How to get URL link on X (Twitter) App

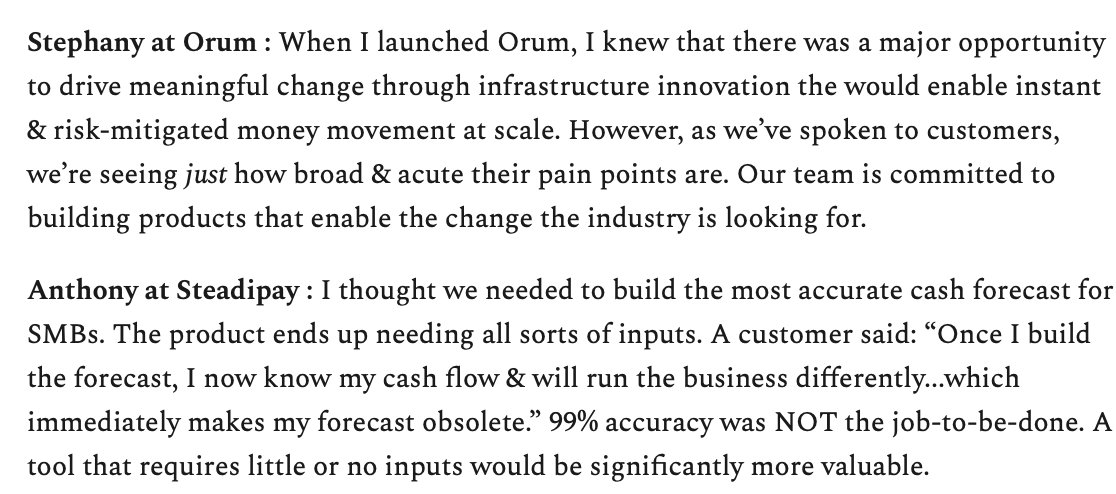

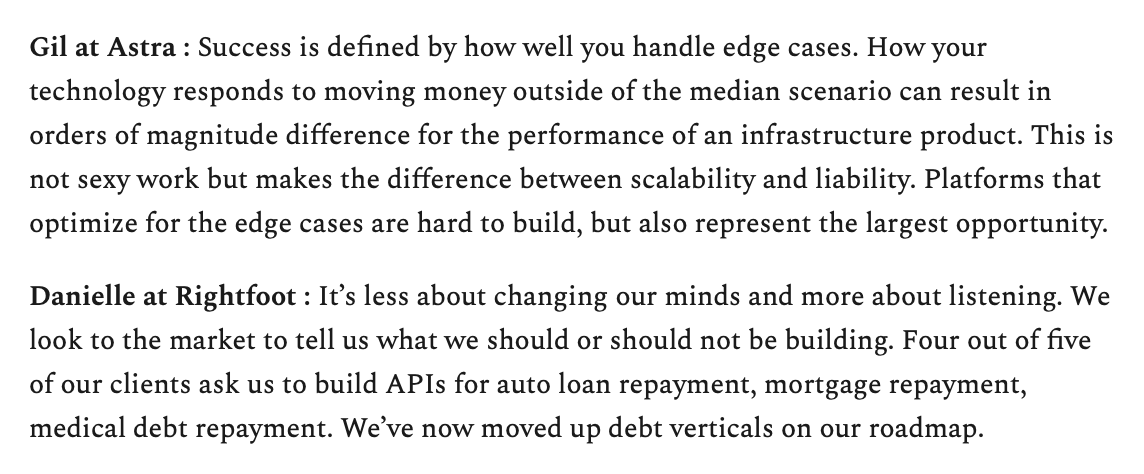

.@StephKirkpat of Orum (money movement), @anthonystrike of Steadipay (SMB cash flow management), @Pencilsack of Rightfoot (student debt API) & @gil_akos of Astra (automated bank transfers) on what they changed their mind on or misunderstood : sarharibhakti.substack.com/p/21-fintech-f…

.@StephKirkpat of Orum (money movement), @anthonystrike of Steadipay (SMB cash flow management), @Pencilsack of Rightfoot (student debt API) & @gil_akos of Astra (automated bank transfers) on what they changed their mind on or misunderstood : sarharibhakti.substack.com/p/21-fintech-f…

We have a long way to go in terms of technology helping us control our worst avocado, coffee and kombucha impulses when it comes to money.

We have a long way to go in terms of technology helping us control our worst avocado, coffee and kombucha impulses when it comes to money.