How to get URL link on X (Twitter) App

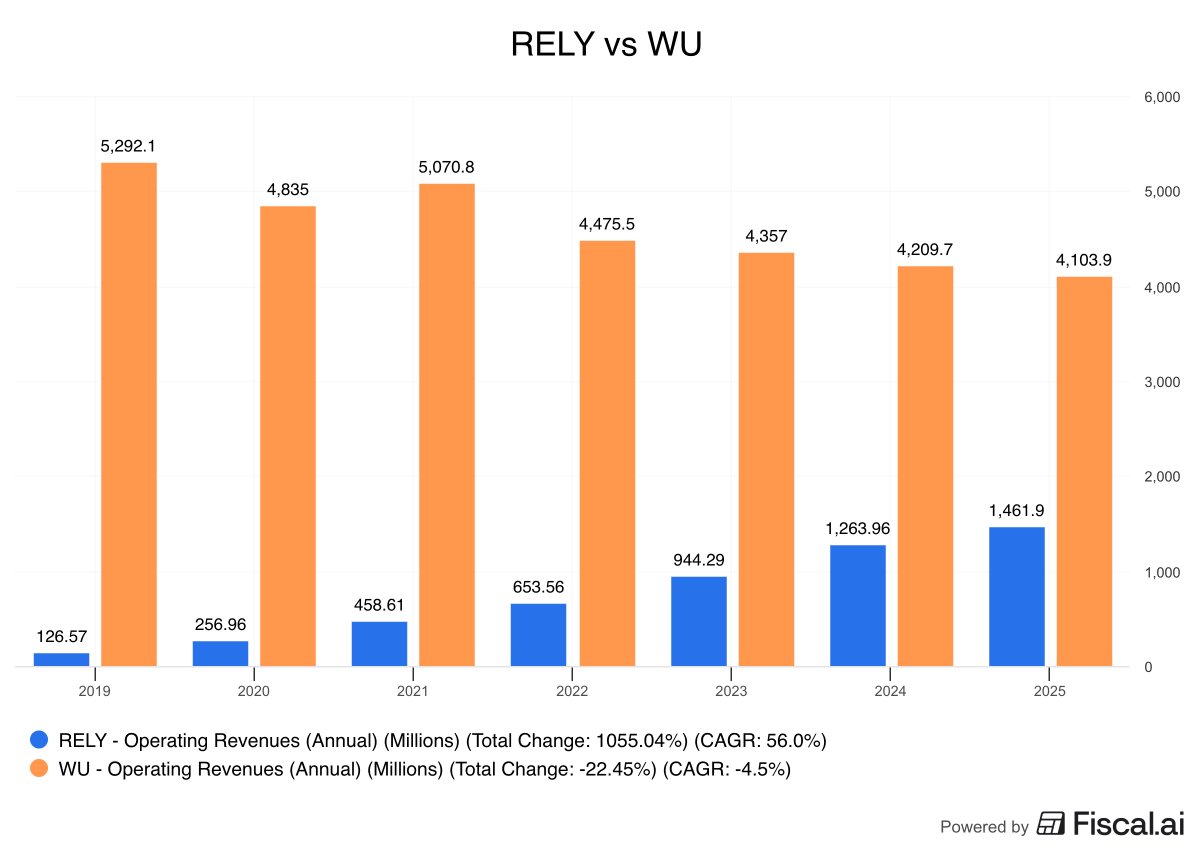

1) Disrupting Traditional Remittance

1) Disrupting Traditional Remittance

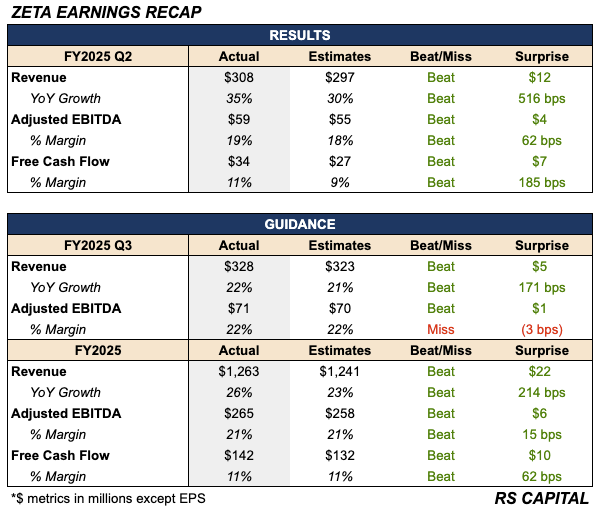

1) 16th Straight “Beat and Raise” Quarter

