IRS| Harvard | Founder | @TaxBuddy1 ‘India’s most TRUSTED tax filing service | If u face any issue with our service,pls feel free to write me sujit@taxbuddy.com

How to get URL link on X (Twitter) App

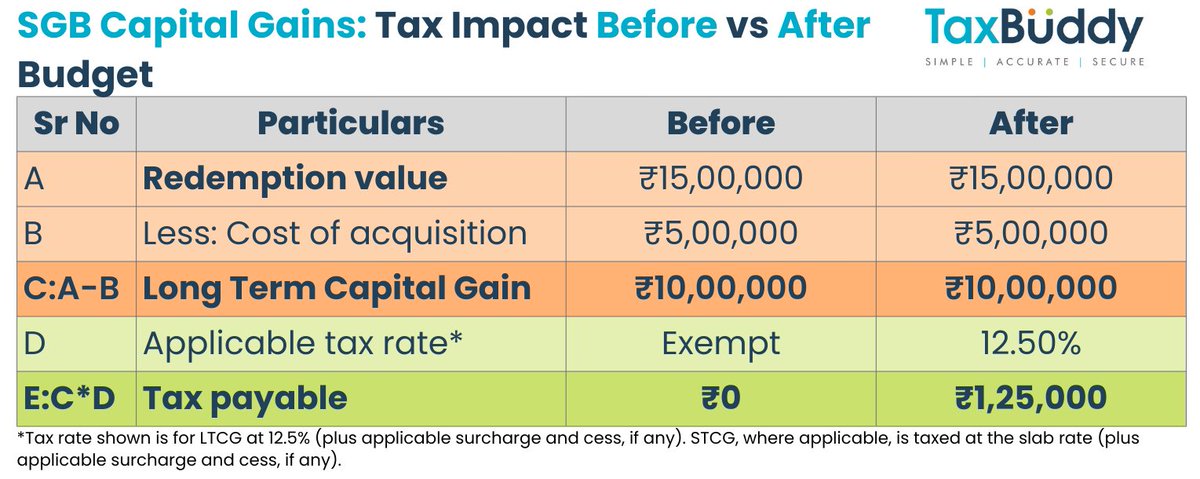

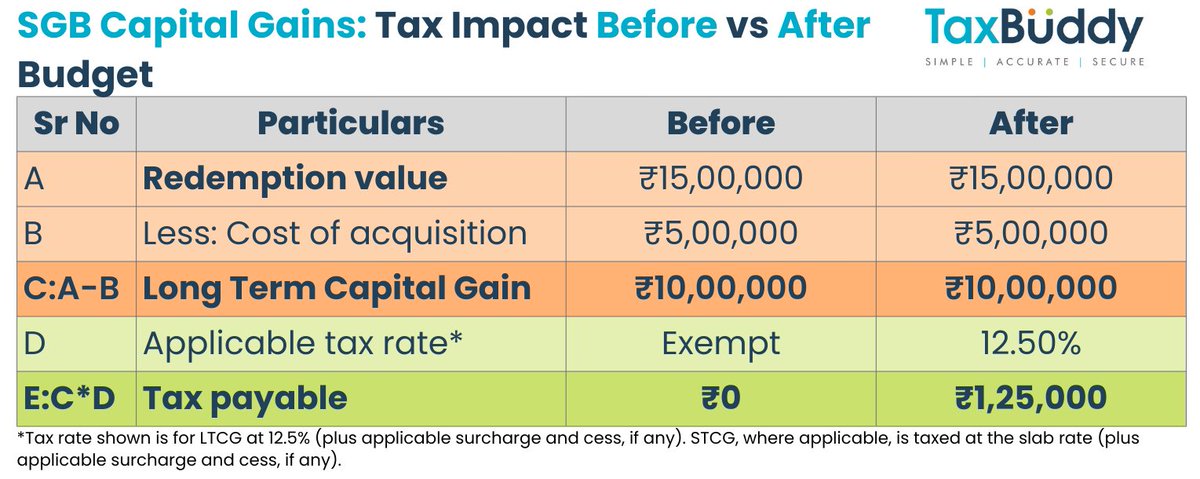

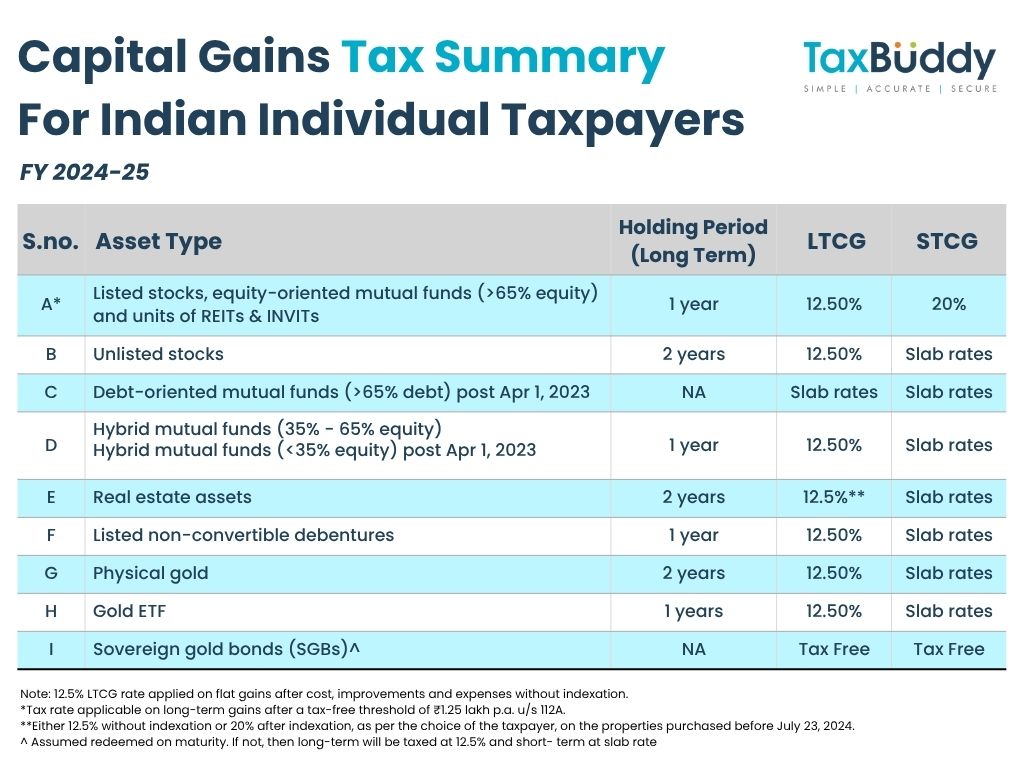

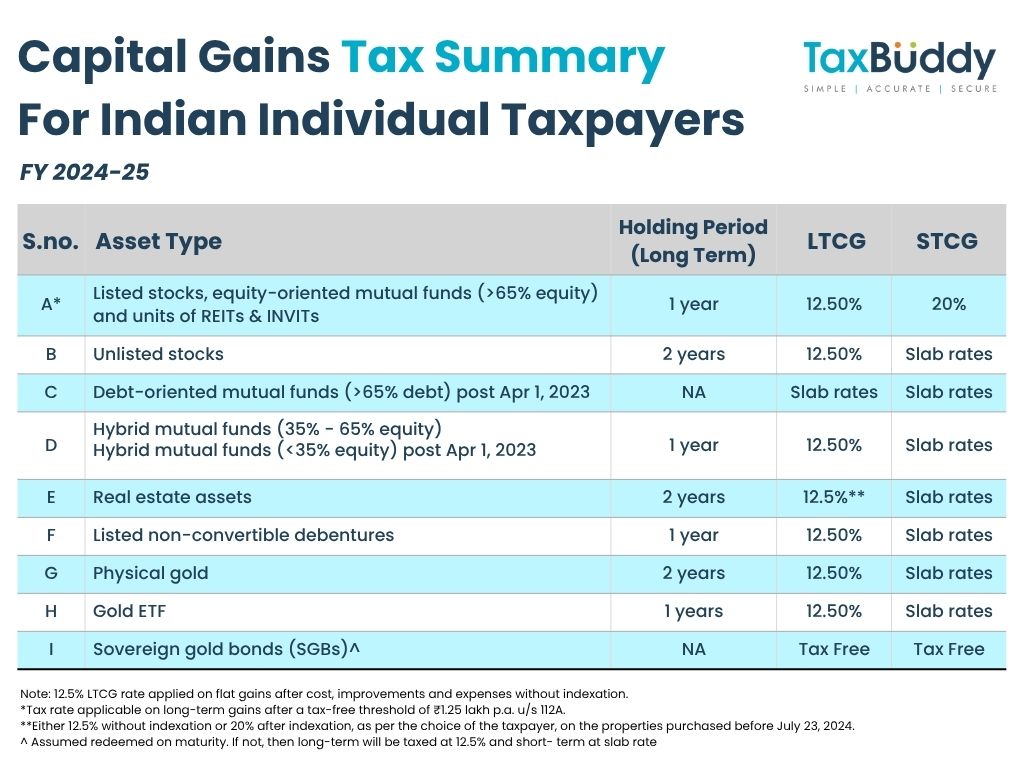

[1] What exactly changes after the Budget

[1] What exactly changes after the Budget

[1] Background of the facts

[1] Background of the facts

[1] Facts of the case

[1] Facts of the case

[1] Facts of the case

[1] Facts of the case

[1] Facts of the case

[1] Facts of the case

[1] A Home OD loan works like a regular home loan, except it links your loan to an overdraft account.

[1] A Home OD loan works like a regular home loan, except it links your loan to an overdraft account.

[1] What’s new?

[1] What’s new?

[1] What is Chapter XII-A?

[1] What is Chapter XII-A?

