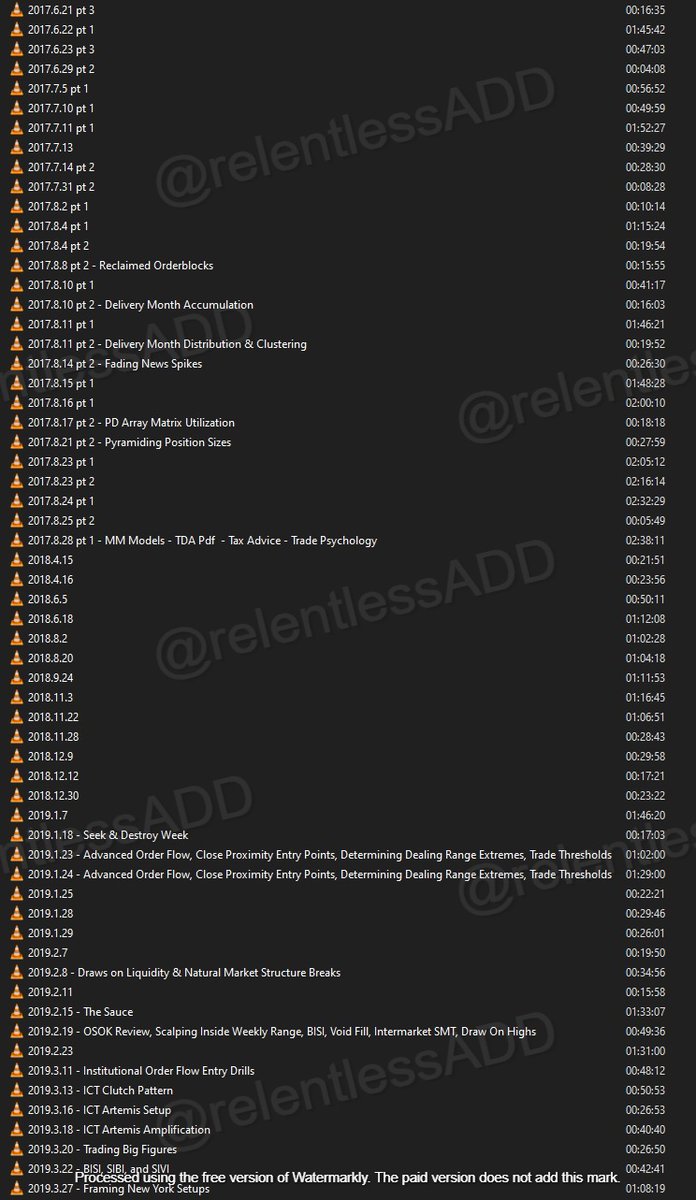

i trade. Not Financial Advice (NFA). Learning since 2012, ICT 2015, Charter.

How to get URL link on X (Twitter) App

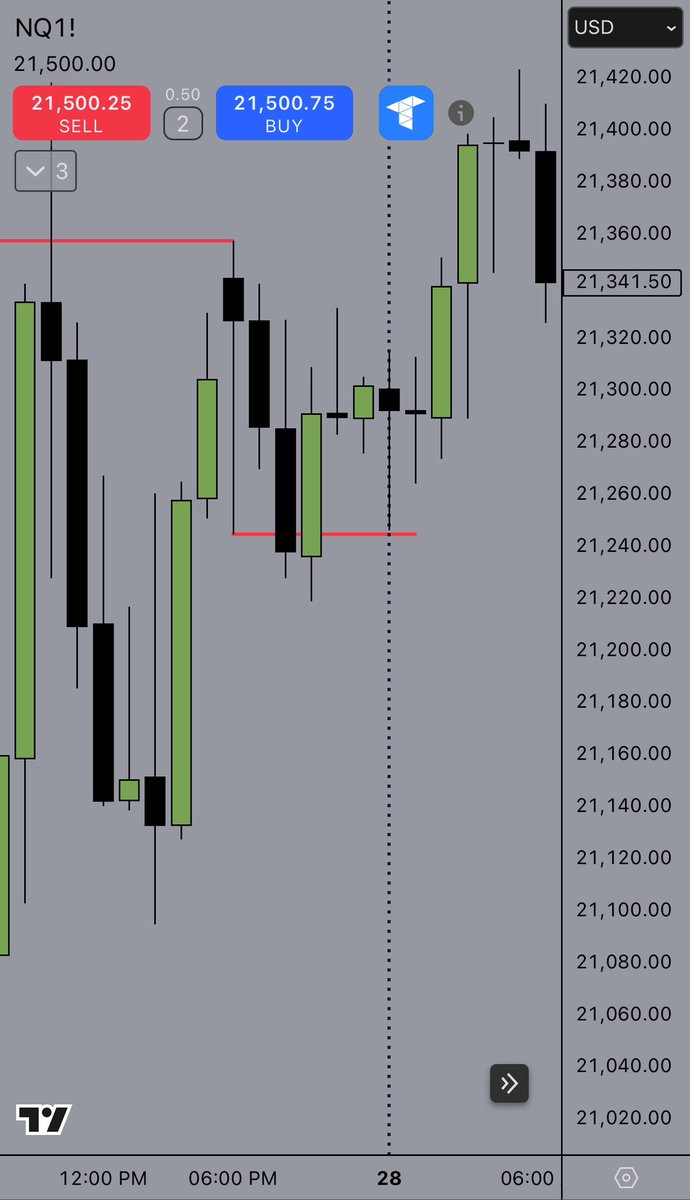

A trading range (as I define it) is where we take one side of the market but not the other.

A trading range (as I define it) is where we take one side of the market but not the other.