purpose is to provide quick, reliable & key info🎯

data driven analysis🧬

Analysing market trends

Not SEBI registered.

📊 Follow for Daily Updates & insights💡

How to get URL link on X (Twitter) App

HDFC Asset Management Company Ltd 🔖

HDFC Asset Management Company Ltd 🔖

Trent Ltd 🔖

Trent Ltd 🔖

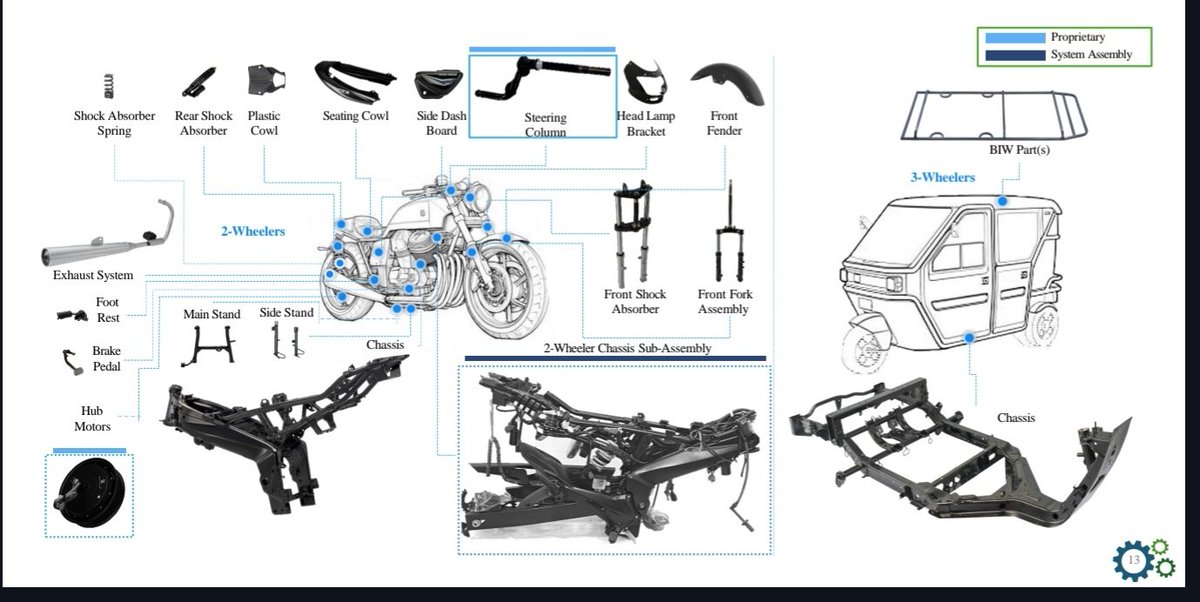

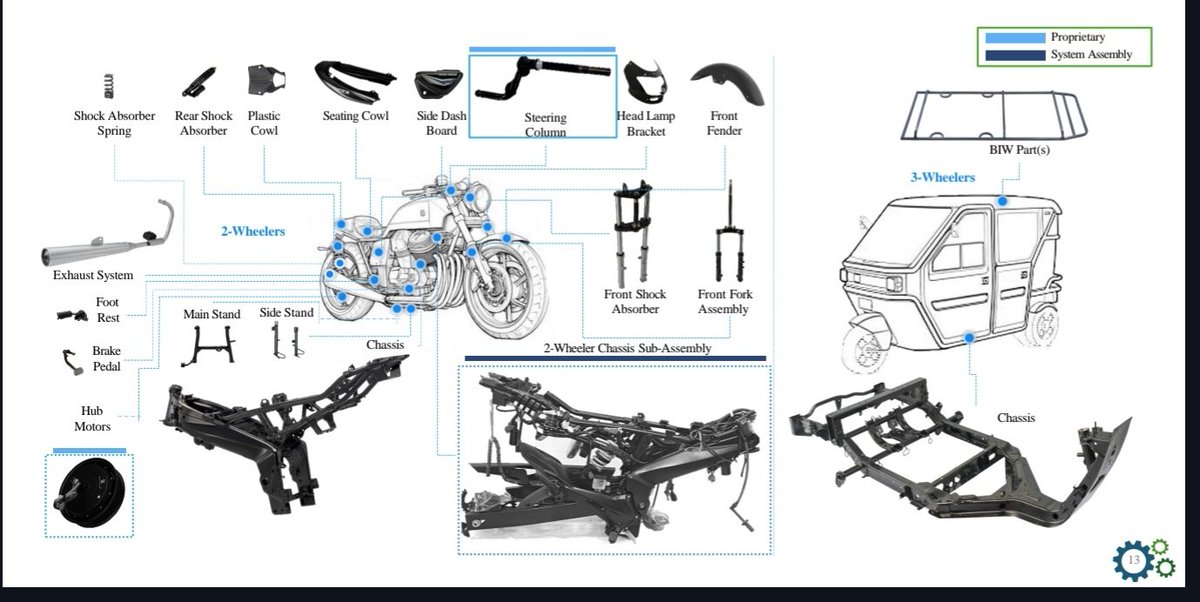

🗓️Incorporated in 1988, Belrise Industries Limited manufactures Automotive Sheet Metal and casting parts, Polymer components, Suspension, and mirror systems for automotives.