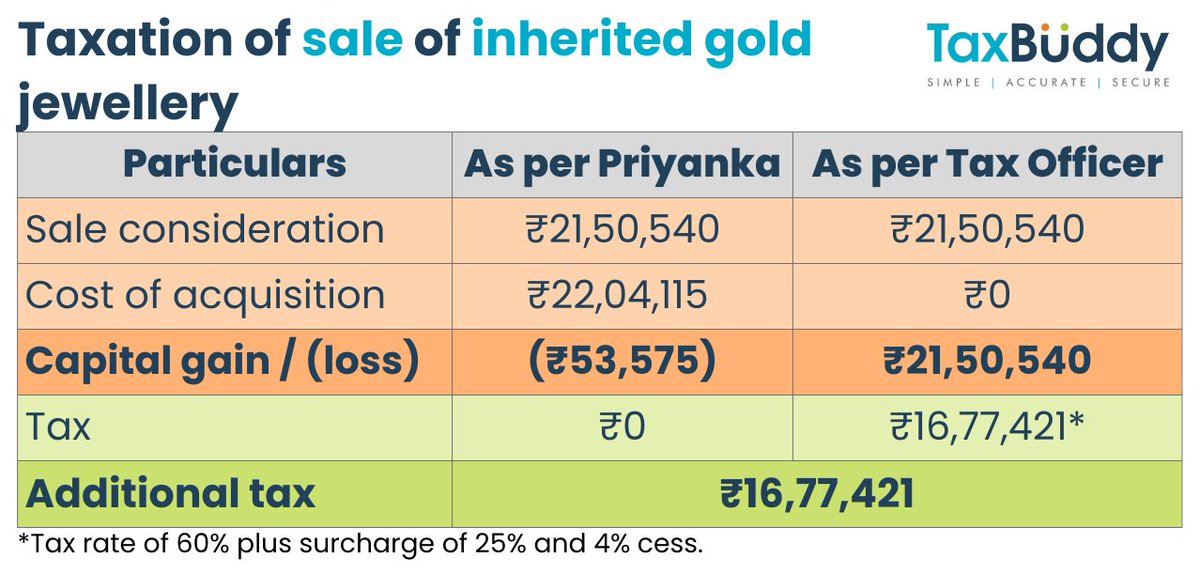

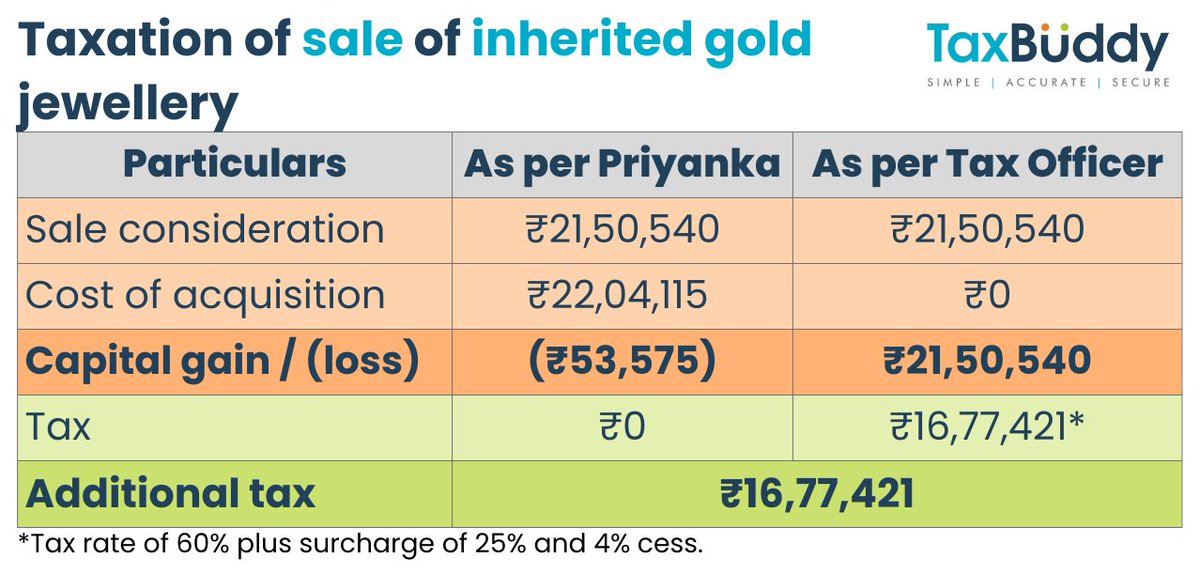

[1] Cost of acquisition is more than just the purchase price

[1] Cost of acquisition is more than just the purchase price

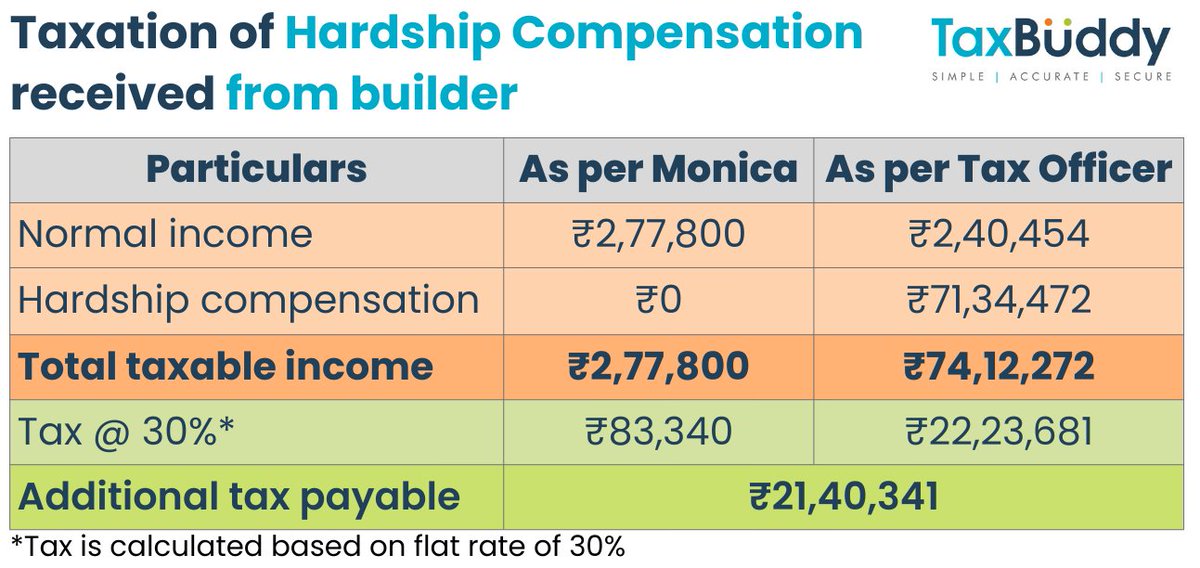

[1] Let’s begin with the income profile:

[1] Let’s begin with the income profile:

[1] Section 54 Basics

[1] Section 54 Basics

[1] Rahul’s income mix looked like this:

[1] Rahul’s income mix looked like this:

[1] Availability of first Basic Exemption Limit

[1] Availability of first Basic Exemption Limit

[1] EPF follow the EEE model—Exempt–Exempt–Exempt:

[1] EPF follow the EEE model—Exempt–Exempt–Exempt: