How to get URL link on X (Twitter) App

https://twitter.com/VMRConstancio/status/1361394154484469768You will find evidence that partisans SAY they are spending in response to winner of election, but it is very difficult to detect actual changes in spending in administrative data.

Suppose decline in interest rates is due to demand-side factors (population aging, rising inequality, global saving glut). How will firms respond to lower interest rates when deciding how much to invest in productivity enhancement? (2/N)

Suppose decline in interest rates is due to demand-side factors (population aging, rising inequality, global saving glut). How will firms respond to lower interest rates when deciding how much to invest in productivity enhancement? (2/N)

https://twitter.com/M_C_Klein/status/1268922873957109760The indebted demand framework makes the case that rising inequality fuels a saving glut of the rich, putting downward pressure on interest rates and ultimately economic output.

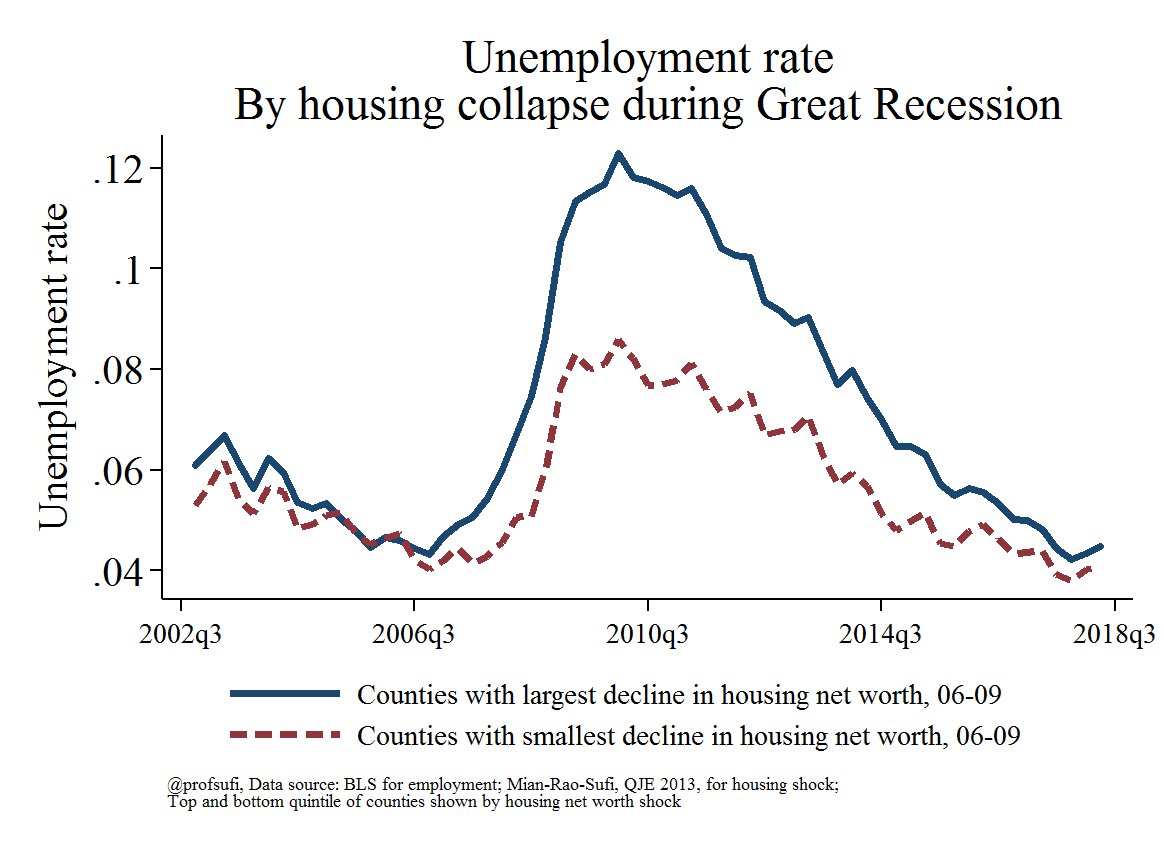

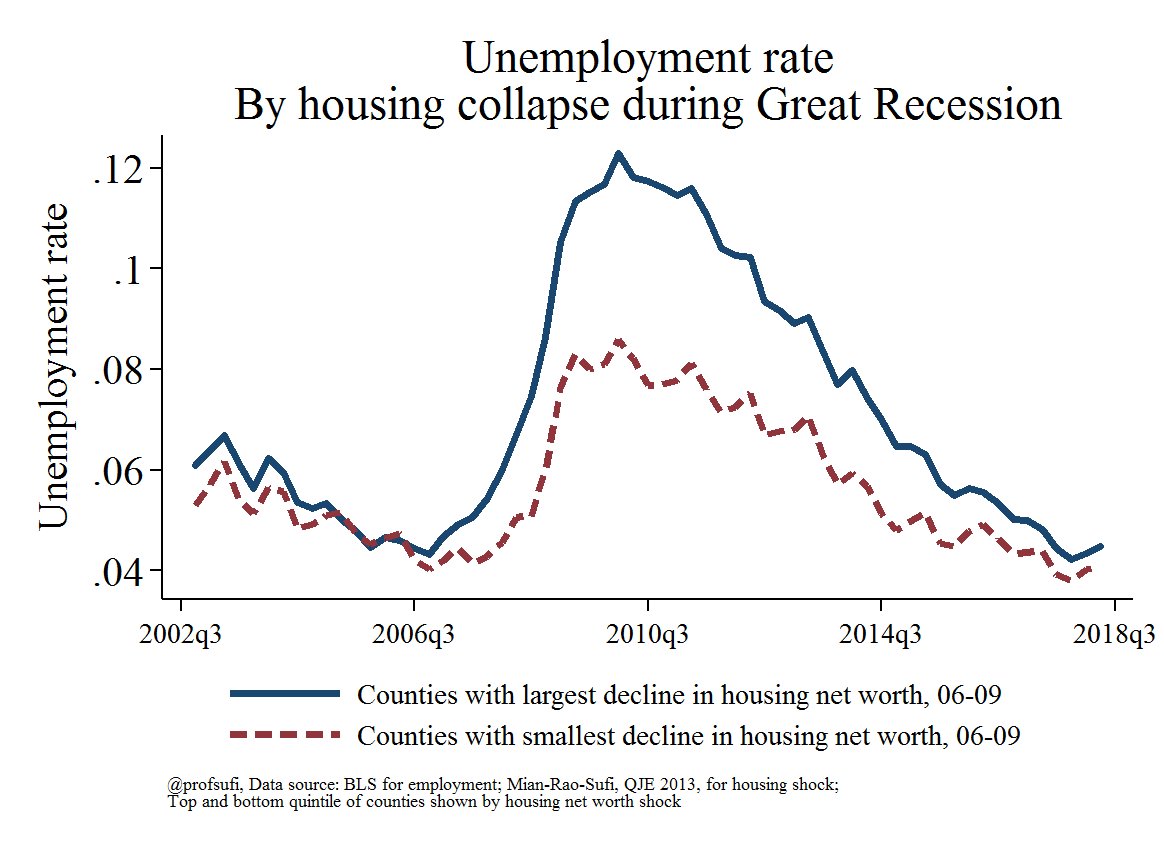

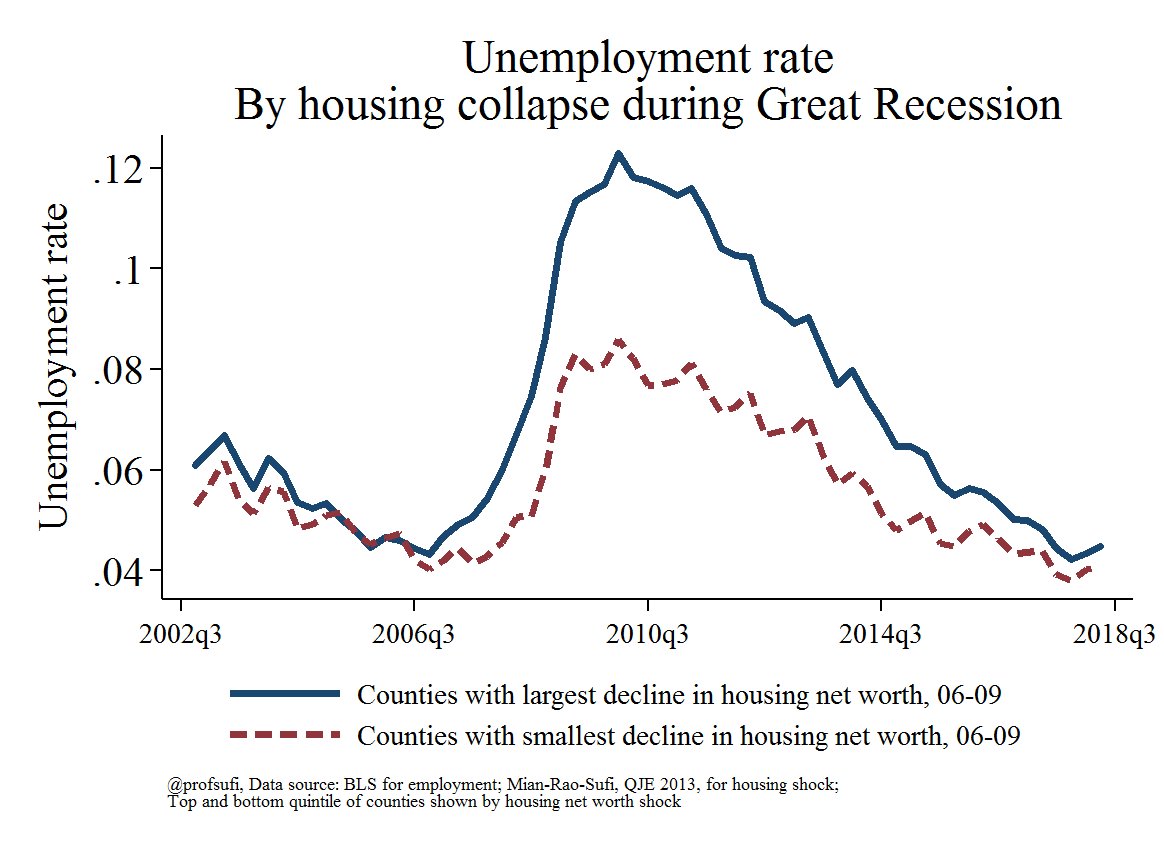

2/ Notice that pre 2006, counties with largest subsequent housing collapse saw similar unemployment rates, and even weak evidence of a larger decline in unemployment rate.

2/ Notice that pre 2006, counties with largest subsequent housing collapse saw similar unemployment rates, and even weak evidence of a larger decline in unemployment rate.