How to get URL link on X (Twitter) App

https://twitter.com/nic__carter/status/1717622001014067417

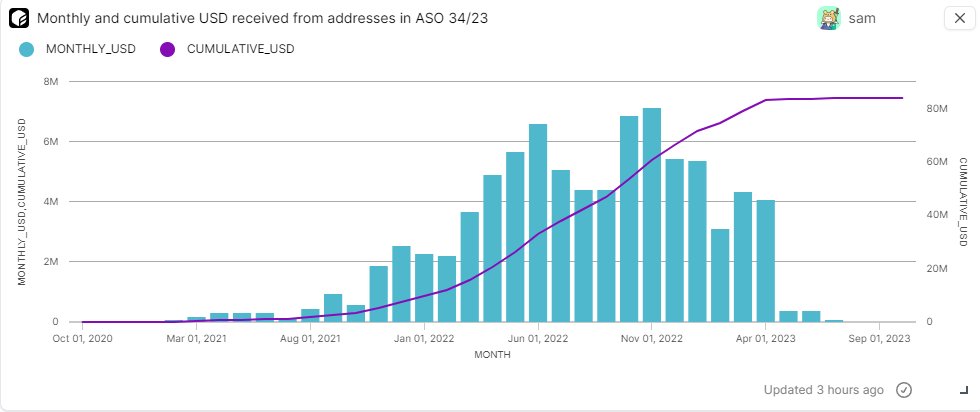

which suggests they might have included self transfers in their calculation.

which suggests they might have included self transfers in their calculation.

