How to get URL link on X (Twitter) App

(2/4)

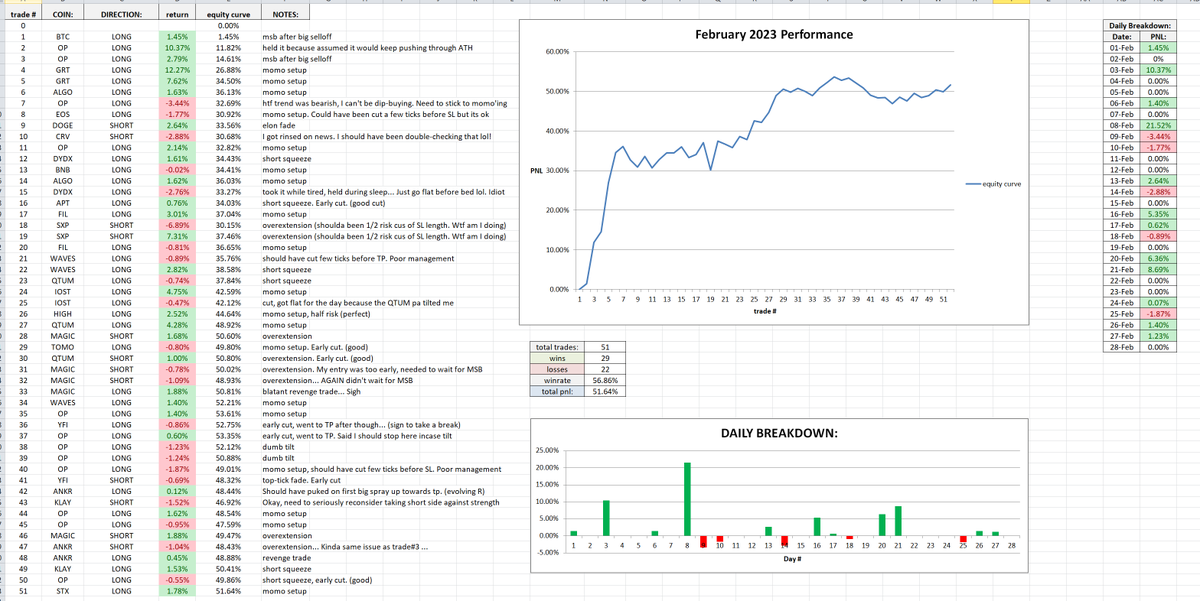

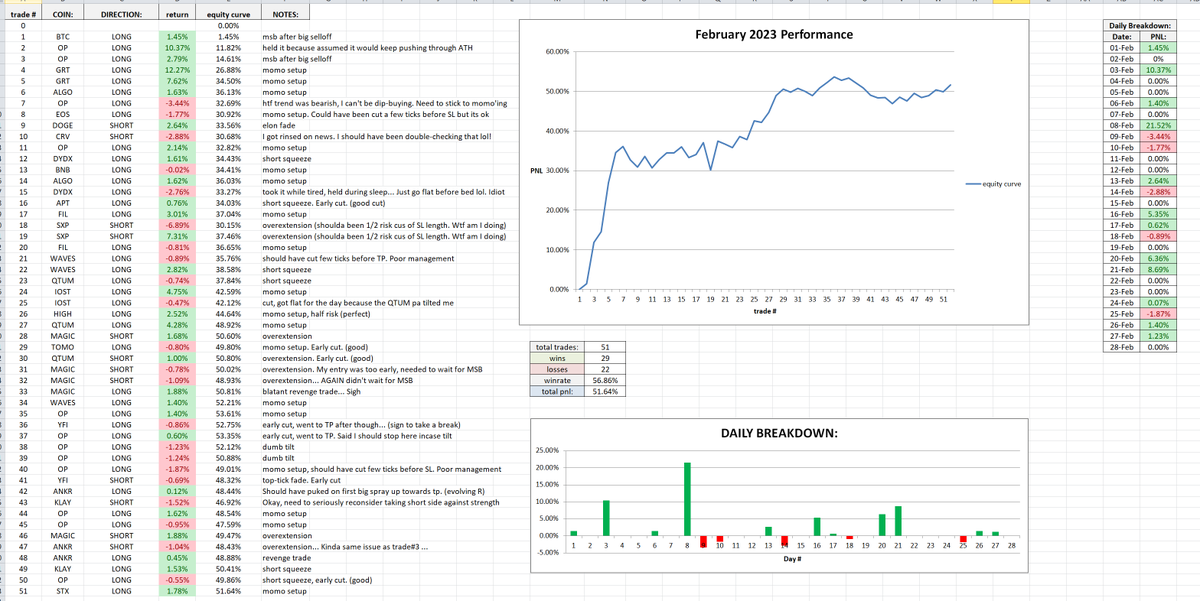

