Position Trader | 3X US Investing Championship Top Performer | $1MM+ Money Manager Division | Macro/Fundamental/Technical Analysis

How to get URL link on X (Twitter) App

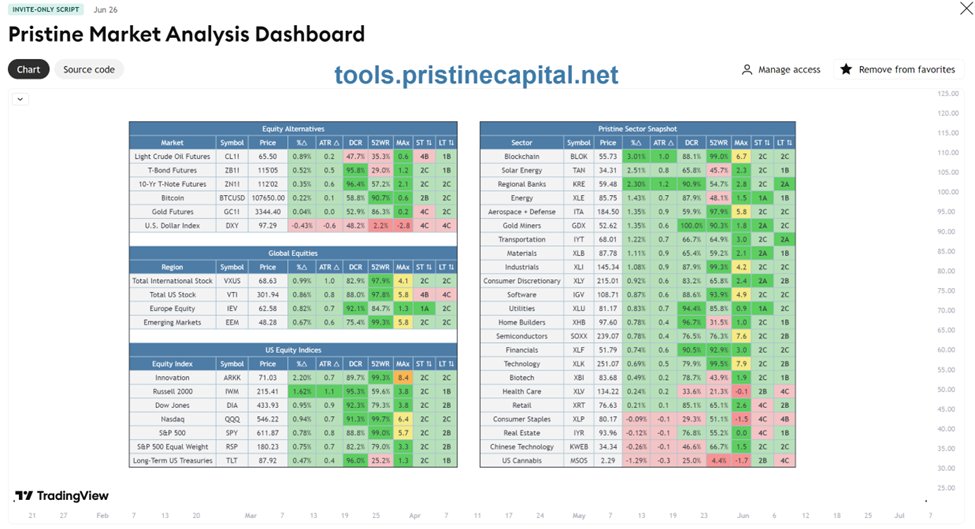

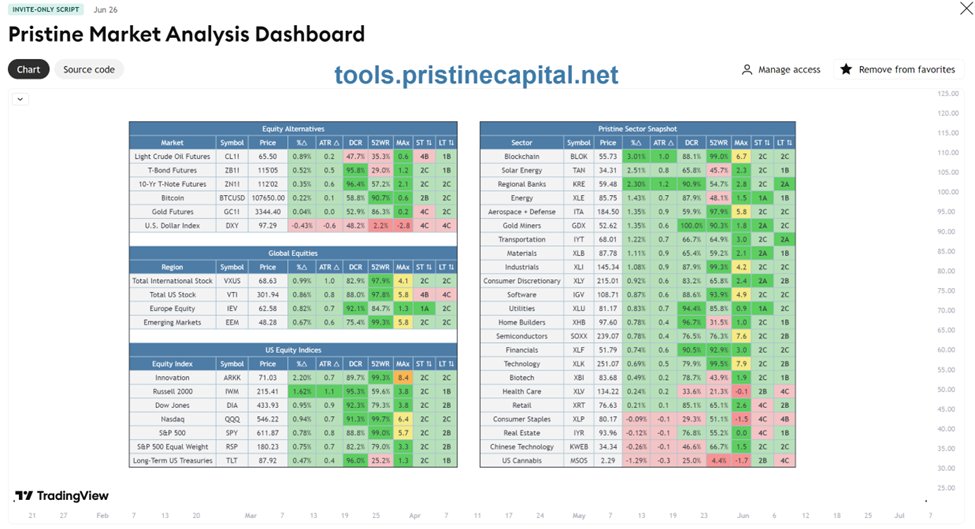

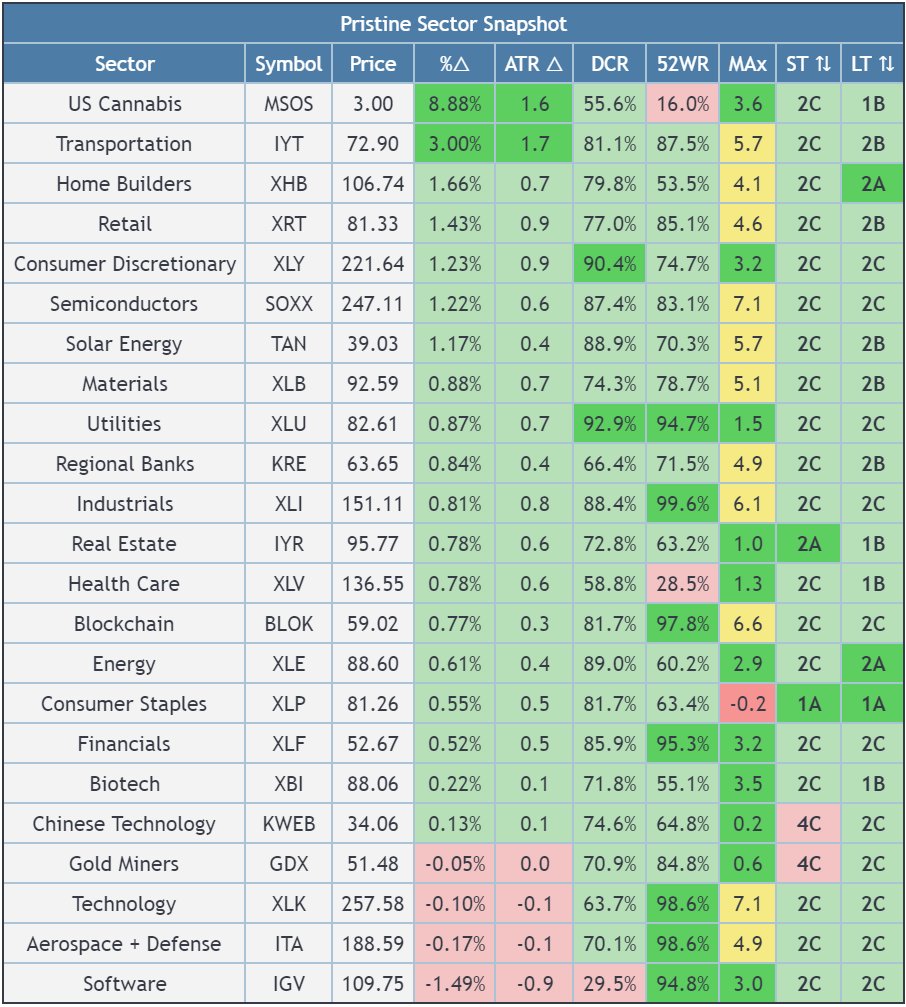

@tradingview @JohnMuchow 1️⃣ Pristine Value Areas

@tradingview @JohnMuchow 1️⃣ Pristine Value Areas

Stage analysis, popularized by Stan Weinstein, is a trend-following system that classifies assets into 4 stages:

Stage analysis, popularized by Stan Weinstein, is a trend-following system that classifies assets into 4 stages:

1/

1/

1/

1/

1. Every options trade starts with a view.

1. Every options trade starts with a view.https://twitter.com/860869806500839429/status/1859221277640200494

1/ 🧵 **My Trading System**

1/ 🧵 **My Trading System**

1. Trading PnL isn’t linear but comes in sporadic bunches.

1. Trading PnL isn’t linear but comes in sporadic bunches.