https://twitter.com/sem1d5/status/1430580219736256514

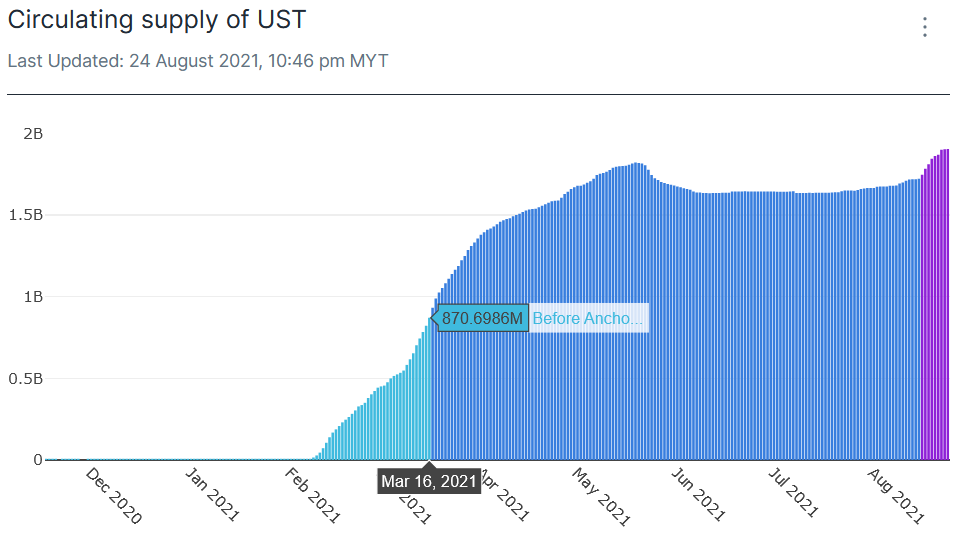

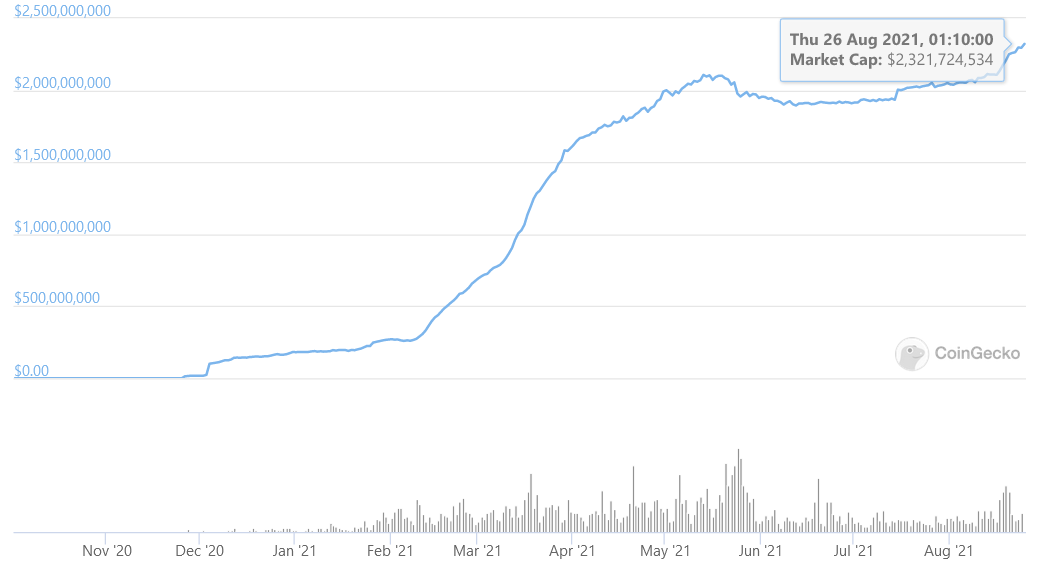

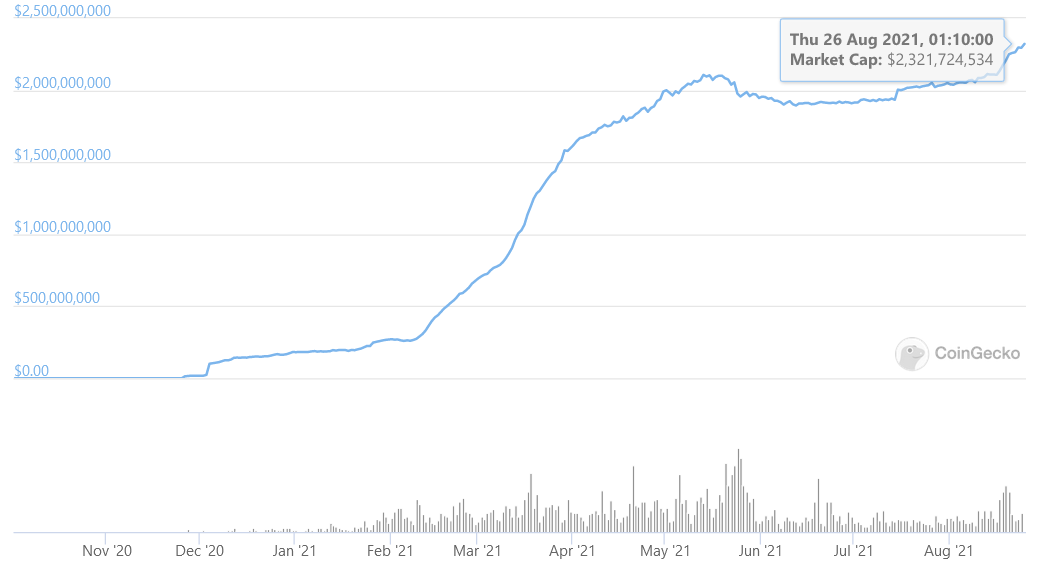

This is the overall circulating supply of UST. From Feb 7 to March 16, UST went from 2M in market cap (MC) to 870M MC! Note that Anchor only launched on March 17. One driver could be the anticipation of Anchor’s launch.

This is the overall circulating supply of UST. From Feb 7 to March 16, UST went from 2M in market cap (MC) to 870M MC! Note that Anchor only launched on March 17. One driver could be the anticipation of Anchor’s launch.