Tech and free speech lawyer | Managing Partner at @byrnestorm | co-author of the GRANITE Act | Senior Fellow @ASI | Legal Advisory Council @speechunion

4 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/54johnbull/status/2029482549370638520I'm not sure what legal theory Ofcom is operating under here that tells them that an English law gives them power to tell people in America what to do. But America *and* Canada? And anyone anywhere in the world with a server accessible from the UK?

https://twitter.com/owenboswarva/status/2027424766206890203I have handed off the file to the press.

https://twitter.com/gavinbarwell/status/2003727043834634521And I don’t want a crappy fruit basket sent to my clients either. We’re talking Fortnum & Mason or Harry and David, the good shit

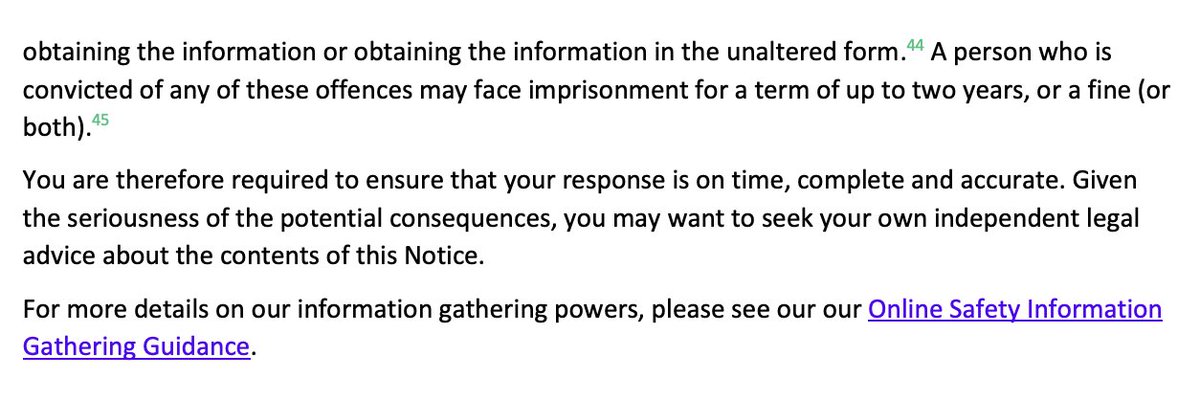

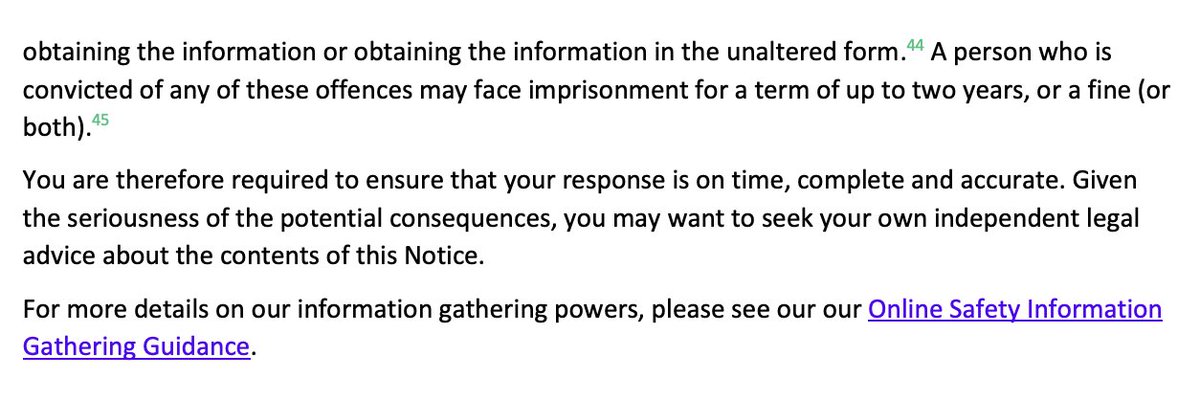

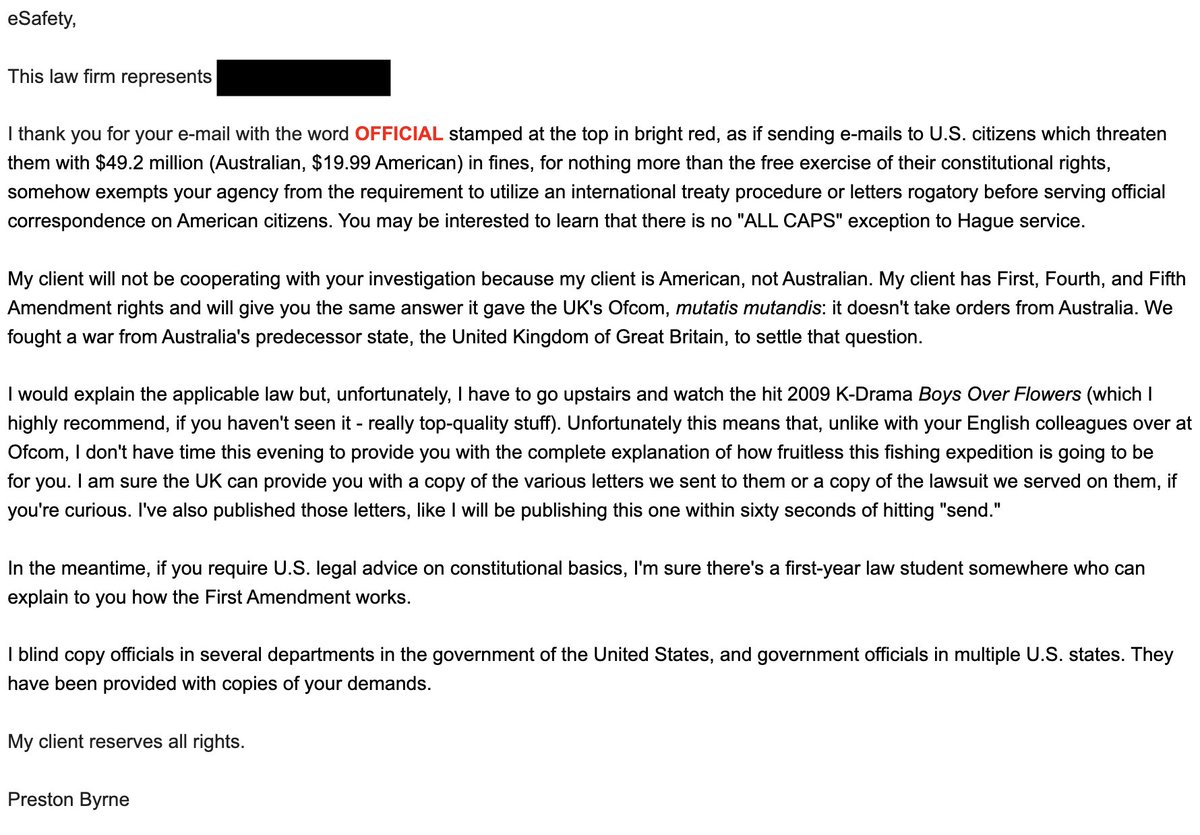

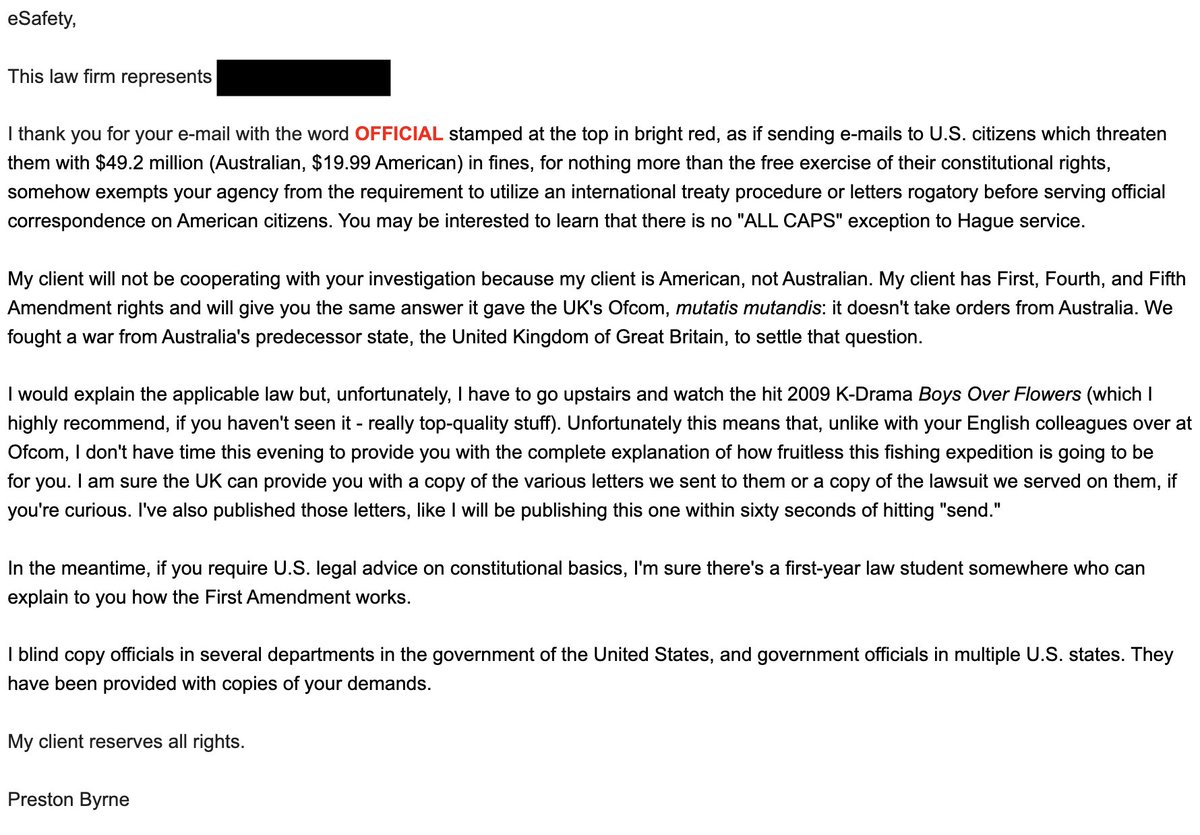