(2/4)https://x.com/spicyofc/status/1777369480408318367

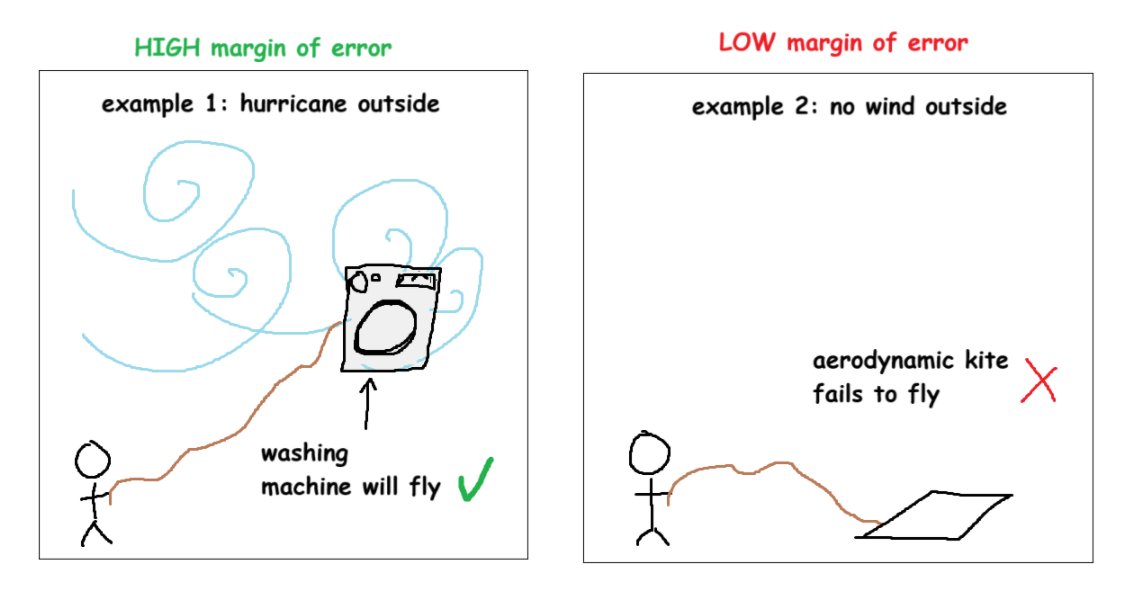

(2/7)

(2/7)

(2/14)

(2/14)

(2/4)

