Chief Strategist Simplify Asset Management | PM of top ranked high yield ETF, $CDX. Not investment advice

35 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/KrisAbdelmessih/status/1908924598789591543

2/n What the chart is highlighting is that credit and equity are both parts of the capital structure with unique behavior that is contingent on the value of the assets. Credit is a "short put" asset claim. If assets rise to absurd heights, credit "benefits" because risk of default declines. But it doesn't benefit "much"

2/n What the chart is highlighting is that credit and equity are both parts of the capital structure with unique behavior that is contingent on the value of the assets. Credit is a "short put" asset claim. If assets rise to absurd heights, credit "benefits" because risk of default declines. But it doesn't benefit "much"

https://twitter.com/NickTimiraos/status/19068370289955266592/n But two-axis charts, especially on time series, are critical tools. Few would blanche at an XY of Freddie Mac Multifamily Seriously Delinquent vs Fannie Mae Multifamily Seriously Delinquent -- they are two lenders each lending to a similar asset class. Comparing FNMSDQ vs FRESDQ at points in time would make perfect sense:

https://x.com/pmarca/status/1873880292043481203

2/n It's one thing to have your fundamental errors pointed out (repeatedly) and adjust. It's another to double down. You have to ask, "What's the agenda?" at some point

2/n It's one thing to have your fundamental errors pointed out (repeatedly) and adjust. It's another to double down. You have to ask, "What's the agenda?" at some point https://x.com/profplum99/status/1783527343526404303

https://twitter.com/paulomacro/status/17144616037504373312/n US Debt/GDP vs France Debt/GDP vs CDS

https://twitter.com/radigancarter/status/17131796374785600732/n Emotional events, like the GFC, represent opportunity in HINDSIGHT. If you define events by their ex-post success, they always appear “smart.” In the heat of the moment, the “smart” move may not be the “after the fact” smart move

https://twitter.com/wabuffo/status/17056003916629936142/n The Fed data is misleading when aggregated. Several will proclaim, "it's real estate" or "of course, stock markets are higher." But neither is really the driver here. Remember in the bottom 50% of households by WEALTH, home ownership is low and few own stocks.

https://twitter.com/BarbarianCap/status/16932249814449277952/ and many professors are overtly hostile. My daughter has had to drop classes with professors that require 100% attendance with no excuses accepted despite the obvious impossibility of being in two locations at once.

https://twitter.com/josephpolitano/status/16234577739115151392/n I can’t speak for Joey, but I can certainly note that we are actually saying the same thing. First, inflation is “complicated” — despite what you’ve read, MEASURED inflation is nowhere and never a strictly ANYTHING phenomenon

https://twitter.com/rjrcapital/status/16568381008767754242/n In point #3, he asserts that active managers are responsible for the relative share gain of the mega cap leaders and that passive would keep them “the same.” A common misunderstanding. Passive funds buy in proportion to market cap, BUT liquidity does not scale with market cap

https://twitter.com/FedGuy12/status/1655952494789533696

2/n even as they rise (and will continue to rise on a seasonal basis as Q1 tends to see bonus checks/tax refunds used to catch up). I would highlight that the low levels of delinquency are a function of unique factors that are now REVERSING rather than normalizing

2/n even as they rise (and will continue to rise on a seasonal basis as Q1 tends to see bonus checks/tax refunds used to catch up). I would highlight that the low levels of delinquency are a function of unique factors that are now REVERSING rather than normalizing

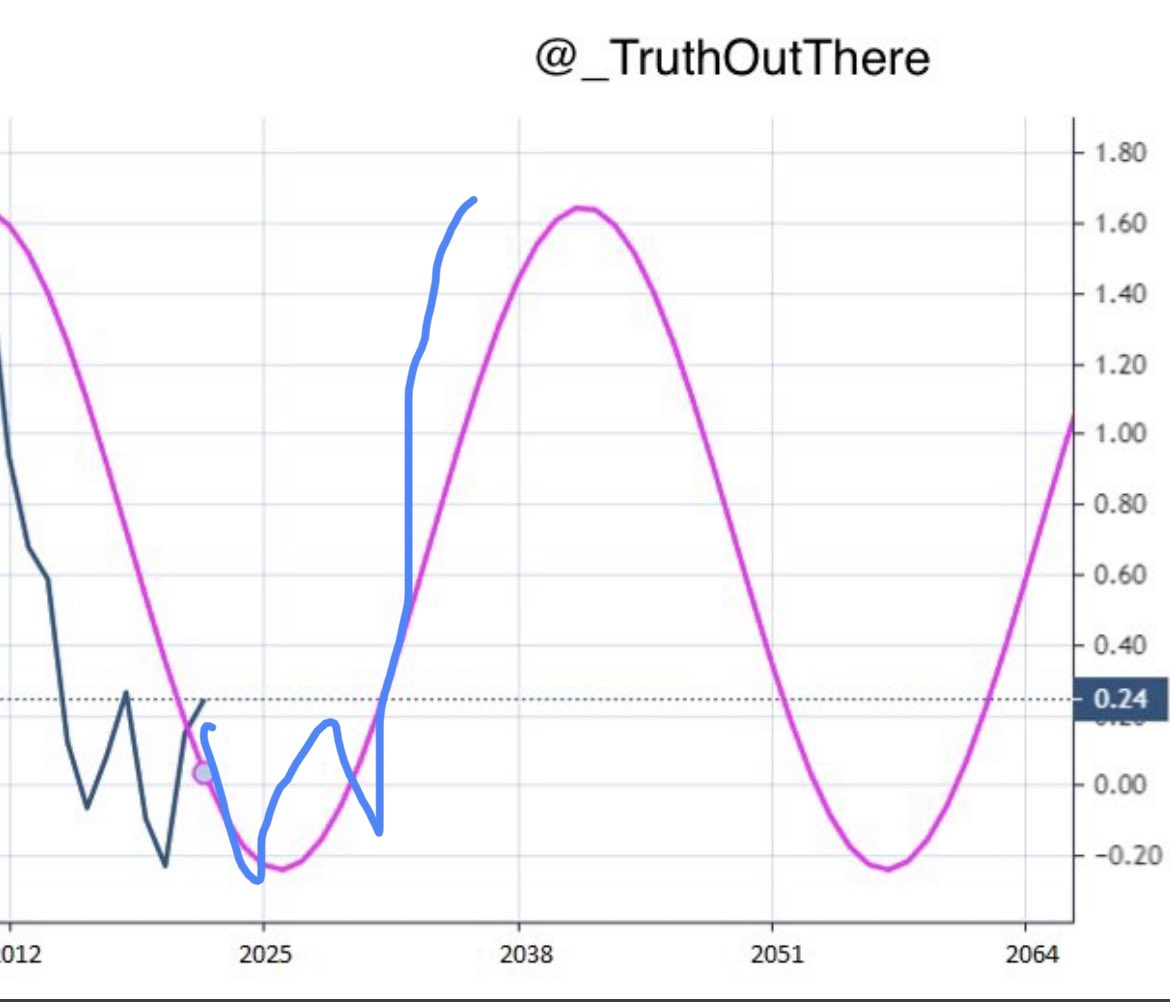

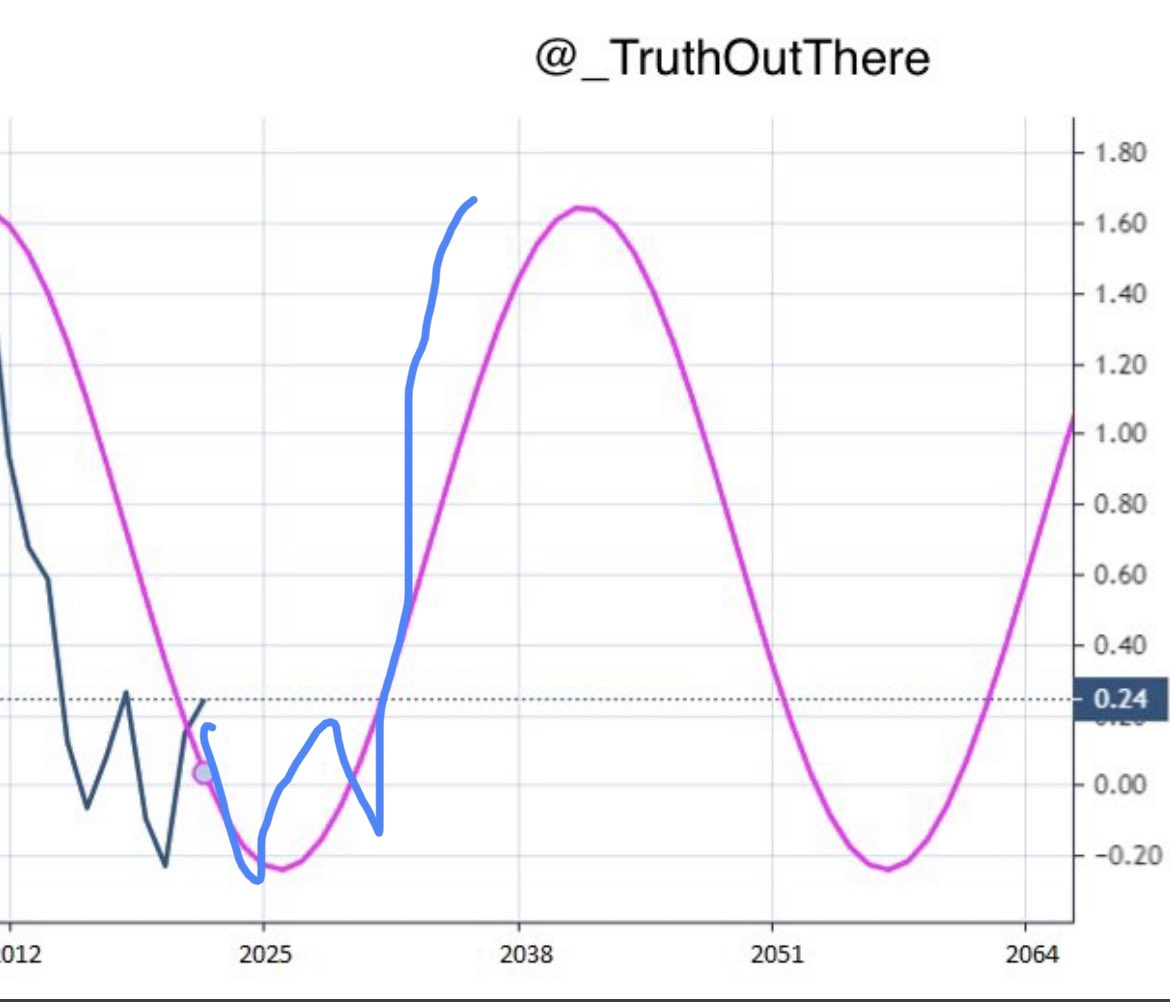

https://twitter.com/_TruthOutThere/status/16405334338678128642/n Assuming the historical cycles hold, sometime between now and 2030 there will be an epic buying opportunity in commodities. But before we get there, it’s likely to look something like this.