🗓️Incorporated in 1988, Belrise Industries Limited manufactures Automotive Sheet Metal and casting parts, Polymer components, Suspension, and mirror systems for automotives.

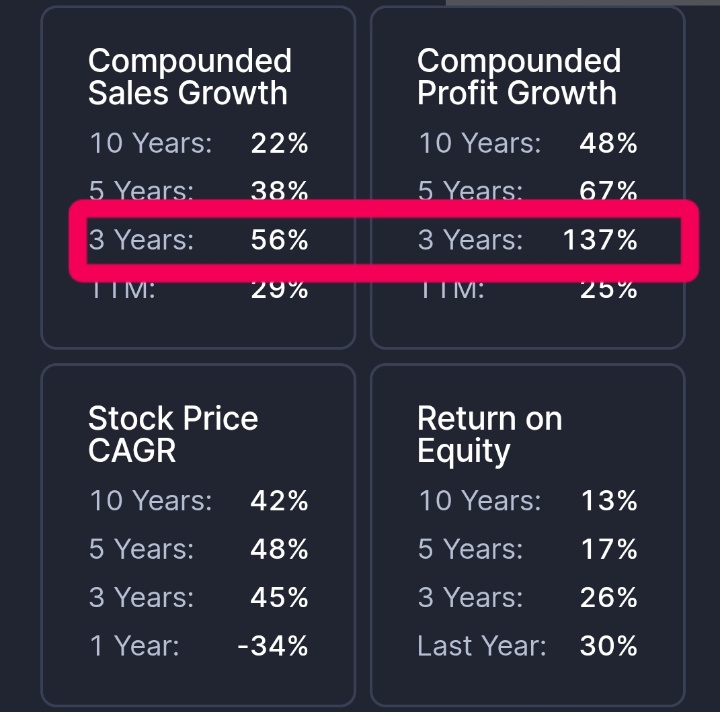

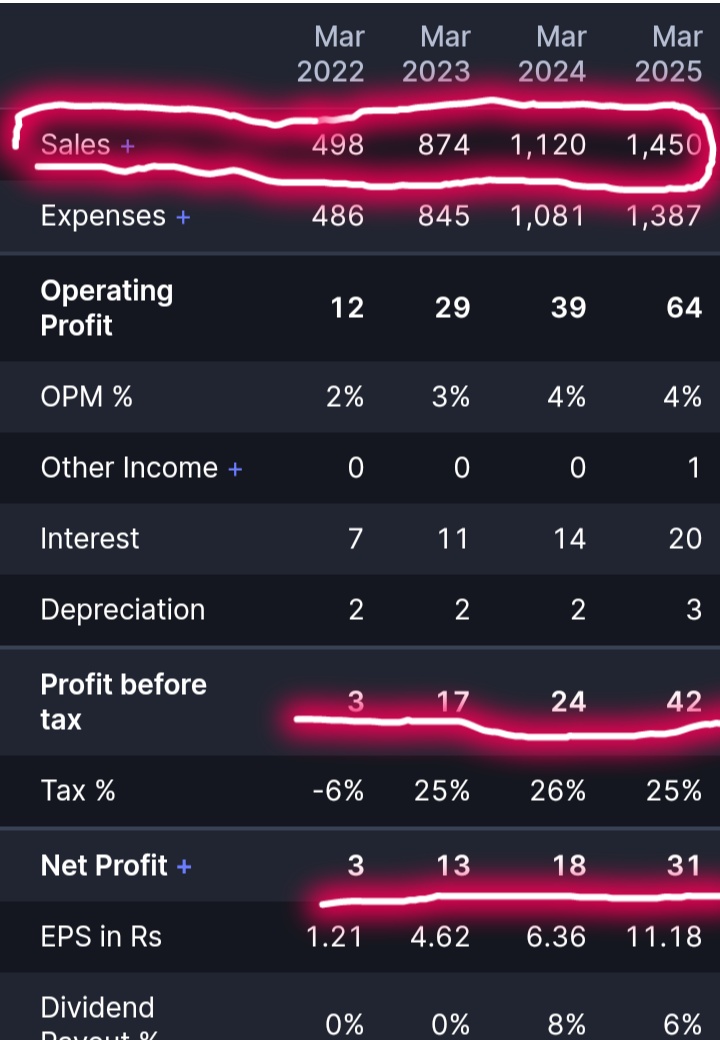

Company Name ~ POCL Enterprises Ltd 🔖

Company Name ~ POCL Enterprises Ltd 🔖

⏫Capacity Expansion ~

⏫Capacity Expansion ~

👀Business Overview~ Incorporated in 2011,AIL specializes in Electronics System Design & Manufacturing(ESDM), focusing on high-value precision engineering & complex product manufacturing.With expertise in embedded design,it has completed 250 projects for over 500 global customers

