Growth Investing, Thesis, uncovering hidden insights on stocks |

Breakout Stocks

https://t.co/C2s2jQN9L0

Not SEBI registered

How to get URL link on X (Twitter) App

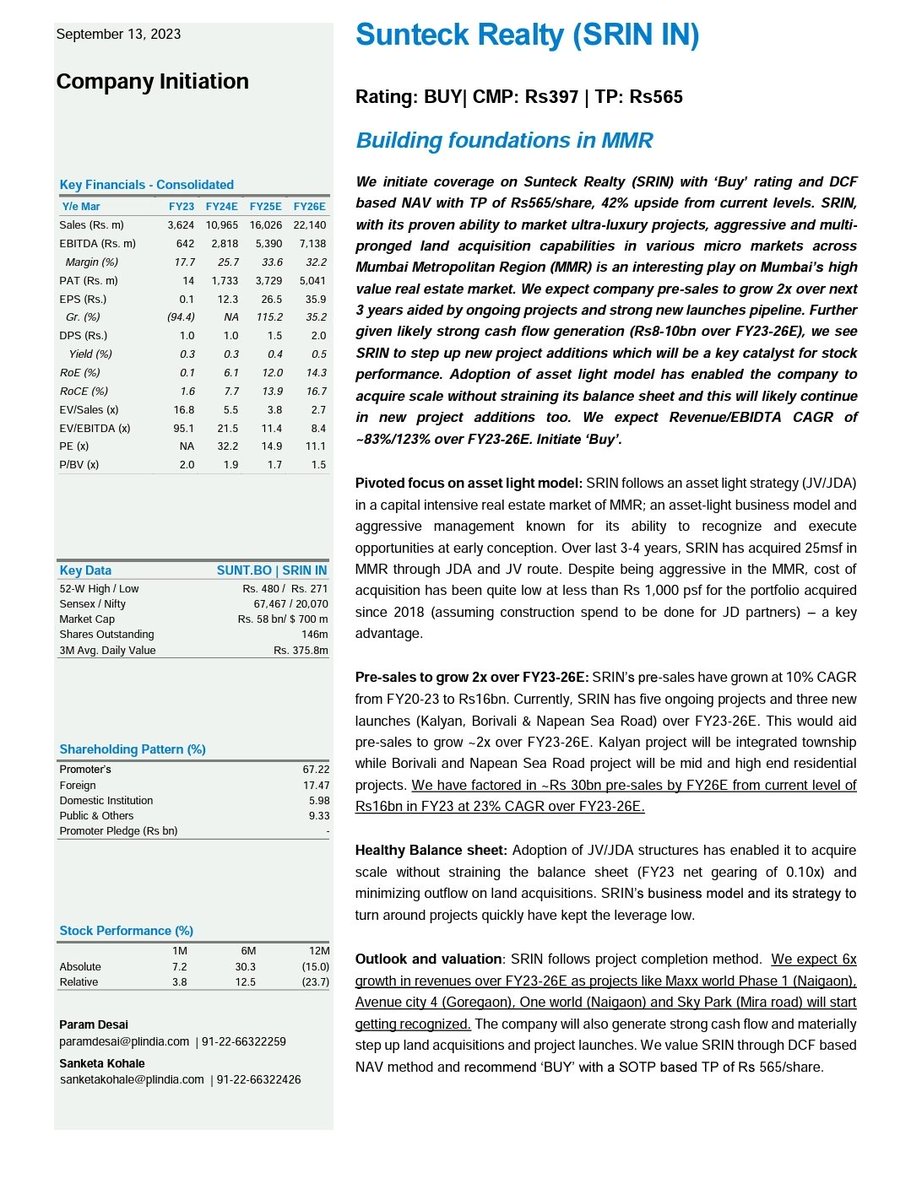

👉Pre-sales of Sunteck Realty to grow 2x over FY23-26E on new launches

👉Pre-sales of Sunteck Realty to grow 2x over FY23-26E on new launches

25-30% cost of Data Centers is for land and building

25-30% cost of Data Centers is for land and building

Trigger 2: Implementation of dynamic pricing

Trigger 2: Implementation of dynamic pricing

Its not just the Hunter , the real hero is PowerCool that's driving SDBL

Its not just the Hunter , the real hero is PowerCool that's driving SDBL

Agarwal Industries' timely addition of vessels to meet Bitumen demand has enabled improvement in its ROCE

Agarwal Industries' timely addition of vessels to meet Bitumen demand has enabled improvement in its ROCE