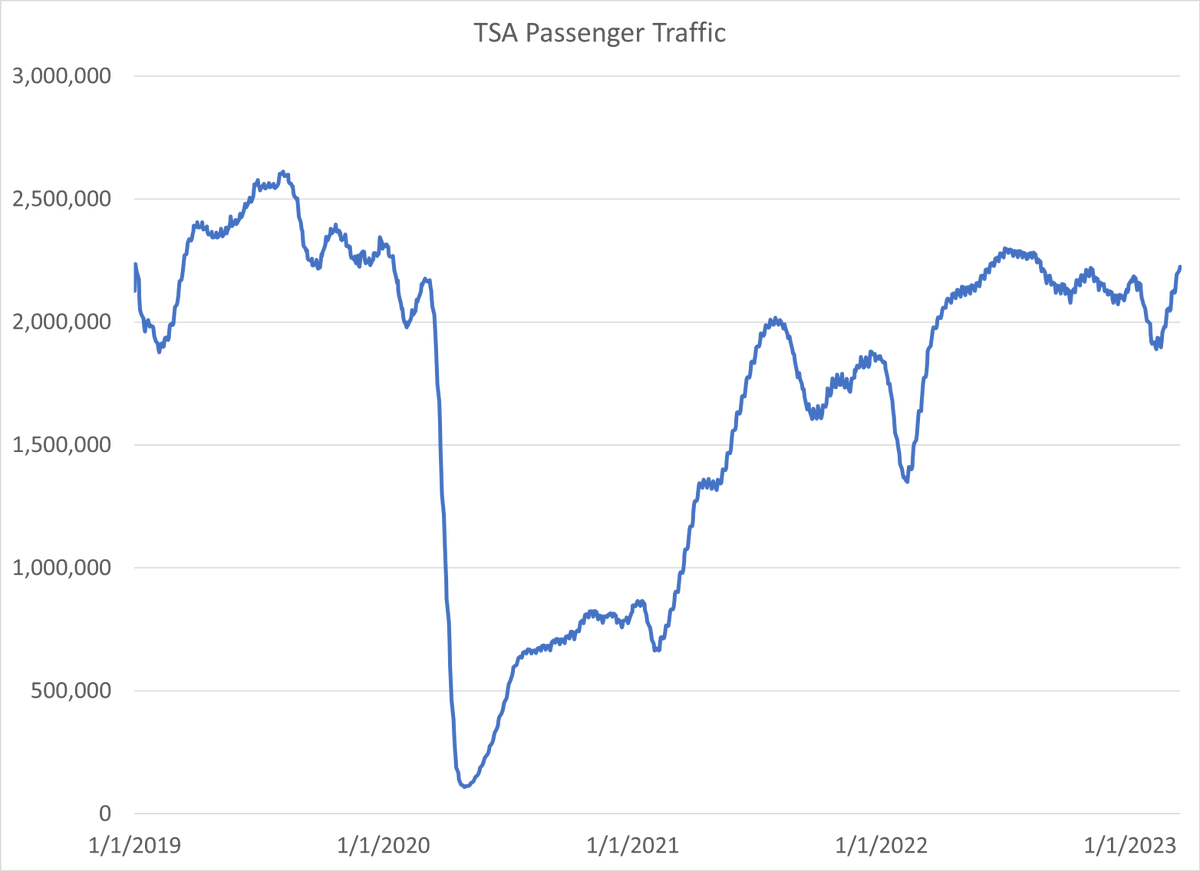

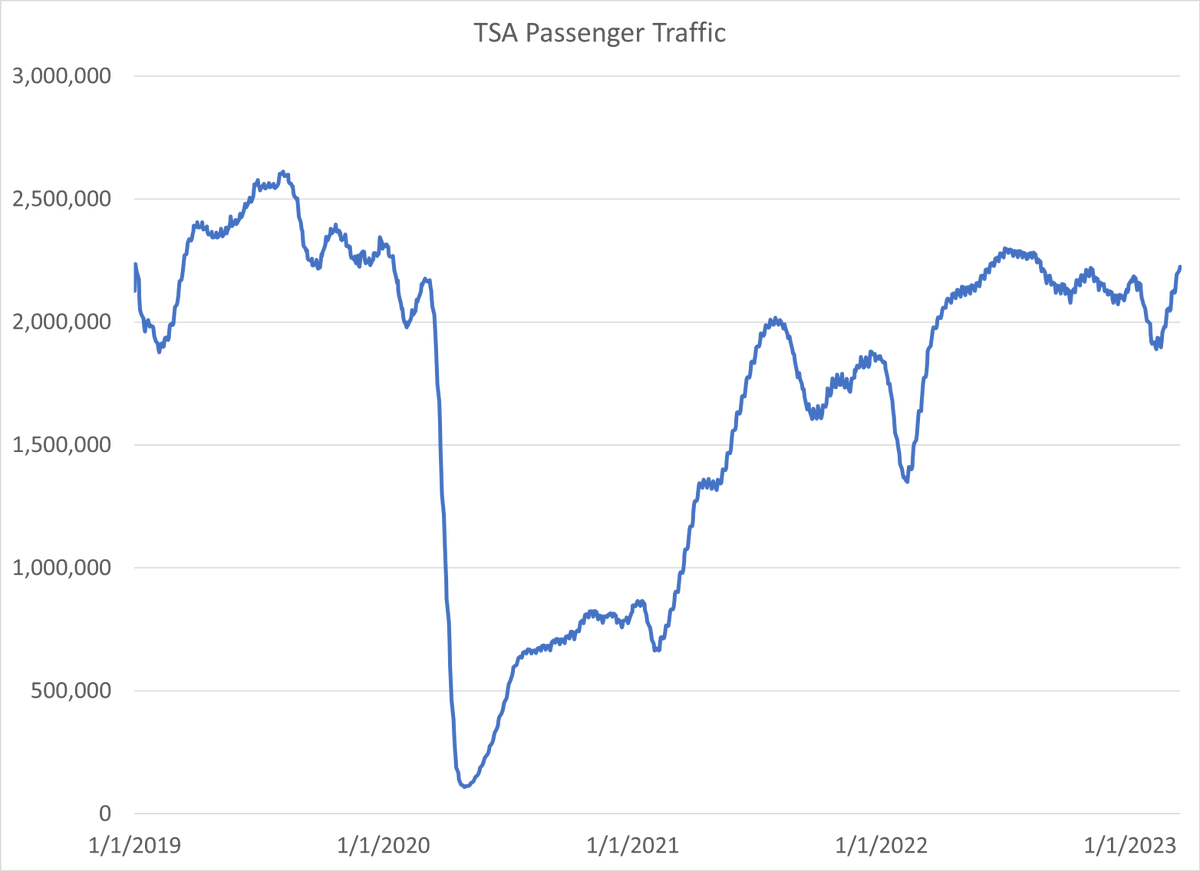

https://twitter.com/profplum99/status/16364401282301337602/n The TSA daily passenger data has matched 2019 levels and are up roughly 12% from 2022 levels. This is clearly a sign of economic strength, no? Well... it's complicated

https://twitter.com/kenanfikri/status/1617918980802613248

"The national surge in business formation since 2020 has been led by a handful of industries, including transport and warehousing; accommodation and food services; health care and social assistance; and retail trade."

"The national surge in business formation since 2020 has been led by a handful of industries, including transport and warehousing; accommodation and food services; health care and social assistance; and retail trade."