Equity Research | Stock Market Insights | 10+ Yrs in SM | Not SEBI Registered | Edu & Learning Only | No Trade Recos | Views Personal | Investor & Swing trader

How to get URL link on X (Twitter) App

4⃣ Backward Integration (RIP Cores)

4⃣ Backward Integration (RIP Cores)

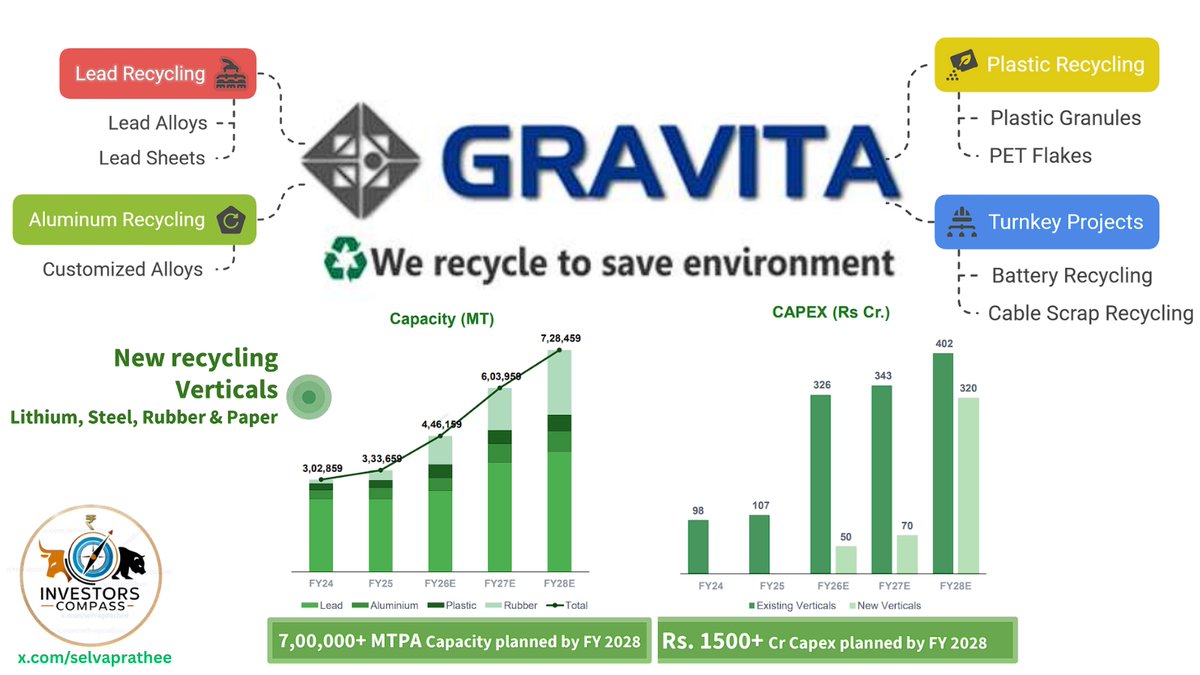

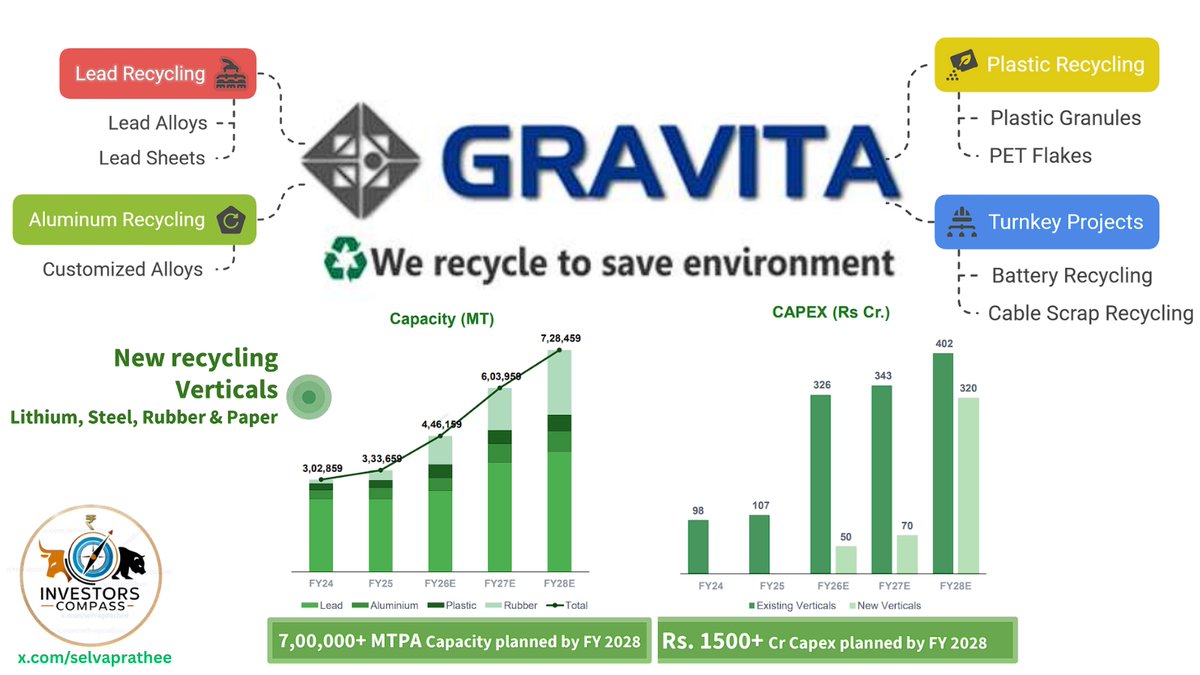

1 | Business Model

1 | Business Model

1 | Drones Will Be the First to Strike.

1 | Drones Will Be the First to Strike.

1 | Not Just Revenue Growth - Gravita Is Rewiring Its DNA

1 | Not Just Revenue Growth - Gravita Is Rewiring Its DNA

Waaree Energies - Full Stack Solar Powerhouse in Motion

Waaree Energies - Full Stack Solar Powerhouse in Motion

1 | Who is Ami Organics?

1 | Who is Ami Organics?

1 | Transrail Lighting Limited - Who Are They?

1 | Transrail Lighting Limited - Who Are They?

1 | Apollo Micro Systems - Who Are They?

1 | Apollo Micro Systems - Who Are They?

1 | KRN Heat Exchanger - Who Are They?

1 | KRN Heat Exchanger - Who Are They?