1) 16th Straight “Beat and Raise” Quarter

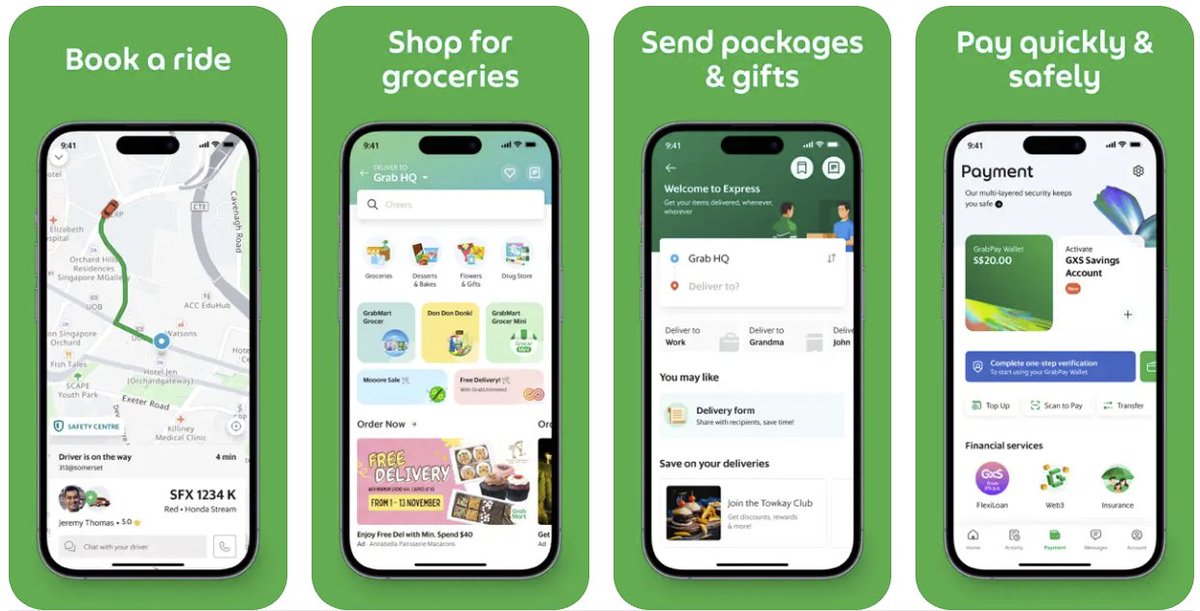

1) The Leading Superapp in Southeast Asia

1) The Leading Superapp in Southeast Asia

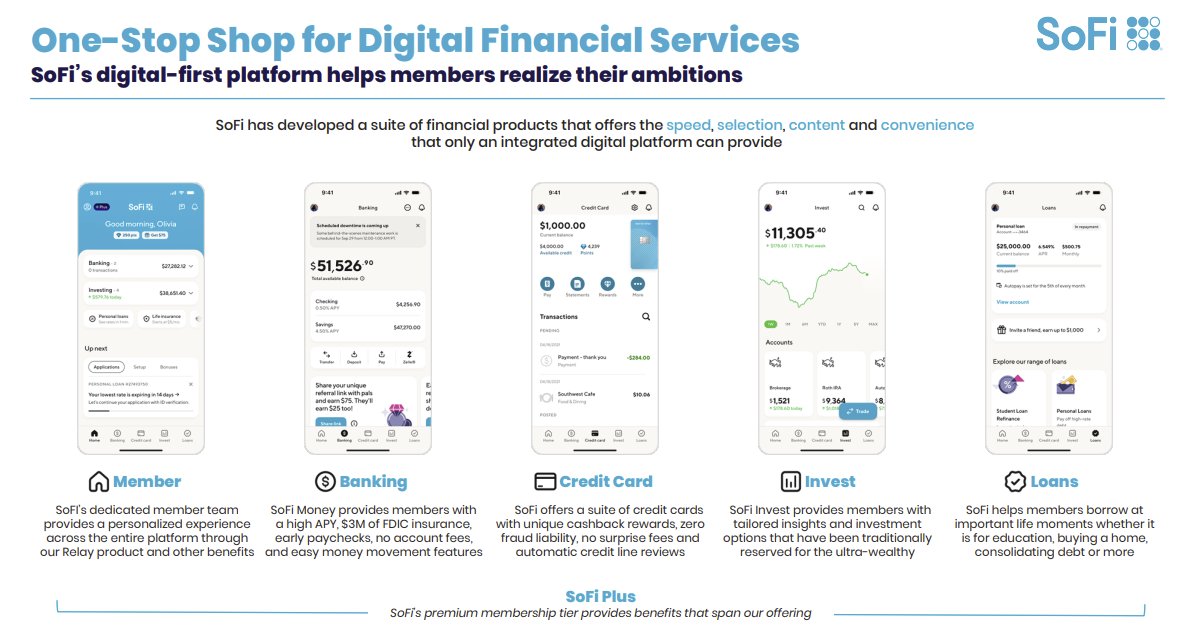

1) The One-Stop Shop for All Things Finance