(2/4)https://x.com/spicyofc/status/1974522913501192638

(1-9) Information & Knowledge Edges

(1-9) Information & Knowledge Edges

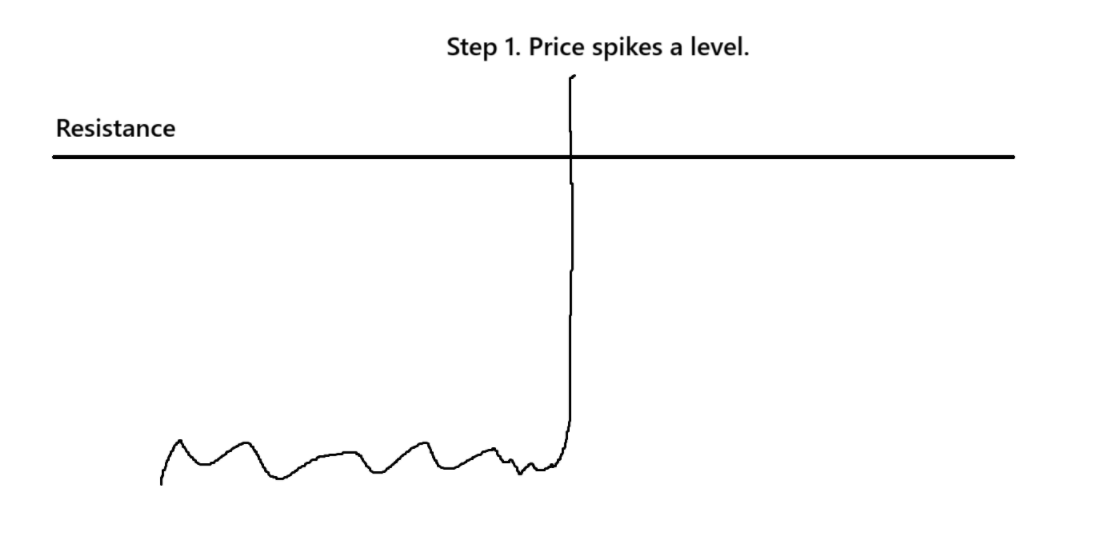

Step 1.

Step 1.

1) Average Trade Duration data is an Unexpected place to look for Edge.

1) Average Trade Duration data is an Unexpected place to look for Edge.

1) Clear Goals

1) Clear Goals

2)

2)

Mistake #1: Trading with 6hrs or less sleep increases the chances of making mistakes DRAMATICALLY

Mistake #1: Trading with 6hrs or less sleep increases the chances of making mistakes DRAMATICALLY

