How to get URL link on X (Twitter) App

https://twitter.com/1471420332862885889/status/1854554613929644332

1/ Introduction to Story Protocol 🧑🏫

1/ Introduction to Story Protocol 🧑🏫

1/ What is ListaDAO? 🤔

1/ What is ListaDAO? 🤔

1/ Cyberbeavers is a multiplayer, top-down 2D shooting game featuring unique mechanics. Your goal is to score the most points.

1/ Cyberbeavers is a multiplayer, top-down 2D shooting game featuring unique mechanics. Your goal is to score the most points.

1/ Bitcoin Liquid Staking 💧

1/ Bitcoin Liquid Staking 💧

1/ What's KelpDAO? 🧐

1/ What's KelpDAO? 🧐

https://twitter.com/1377493693762969600/status/1759850973546287141

1/ What's Pendle? 🧐

1/ What's Pendle? 🧐

1/ What is pxETH? 🧐

1/ What is pxETH? 🧐

1/ Diversity of Data Feeds 🧮

1/ Diversity of Data Feeds 🧮

https://twitter.com/1294053547630362630/status/1721845358635192591

1/ LST Protocols & CEXes: @LidoFinance @Rocket_Pool @binance @fraxfinance @coinbase @staderlabs @swellnetworkio @stakewise_io

1/ LST Protocols & CEXes: @LidoFinance @Rocket_Pool @binance @fraxfinance @coinbase @staderlabs @swellnetworkio @stakewise_io

https://twitter.com/1163782803298951170/status/1729530659566149762

1/ What is StakeWise V3?

1/ What is StakeWise V3?https://twitter.com/1163782803298951170/status/1680928278108930049

2/ What's ZK Stack?

2/ What's ZK Stack?

https://twitter.com/enzymefinance/status/1713873027216109909

1/ What's Enzyme?

1/ What's Enzyme?

1/ What's AltLayer?

1/ What's AltLayer?

1/ What's Caldera?

1/ What's Caldera?

https://twitter.com/gelatonetwork/status/1702034463432261695

1/ What is zkRaaS?

1/ What is zkRaaS?

1/ Let's start with what is Gravita?

1/ Let's start with what is Gravita?

1/ RedStone is thrilled to announce it has partnered with Avalanche Evergreen as its launch partner, providing data feeds to dApps on Avalanche Spruce Testnet, allowing traditional finance organisations to interact with OnFi (on-chain finance).

1/ RedStone is thrilled to announce it has partnered with Avalanche Evergreen as its launch partner, providing data feeds to dApps on Avalanche Spruce Testnet, allowing traditional finance organisations to interact with OnFi (on-chain finance).

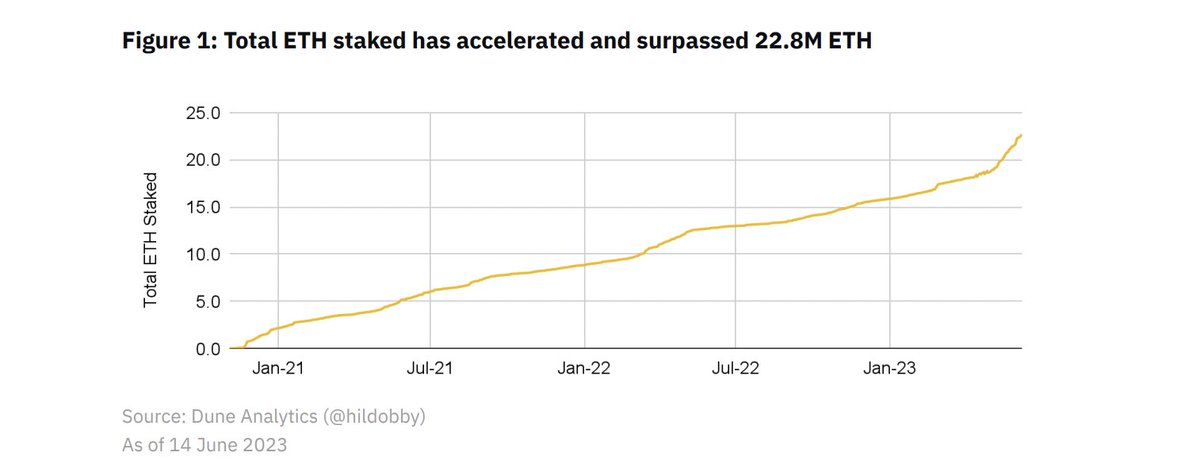

1/ This growth couldn't be possible without so many ppl staking their ETH reaching for now 22.8M

1/ This growth couldn't be possible without so many ppl staking their ETH reaching for now 22.8M

1/ First off, if you're new to Swell, it's a top-tier decentralized liquid staking protocol that allows users to generate passive income by staking $ETH, earning blockchain rewards, & obtaining a yield-bearing liquid staking token (LST), swETH 🌊

1/ First off, if you're new to Swell, it's a top-tier decentralized liquid staking protocol that allows users to generate passive income by staking $ETH, earning blockchain rewards, & obtaining a yield-bearing liquid staking token (LST), swETH 🌊