👀Business Overview~ Incorporated in 2011,AIL specializes in Electronics System Design & Manufacturing(ESDM), focusing on high-value precision engineering & complex product manufacturing.With expertise in embedded design,it has completed 250 projects for over 500 global customers

🚃Commercial Engineers & Body Builders Company Ltd (CEBBCO) is primarily involved in the business of manufacturing metal fabrication comprising load bodies for commercial vehicles, rail freight wagons, and components.

🚃Commercial Engineers & Body Builders Company Ltd (CEBBCO) is primarily involved in the business of manufacturing metal fabrication comprising load bodies for commercial vehicles, rail freight wagons, and components.

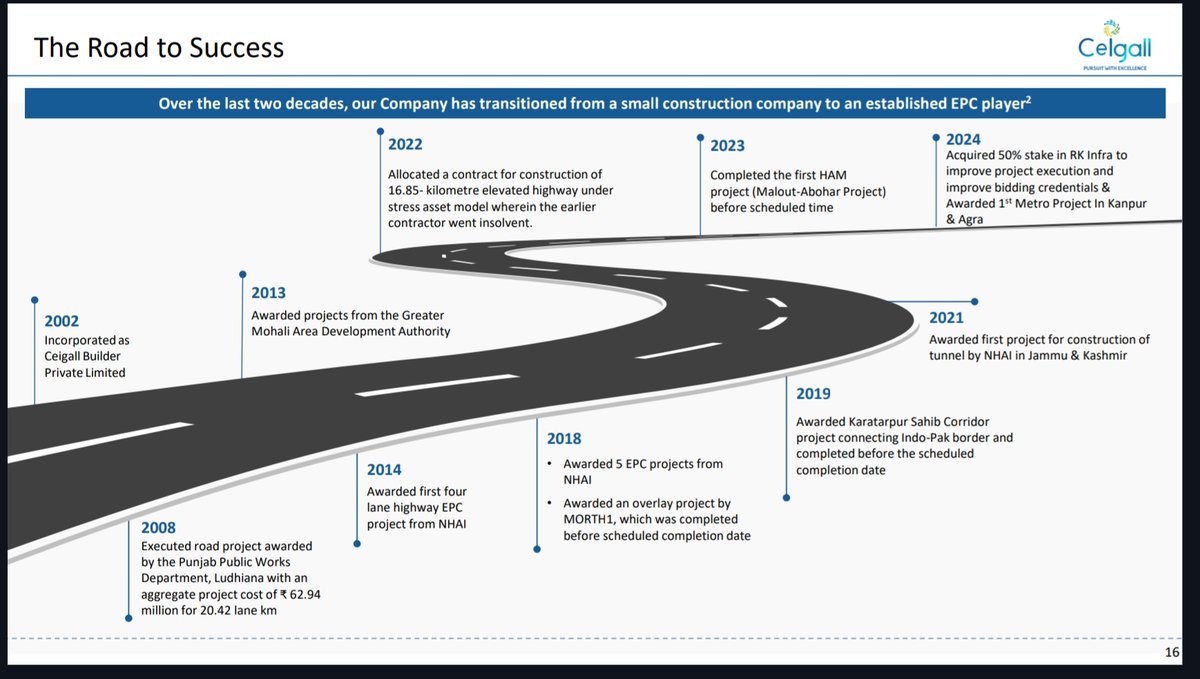

🌟Company Name ~ Ceigall India Ltd.

🌟Company Name ~ Ceigall India Ltd.

Unifinz Capital India Ltd 🔖

Unifinz Capital India Ltd 🔖

🌟Part of RPG Group ~

🌟Part of RPG Group ~

🔋Company is diversifying into the Solar EPC market and Battery Energy Storage Systems (BESS)

🔋Company is diversifying into the Solar EPC market and Battery Energy Storage Systems (BESS)

🌟Company Name ~ GP Eco solution Ltd

🌟Company Name ~ GP Eco solution Ltd

1) Remsons Industries Ltd

1) Remsons Industries Ltd

🌟Company Name ~Owais Metal and Mineral Processing Ltd

🌟Company Name ~Owais Metal and Mineral Processing Ltd

Company Name~ Trishakti

Company Name~ Trishakti

👉Expansion into Saudi Arabia with an initial plan to establish a tire recycling facility with a capacity of 24,000 MT per annum

👉Expansion into Saudi Arabia with an initial plan to establish a tire recycling facility with a capacity of 24,000 MT per annum

1️⃣Syrma SGS Technology Ltd

1️⃣Syrma SGS Technology Ltd