1) The One-Stop Shop for All Things Finance

2) Only 1% Market Penetration

2) Only 1% Market Penetration

2) The Road to 1GW+ Capacity

2) The Road to 1GW+ Capacity

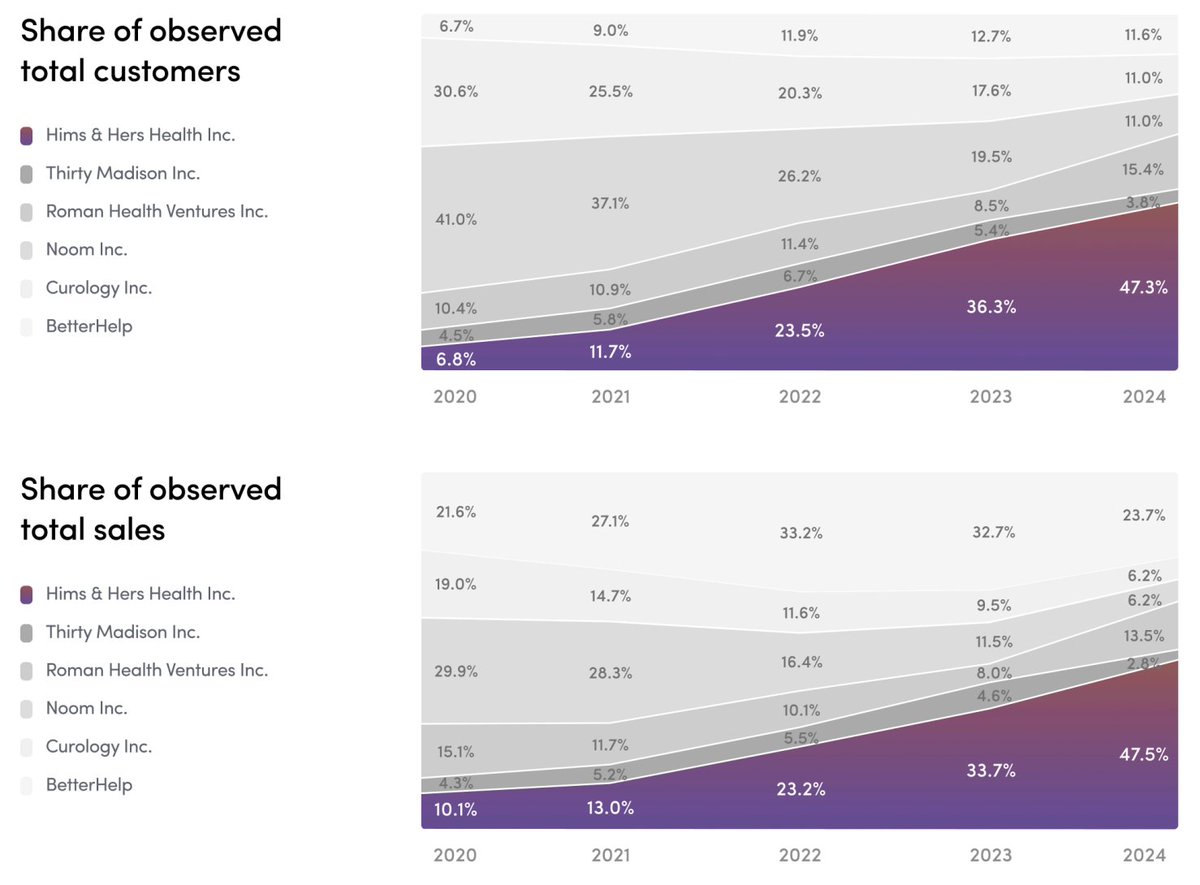

2) Dominant Market Position

2) Dominant Market Position