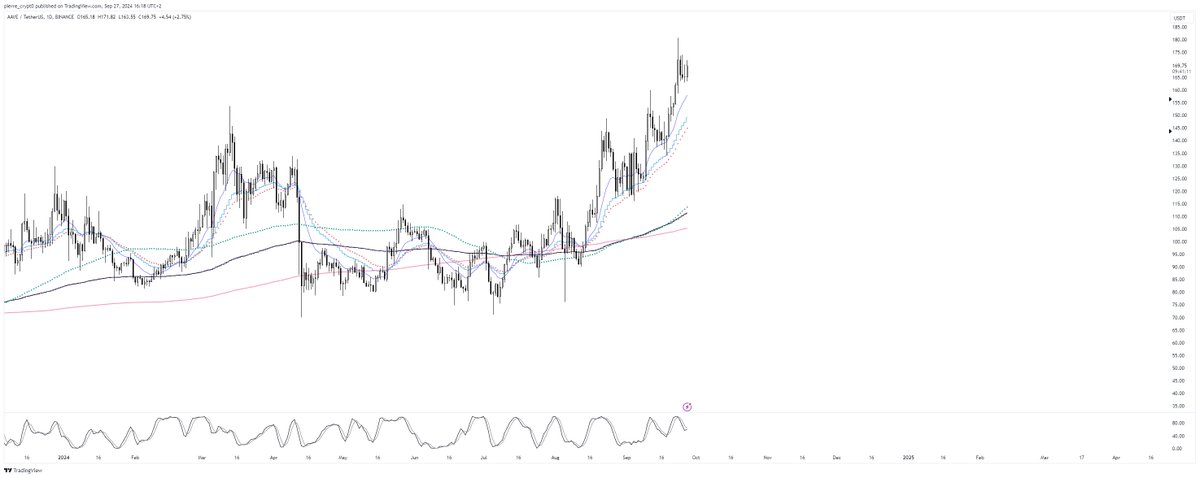

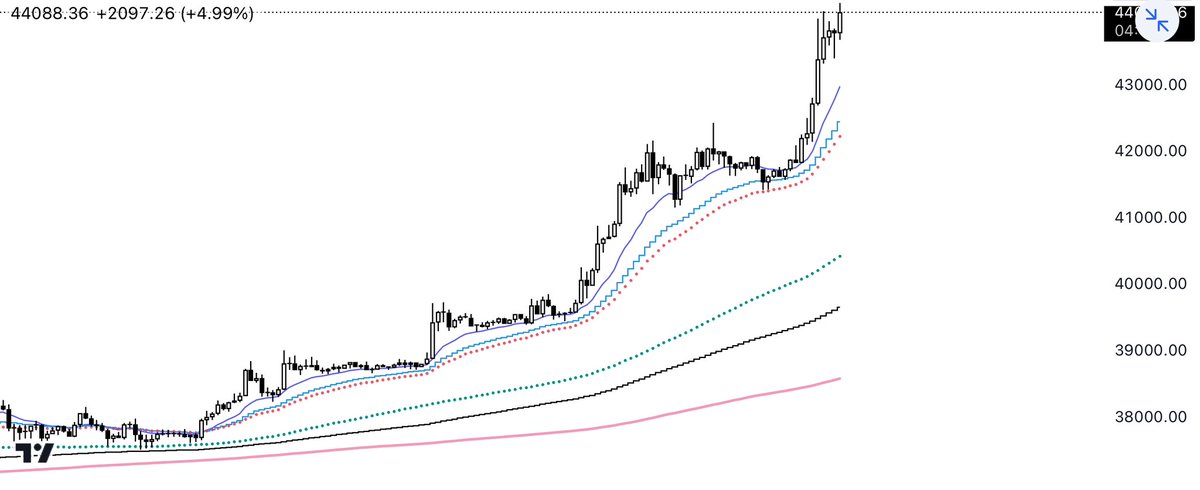

some more examples of gap fill setups:

some more examples of gap fill setups:https://x.com/pierre_crypt0/status/1839669603812684056

https://x.com/pierre_crypt0/status/1839668690179981772

https://x.com/pierre_crypt0/status/1839668001559196063

https://x.com/pierre_crypt0/status/1839667811901210760

conditions for fun to be allowed in shitcoins from here:

conditions for fun to be allowed in shitcoins from here:

https://twitter.com/pierre_crypt0/status/1673081691022278663

Second focus being this ETHBTC H4 downtrend of course to time potential ETH rotation or not (coupled with BTC maxis calling for its death etc etc you know the usual cycle rotation).

Second focus being this ETHBTC H4 downtrend of course to time potential ETH rotation or not (coupled with BTC maxis calling for its death etc etc you know the usual cycle rotation).

Beside examples like these two, most of alts are still shorts to me with some much weaker than others (TOMO, but too late to enter here, wait for H4/D1 trend retests on bounces).

Beside examples like these two, most of alts are still shorts to me with some much weaker than others (TOMO, but too late to enter here, wait for H4/D1 trend retests on bounces).https://twitter.com/pierre_crypt0/status/1651327270886187010Tldr:

https://twitter.com/pierre_crypt0/status/1650826275332734977

https://twitter.com/Investingcom/status/1650930499903270912If we do this again.. should we send btc to new highs then ?

For me:

For me:

https://twitter.com/pierre_crypt0/status/1628806912878817280

Fail to flip H4 == chopfest continuation.

Fail to flip H4 == chopfest continuation.

https://twitter.com/jimcramer/status/1630507470060765186Could it be just what the market needed for a pop, time will tell, would be funny once again.

https://twitter.com/pierre_crypt0/status/1630267430965575681

https://twitter.com/pierre_crypt0/status/1629441290524930049

https://twitter.com/pierre_crypt0/status/1630222551967313922

Shoutout to @PC_PR1NCIPAL as us usual, his content in @TheHavenCrypto often helps me narrowings alts of importance within trends.

Shoutout to @PC_PR1NCIPAL as us usual, his content in @TheHavenCrypto often helps me narrowings alts of importance within trends.

https://twitter.com/pierre_crypt0/status/1628806912878817280As usual, just applying system robotically, exited/got targets hit on most shorts last week when BTC came back for H4 200 EMA/D1 trend