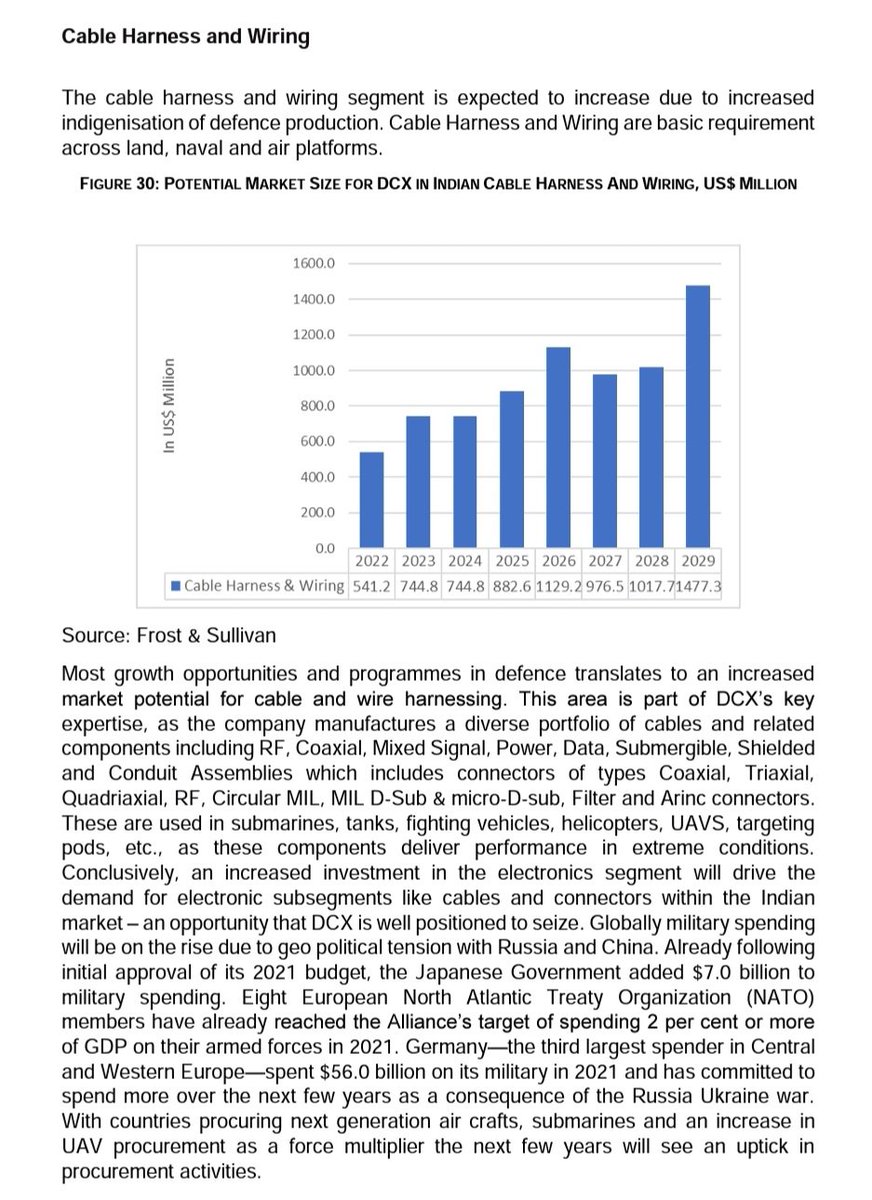

Rev was up 11.7% Qoq,32.9 % yoy

Rev was up 11.7% Qoq,32.9 % yoy

#PBFINTECH is the owner of PolicyBazaar and PaisaBazaar, 🇮🇳 largest marketplaces for insurance and credit products respectively

#PBFINTECH is the owner of PolicyBazaar and PaisaBazaar, 🇮🇳 largest marketplaces for insurance and credit products respectively

Positives

Positives

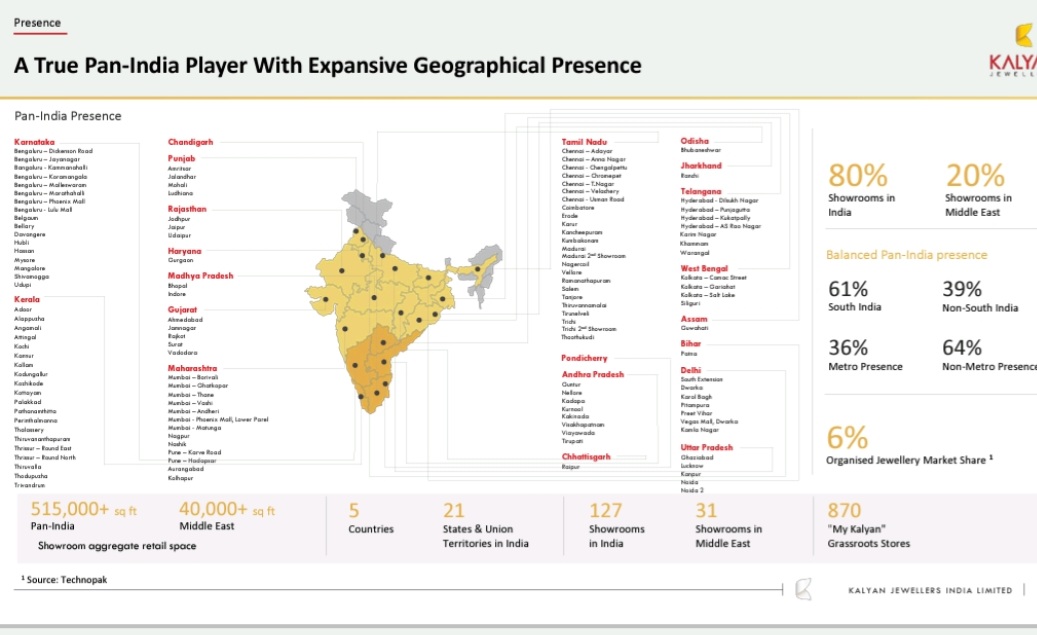

Its not that #KalyanJewellers didn't have presence in Non-South market, it opened store in 2012 but revenue contribution was not big enough to consider pan-India player

Its not that #KalyanJewellers didn't have presence in Non-South market, it opened store in 2012 but revenue contribution was not big enough to consider pan-India player