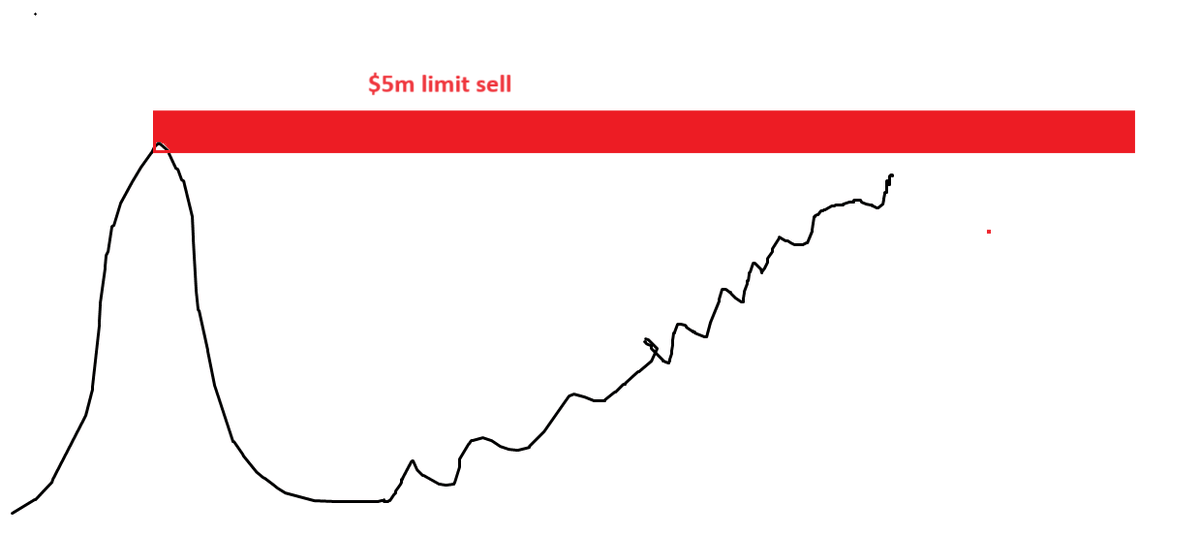

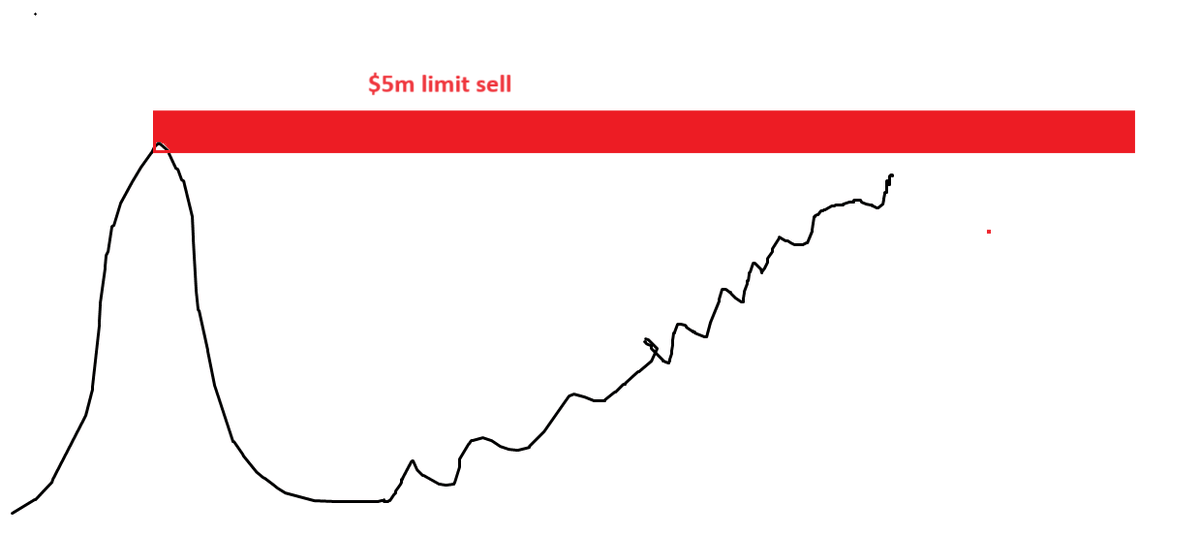

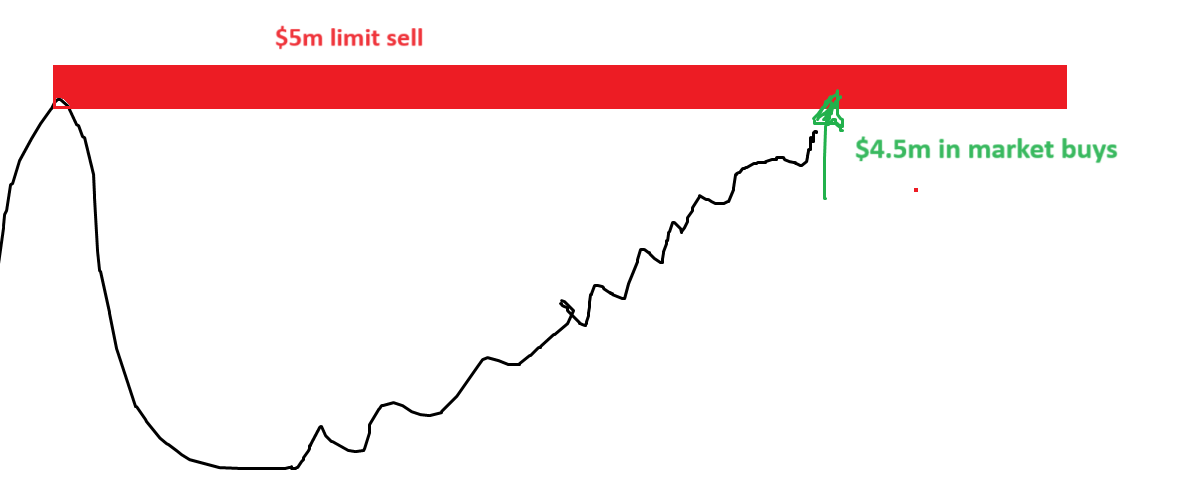

2) Example:

2) Example:

2)

2)