I try to simplify the markets ➡️ Macro insights 🔎 | Stock market info 📊 | Tech news 💬 | 𝐅𝐫𝐞𝐞 🗞️ @TheOneRead | Not financial advice.

3 subscribers

How to get URL link on X (Twitter) App

🛬 Landing? #Bigflip ? Soft landing?

🛬 Landing? #Bigflip ? Soft landing? https://twitter.com/benjaminmlavine/status/1627317292122898434

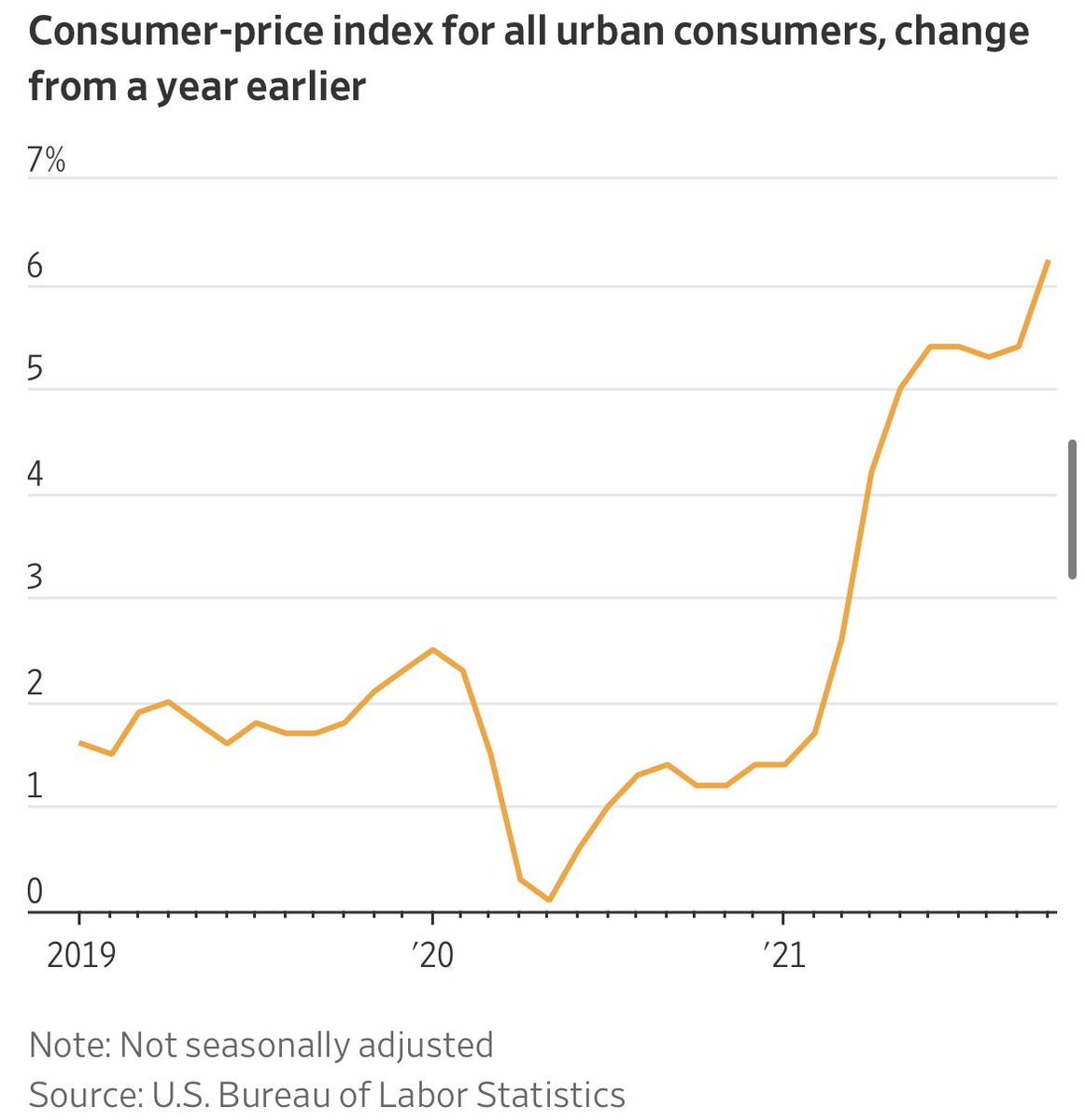

So if the decline started March 2022 we would bottom somewhere early to middle of next year.

So if the decline started March 2022 we would bottom somewhere early to middle of next year.

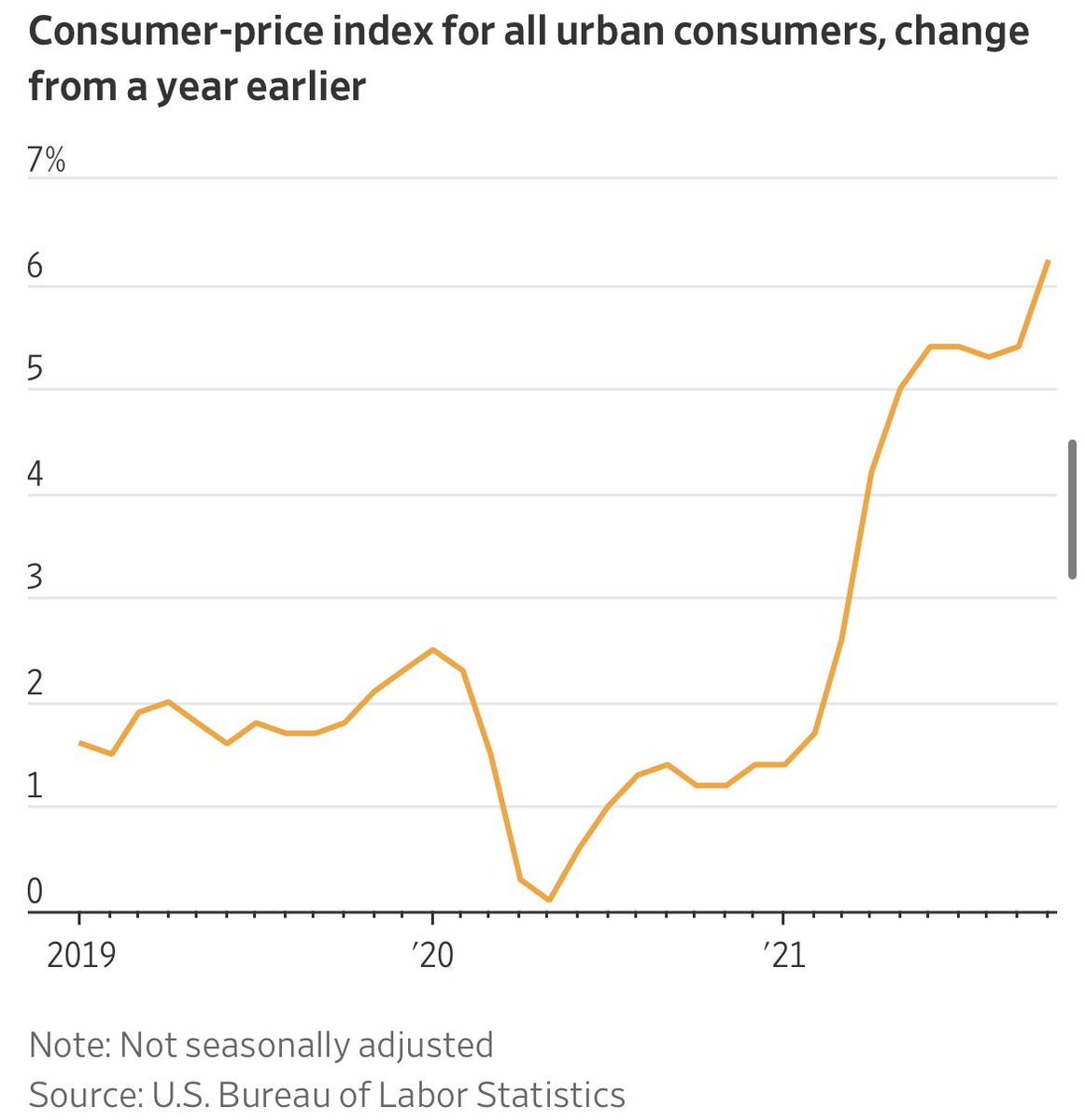

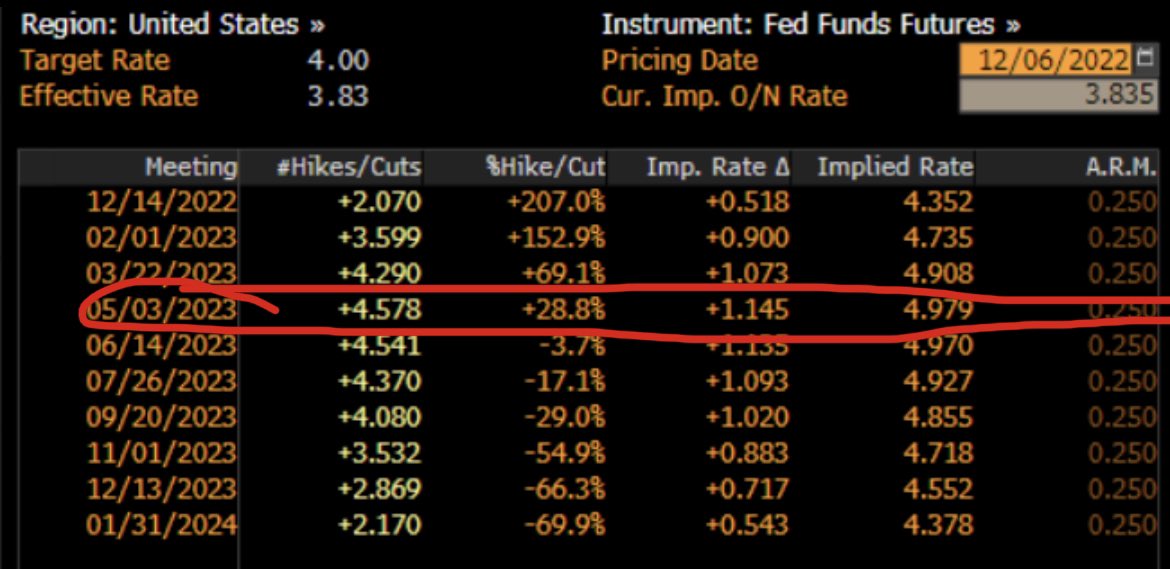

First, how do the markets perform after inflation has peaked? Here’s the data 📊

First, how do the markets perform after inflation has peaked? Here’s the data 📊

To follow the recent rise, we’ll need to note 3 things:

To follow the recent rise, we’ll need to note 3 things:

https://twitter.com/rhemrajani9/status/1577044615491829760

https://twitter.com/rhemrajani9/status/1565761777715003394

https://twitter.com/rhemrajani9/status/1466620519948554242?s=21&t=iq19i8dW8-MqRjOxFpzOTw

Median home prices hit >$400k last month. The pace at which we have seen this increase is astonishing.

Median home prices hit >$400k last month. The pace at which we have seen this increase is astonishing.

Indicators of a bottom ? @42macroDDale 🎧

Indicators of a bottom ? @42macroDDale 🎧

Recent report by $GS via Bloomberg stating their concerns.

Recent report by $GS via Bloomberg stating their concerns.

https://twitter.com/mayhem4markets/status/1485324494583615488?s=21

https://twitter.com/rhemrajani9/status/1397284987427241991

1. Multiples // PE ratio

1. Multiples // PE ratiohttps://twitter.com/rhemrajani9/status/1482546562983239681?s=20