How to get URL link on X (Twitter) App

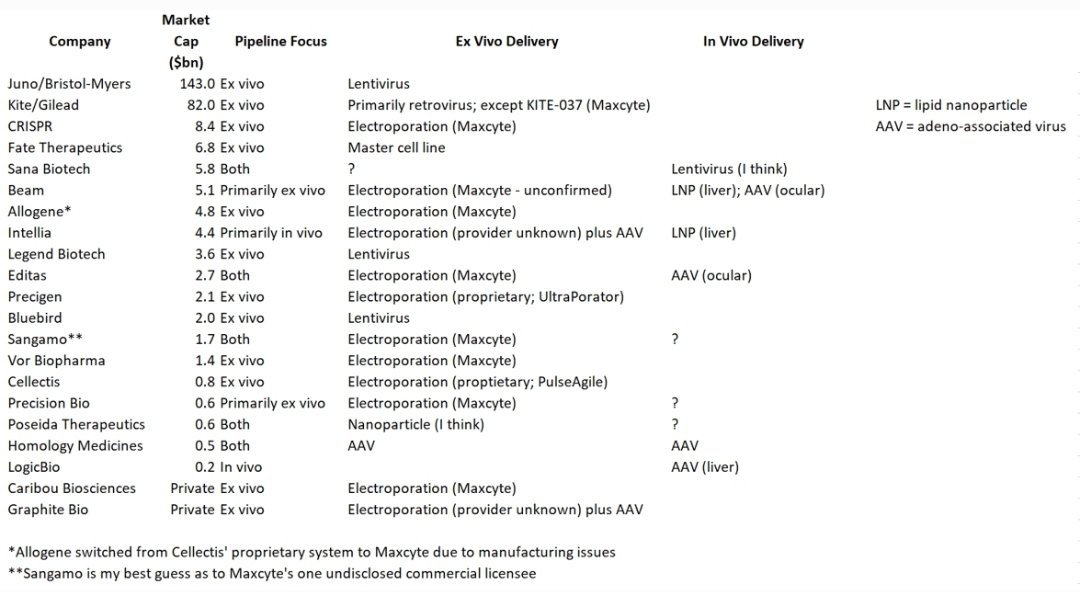

https://twitter.com/saharainvesting/status/1392492200978694144As I mentioned last week, there are five FDA-approved CAR-T therapies at the moment.

https://twitter.com/saharainvesting/status/1392492209652514819?s=20

When I first invested in Maxcyte, I framed the opportunity like this:

When I first invested in Maxcyte, I framed the opportunity like this:https://twitter.com/saharainvesting/status/1291385170944286722?s=19

https://twitter.com/saharainvesting/status/1345396245272154115Exited CDON and CLPT as they ran up largely due to valuation.

My takeaways:

My takeaways:

A little background first

A little background firsthttps://twitter.com/saharainvesting/status/1311999157587136517In case it wasn't obvious, I am very excited by Maxcyte.