Australia presents, to the United States, the exact same threat that the UK and EU do.

Australia presents, to the United States, the exact same threat that the UK and EU do.https://x.com/hoffmang/status/1992802540564762722?s=20

https://twitter.com/WarriorOfTrut10/status/1987910089148178732Ofcom took ten months to figure out that every time they give an American the ability to visibly refuse their orders, that is a defeat.

https://twitter.com/LundukeJournal/status/1979011774067487117If Ofcom wants to block 4chan, that's on Ofcom, and never again will anyone be able to call the Online Safety Act anything other than a censorship law.

"The Online Safety Act is about preserving a status quo that benefited and enriched powerful platforms"

"The Online Safety Act is about preserving a status quo that benefited and enriched powerful platforms"

You can say something is to "protect the kids," but if its effect is to dox internet users and interfere with protected speech, it's a censorship law.

You can say something is to "protect the kids," but if its effect is to dox internet users and interfere with protected speech, it's a censorship law.

Also if any lawyer in London thinks that the U.S. will give reciprocity under the MLAT or that a U.S. court will enforce a money judgment based on OSA enforcement - a subject that I have personally broached with our government - there's a bridge in Brooklyn I'd like to sell you

Also if any lawyer in London thinks that the U.S. will give reciprocity under the MLAT or that a U.S. court will enforce a money judgment based on OSA enforcement - a subject that I have personally broached with our government - there's a bridge in Brooklyn I'd like to sell you

The UK government should now understand that any attempt to touch any American company, however small, will be met with a coordinated U.S. legal response.

The UK government should now understand that any attempt to touch any American company, however small, will be met with a coordinated U.S. legal response.

Link:

Link: