Chairman @kruthamx. Associate researcher @LSEPhilosophy. 6* finisher @WMMajors. Follow me on Bluesky https://t.co/3oa5ME6G3m

How to get URL link on X (Twitter) App

https://twitter.com/StuartPringle1/status/1303998545272492033The BEE Commission analysed almost 6000 BEE certificates this year. It found that ave black ownership in companies had increased to 29% from 25%. While it doesn't determine how many individuals benefit from this ownership, smaller companies often use staff schemes. So its a lot.

https://twitter.com/Sentletse/status/1272976109035048962China: Government has been introducing private shareholders into the three state-owned airlines for some time efe.com/efe/english/bu…. Have a look at China on this list: not one single case of increased investment in airlines by the state in China: https://t.co/1wgLv3f1yA

https://twitter.com/carteblanchetv/status/1125067632686899200Banks are intermediaries. They sit in between savers (funders) and borrowers. Funders have significant influences over banks because they will withhold funds from banks that do not meet desired criteria. 2/13

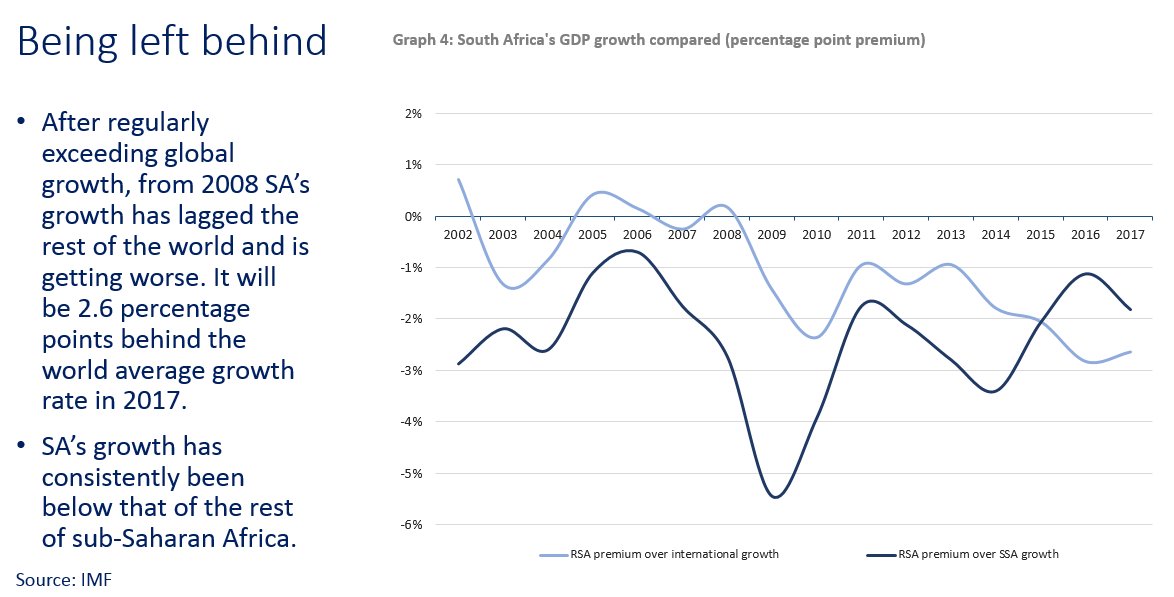

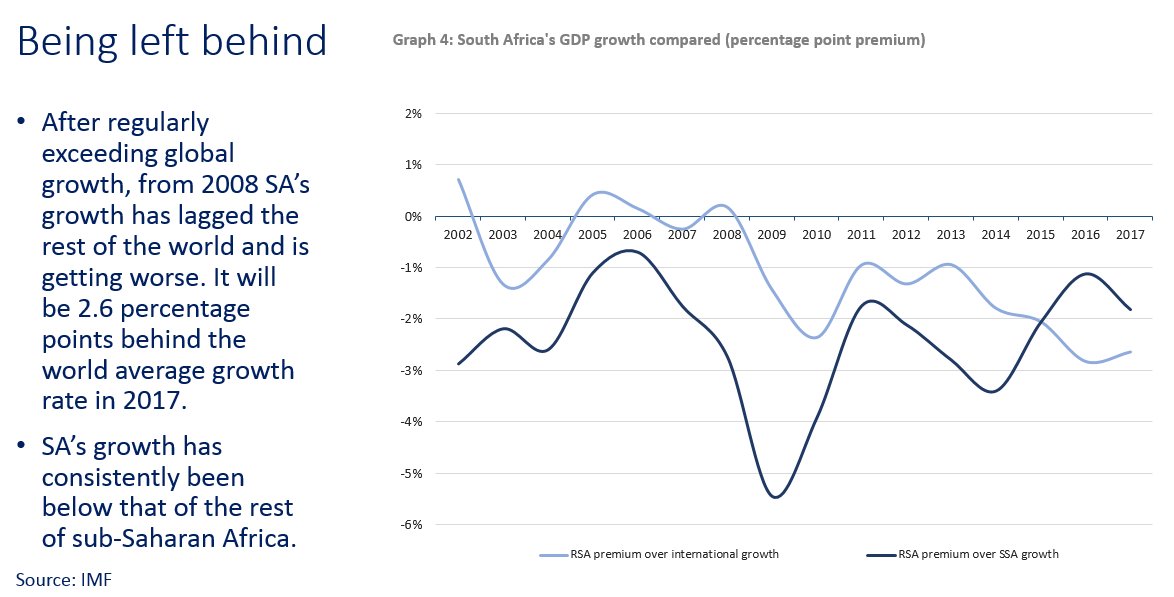

Business confidence collapsed.

Business confidence collapsed.