I trade setups, not opinions

Ex–Goldman & Citi, Trader, Coach, Jeet Kune Do Instructor, author of The Tao of Trading. Helping people master markets & money

4 subscribers

How to get URL link on X (Twitter) App

2/ The blind spot

2/ The blind spot

2/ Here’s the twist: the Advance-Decline Line (a key breadth measure) just hit an all-time high too. This suggests more stocks are participating in the rally than you might think.

2/ Here’s the twist: the Advance-Decline Line (a key breadth measure) just hit an all-time high too. This suggests more stocks are participating in the rally than you might think.

What does this mean, in English?

What does this mean, in English?

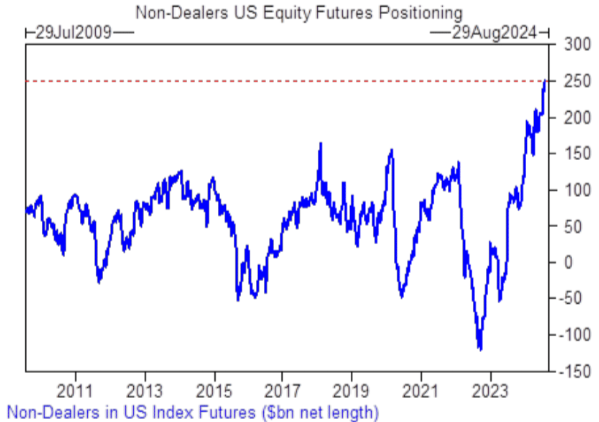

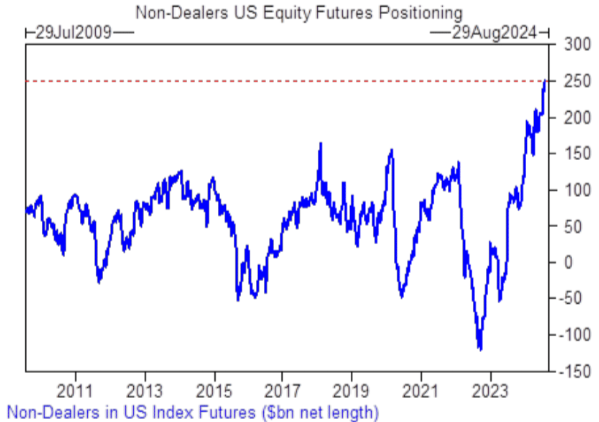

2. Japan has had zero interest rates for over 3 decades. Plenty of time for Yen carry trades to build up (estimates at $4T). Yen strength is causing a negative feedback loop as stops get triggered and overstretched carry positions get unwound. This is rattling positioning in global risk assets

2. Japan has had zero interest rates for over 3 decades. Plenty of time for Yen carry trades to build up (estimates at $4T). Yen strength is causing a negative feedback loop as stops get triggered and overstretched carry positions get unwound. This is rattling positioning in global risk assets