How to get URL link on X (Twitter) App

I knew that a Facebook job was a better opportunity, so when he suddenly responded 6 weeks later, my gut sunk.

I knew that a Facebook job was a better opportunity, so when he suddenly responded 6 weeks later, my gut sunk.

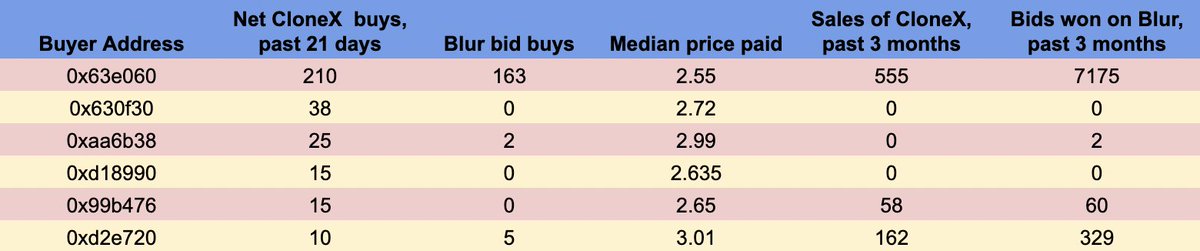

Because sellers can only sell 60 at once, his bot can remove the bids when he sees that someone sold.

Because sellers can only sell 60 at once, his bot can remove the bids when he sees that someone sold.

He has done the same thing on CloneX over the past few weeks, currently long 210 between many wallets.

He has done the same thing on CloneX over the past few weeks, currently long 210 between many wallets.

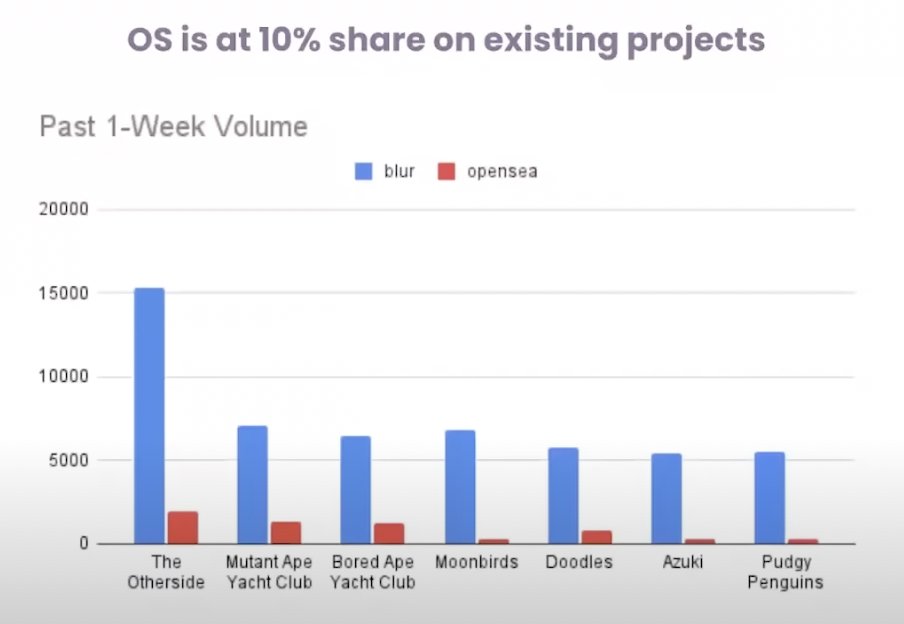

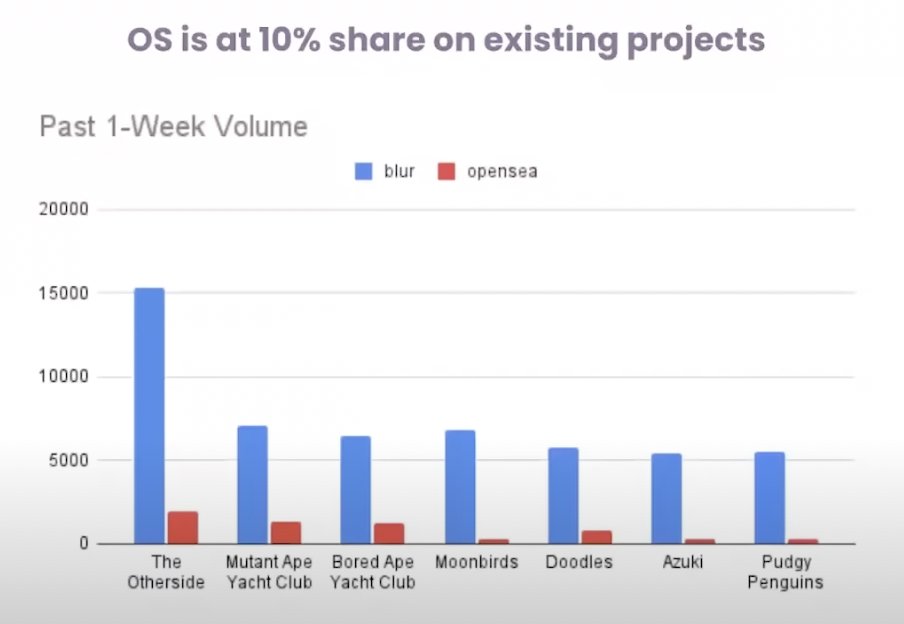

The trend has been pretty similar on Azuki, even though prices have been more steady. People are taking advantage of market-maker liquidity.

The trend has been pretty similar on Azuki, even though prices have been more steady. People are taking advantage of market-maker liquidity.

Magnitude is impacted too.

Magnitude is impacted too.

2) 96.8% of punks haven't sold once in 2023 this year, the lowest of major projects, by far.

2) 96.8% of punks haven't sold once in 2023 this year, the lowest of major projects, by far.

I feel like that's starting to happen.

I feel like that's starting to happen.

2) There are two reasons for this:

2) There are two reasons for this:

2) The real move in royalty rate happened when Blur launched. To me that was really when this move happened. OS tried to use their exchange block to protect royalties but when Blur got around it, OS lost all leverage in protecting royalties.

2) The real move in royalty rate happened when Blur launched. To me that was really when this move happened. OS tried to use their exchange block to protect royalties but when Blur got around it, OS lost all leverage in protecting royalties.

3. This is a positive for new projects who want to have royalties enforced. They can now have royalties enforced on OpenSea and Blur. Yesterday they had to be optional royalty.

3. This is a positive for new projects who want to have royalties enforced. They can now have royalties enforced on OpenSea and Blur. Yesterday they had to be optional royalty.

3) At this point, anyone can bid on the punk at the same price or more. If they offer more gas to validators, they will win the punk ("snipe" it).

3) At this point, anyone can bid on the punk at the same price or more. If they offer more gas to validators, they will win the punk ("snipe" it).

2) Other marketplaces claim to be pro-creator but have cut out creators almost completely

2) Other marketplaces claim to be pro-creator but have cut out creators almost completely

The vast majority of volume on x2y2 and blur are 0% royalty, even though both teams make royalties optional and suggest they promote royalties.

The vast majority of volume on x2y2 and blur are 0% royalty, even though both teams make royalties optional and suggest they promote royalties.

4) The proposal by @CodeInCoffee will likely pass (97% have voted in favor, needs 75%) which means NFTs will default earlier & NFTs that default will more easily get bids

4) The proposal by @CodeInCoffee will likely pass (97% have voted in favor, needs 75%) which means NFTs will default earlier & NFTs that default will more easily get bids