How to get URL link on X (Twitter) App

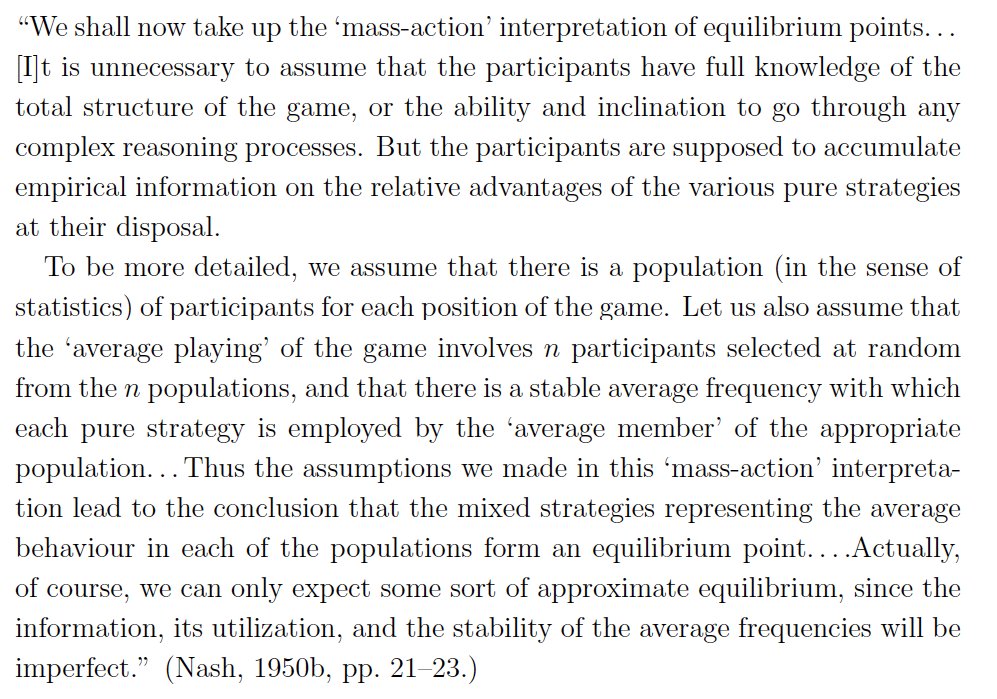

2/ Just when you think you've understood all that Nash brought to game theory, he surprises you. This from his PhD thesis (1950), where he conceptualizes early on, how players could arrive at playing the (well, Nash) equilibrium: a population and an empirical perspective!

2/ Just when you think you've understood all that Nash brought to game theory, he surprises you. This from his PhD thesis (1950), where he conceptualizes early on, how players could arrive at playing the (well, Nash) equilibrium: a population and an empirical perspective!

2/ Policy question: Should we tax capital or specific goods (like luxury items), what they call indirect taxation, to enhance equity? Or can an income tax, what they call direct taxation, alone achieve our redistribution goals? Atkinson & Stiglitz offered a surprising answer.

2/ Policy question: Should we tax capital or specific goods (like luxury items), what they call indirect taxation, to enhance equity? Or can an income tax, what they call direct taxation, alone achieve our redistribution goals? Atkinson & Stiglitz offered a surprising answer.

2/ Imagine a coin flip decides payoffs next year: either (5 now, 10 later) or (5 now, 0). If the flip is revealed today or in a year, final outcomes are the same. Yet many people prefer the earlier resolution – they dislike waiting for uncertainty.

2/ Imagine a coin flip decides payoffs next year: either (5 now, 10 later) or (5 now, 0). If the flip is revealed today or in a year, final outcomes are the same. Yet many people prefer the earlier resolution – they dislike waiting for uncertainty.

Coase pointed out existence of the firm as anomaly in the formidable theories of the market---why not let prices do everything? Why are some activities directed by market forces & others by firms? economist.com/schools-brief/…

Coase pointed out existence of the firm as anomaly in the formidable theories of the market---why not let prices do everything? Why are some activities directed by market forces & others by firms? economist.com/schools-brief/…

I remember while getting my first driver's license (age 18) in Delhi, a question on willingness to donate organs upon death. Paa explained to me how even the living often donate organs such as kidneys to their loved ones. What if they want to but can't, medically speaking?

I remember while getting my first driver's license (age 18) in Delhi, a question on willingness to donate organs upon death. Paa explained to me how even the living often donate organs such as kidneys to their loved ones. What if they want to but can't, medically speaking?

https://twitter.com/rohlamba/status/1340196262109392896

1/ Myerson 1999. "Nash equilibrium & history of economic theory." JEL. Written with characteristic Myersonian elegance. "how a few short papers by a young mathematician achieved one of the great watershed breakthroughs in the history of social science."

1/ Myerson 1999. "Nash equilibrium & history of economic theory." JEL. Written with characteristic Myersonian elegance. "how a few short papers by a young mathematician achieved one of the great watershed breakthroughs in the history of social science."

GDP = GVA + taxes - subsidies. Over last few quarters GVA growth has gone down and GDP is recording a higher number because subsidies this year have decreased 23 percent year on year. GVA is at 7.2 for the financial year. Eventually GDP & GVA tend to converge.

GDP = GVA + taxes - subsidies. Over last few quarters GVA growth has gone down and GDP is recording a higher number because subsidies this year have decreased 23 percent year on year. GVA is at 7.2 for the financial year. Eventually GDP & GVA tend to converge.

Regulators often worry about the monopolization of markets by profit-maximizing marketplaces (think Uber, Airbnb, Amazon) and their welfare impacts.

Regulators often worry about the monopolization of markets by profit-maximizing marketplaces (think Uber, Airbnb, Amazon) and their welfare impacts.

2/ Most models in information economics assume that customers have an informational advantage. Hence, the principal, e.g. the insurance company, faces an adverse selection problem, which it tries to mitigate by offering a menu of screening contracts to potential customers.

2/ Most models in information economics assume that customers have an informational advantage. Hence, the principal, e.g. the insurance company, faces an adverse selection problem, which it tries to mitigate by offering a menu of screening contracts to potential customers.