Economist @econ_uncovered | Unraveling the US economy, with a focus on inflation, jobs & the money supply | Former sell-side research analyst

2 subscribers

How to get URL link on X (Twitter) App

With wholesale used car prices (as per the Manheim Used Vehicle Value Index) seeing several months of significant declines, I expect CPI used car & truck prices (whose retail prices tend to lag the Manheim Index by 2 months), to begin recording significant MoM declines in July.

With wholesale used car prices (as per the Manheim Used Vehicle Value Index) seeing several months of significant declines, I expect CPI used car & truck prices (whose retail prices tend to lag the Manheim Index by 2 months), to begin recording significant MoM declines in July.

CPI used car & truck prices are likely to see a major deceleration in price growth in June.

CPI used car & truck prices are likely to see a major deceleration in price growth in June.

The year is 1928.

The year is 1928.

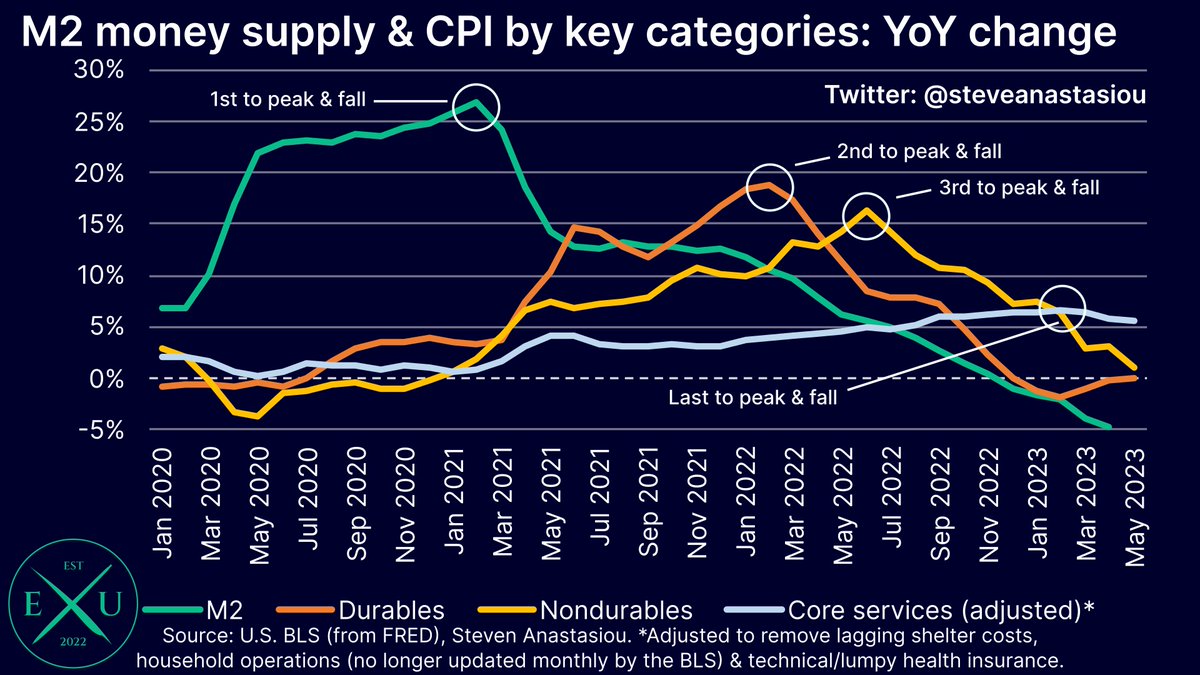

With the M2 money supply seeing its largest declines since the Great Depression, inflation has declined significantly & is set to fall further in June.

With the M2 money supply seeing its largest declines since the Great Depression, inflation has declined significantly & is set to fall further in June.

Inflation is best analysed by breaking it down into its three key components: durables, nondurables and services.

Inflation is best analysed by breaking it down into its three key components: durables, nondurables and services.

The US unemployment rate jumped to 3.7% in May. While low by historical standards, zooming in to analyse more recent trends ...

The US unemployment rate jumped to 3.7% in May. While low by historical standards, zooming in to analyse more recent trends ...

Chemical manufacturing: "Volumes have not rebounded at a level we would expect this time of year. Orders seem to be more erratic, which is in line with automotive & building construction markets trending downward as interest rates have deeply impacted both ... sectors."

Chemical manufacturing: "Volumes have not rebounded at a level we would expect this time of year. Orders seem to be more erratic, which is in line with automotive & building construction markets trending downward as interest rates have deeply impacted both ... sectors."

Yes, core measures can be useful in eliminating MoM price volatility that can occur on account of items like gasoline prices, but there's another way to smooth out MoM volatility - look at a longer time frame!

Yes, core measures can be useful in eliminating MoM price volatility that can occur on account of items like gasoline prices, but there's another way to smooth out MoM volatility - look at a longer time frame!

Before conducting a medium-term inflation forecast, it's important that one takes stock of two key factors: 1) the M2 money supply; and 2) the price cycle.

Before conducting a medium-term inflation forecast, it's important that one takes stock of two key factors: 1) the M2 money supply; and 2) the price cycle.

which recorded another YoY decline on a 3-month moving average basis, falling to -0.6% in April.

which recorded another YoY decline on a 3-month moving average basis, falling to -0.6% in April.

move with a lag. Durables tend to have the most elastic demand & move 1st.

move with a lag. Durables tend to have the most elastic demand & move 1st.

2) With private payroll growth moderating significantly, job growth is instead being supported by government payrolls, which on a 6-month moving average basis, are around peak COVID rehiring levels.

2) With private payroll growth moderating significantly, job growth is instead being supported by government payrolls, which on a 6-month moving average basis, are around peak COVID rehiring levels.

As banks hold only a FRACTION of customer deposits as cash on their balance sheet, in the event that a bank loses deposits, it faces a liquidity drain, as its cash assets are used to satisfy deposit withdrawals.

As banks hold only a FRACTION of customer deposits as cash on their balance sheet, in the event that a bank loses deposits, it faces a liquidity drain, as its cash assets are used to satisfy deposit withdrawals.

The first detail to unpack is that of used car prices. While many have noted the increase in the Manheim Used Vehicle Value Index, it's important to note that the Manheim Index measures wholesale prices. The CPI instead measures retail prices.

The first detail to unpack is that of used car prices. While many have noted the increase in the Manheim Used Vehicle Value Index, it's important to note that the Manheim Index measures wholesale prices. The CPI instead measures retail prices.