Co-founder, Samasthiti Advisors. #40under40 Alternative Investment Professional. Member, PL Committee, CFA Society India. Views personal.

How to get URL link on X (Twitter) App

(2/n) Some funds have chosen their benchmark as Nifty 50 and some as Nifty 100 (see note 3 at the end). Out of the total of 24 funds, 14 funds under-performed their chosen benchmark. Thus, more than half the funds under-performed.

(2/n) Some funds have chosen their benchmark as Nifty 50 and some as Nifty 100 (see note 3 at the end). Out of the total of 24 funds, 14 funds under-performed their chosen benchmark. Thus, more than half the funds under-performed.

Dr Arvind Rajan's session on Global Fixed Income market, explaining the conundrum, how does higher level of global debt ratios lead to lower and lower bond yields. @CFASocietyIndia #ifis2019

Dr Arvind Rajan's session on Global Fixed Income market, explaining the conundrum, how does higher level of global debt ratios lead to lower and lower bond yields. @CFASocietyIndia #ifis2019

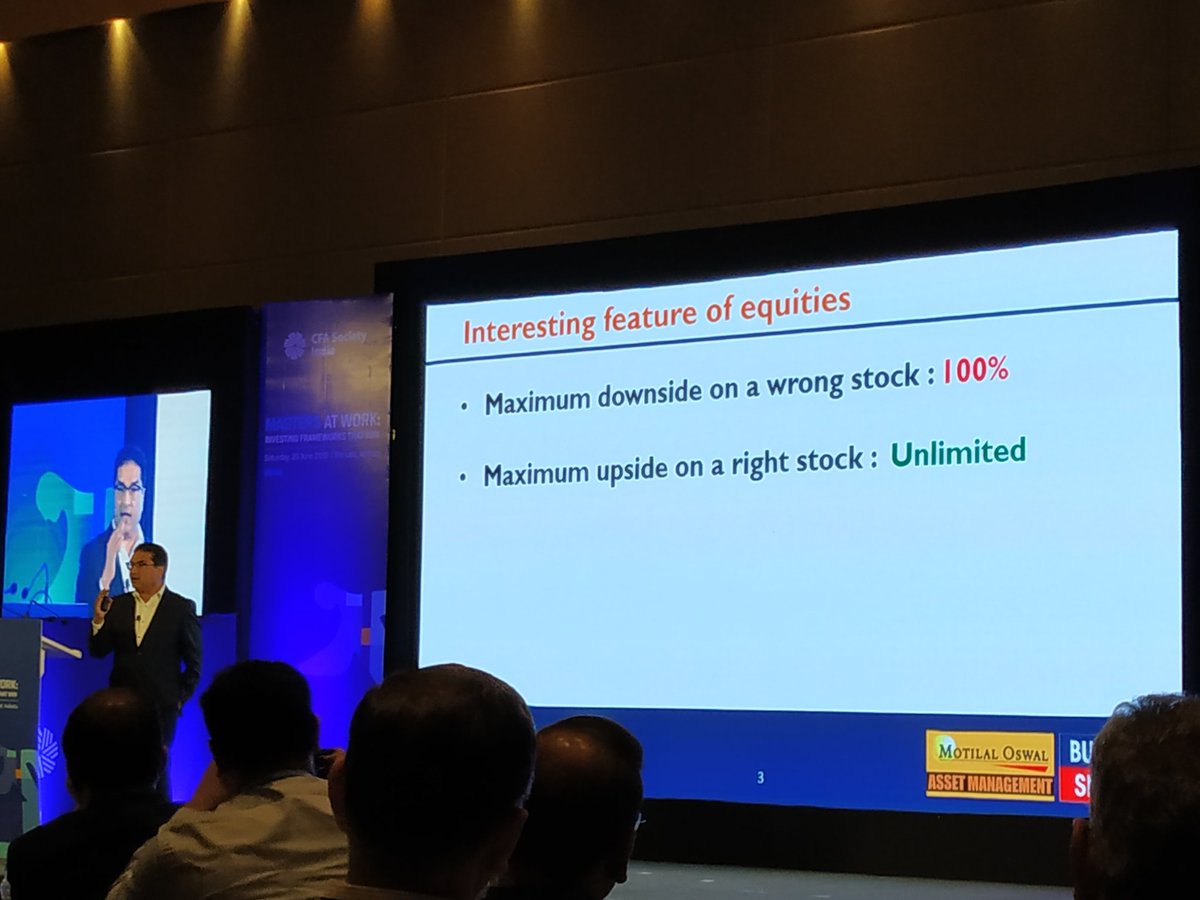

(1/n) Tweet thread below on some fascinating observations. Ramdeo's session: Equities represent limited downside and unlimited upside (!) Downside is 100%, upside is unlimited. #maw @CFASocietyIndia

(1/n) Tweet thread below on some fascinating observations. Ramdeo's session: Equities represent limited downside and unlimited upside (!) Downside is 100%, upside is unlimited. #maw @CFASocietyIndia