Silicon Valley Operator + Wall St Investor.

Open to work on interesting opportunities.

Tweets are just personal notes.

How to get URL link on X (Twitter) App

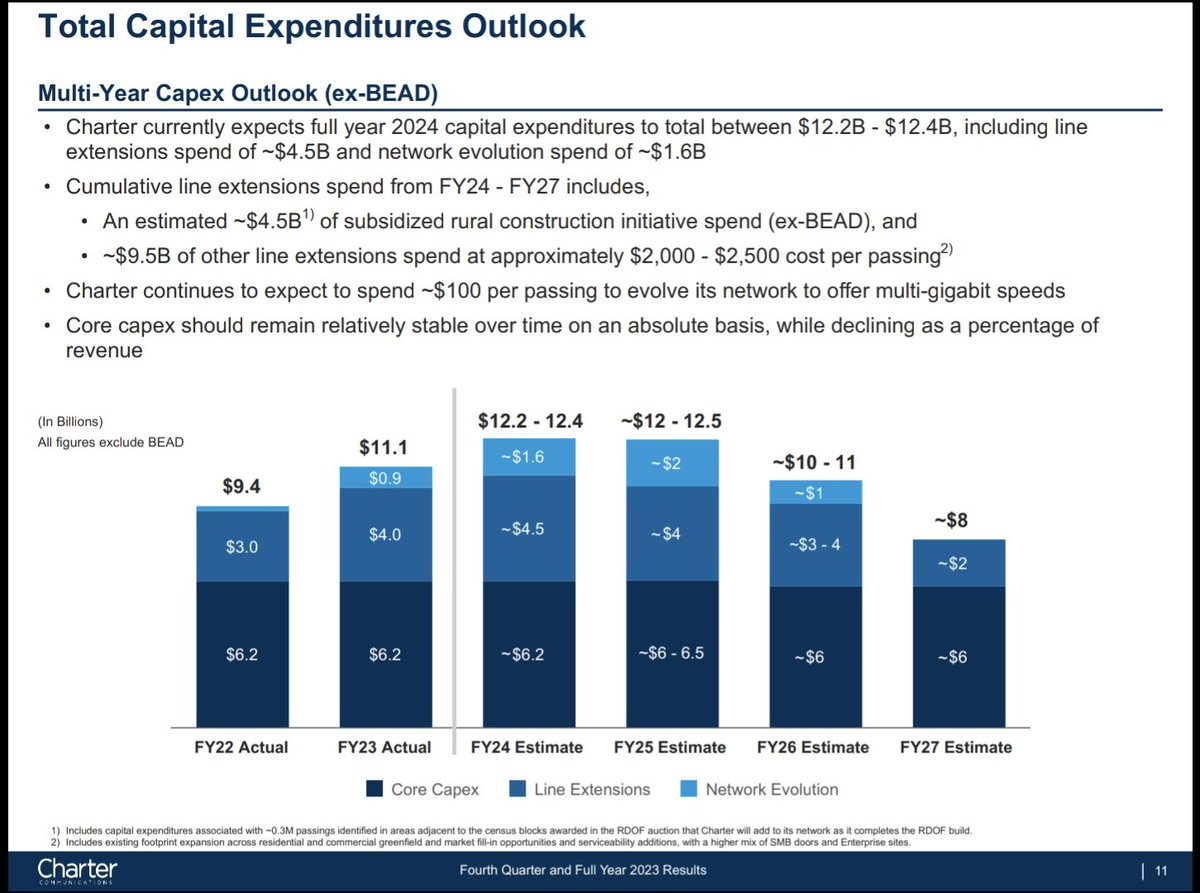

IMO, the elevated capex spend till 2026 are in response to intense competition from both Fiber and FWA.

IMO, the elevated capex spend till 2026 are in response to intense competition from both Fiber and FWA.

Retail businesses with pre-established clout are going to continue printing money in the influencer/AI led era.

Retail businesses with pre-established clout are going to continue printing money in the influencer/AI led era.

https://twitter.com/Roadmap2Retire/status/1433875467615055873?s=19(cont)

https://twitter.com/retaox/status/1392143820444274688?s=19@Wallfacer_LuoJi High barrier to entry :

https://twitter.com/retaox/status/1392141290670788613?s=19

https://twitter.com/TreyHenninger/status/1363141639359750145"Don’t confuse how fast a car is moving at this instant with how much distance it’s covered in the past hour"