How to get URL link on X (Twitter) App

Already know I’m going to get some hate for this thread

Already know I’m going to get some hate for this thread

1. Get data for your strategy

1. Get data for your strategy

It all started in April 2020 during lockdown

It all started in April 2020 during lockdown

1. Spend less time on the charts

1. Spend less time on the charts

1. Finding a trading style that worked for me

1. Finding a trading style that worked for me

1. Killing the need to be right

1. Killing the need to be right

This is not going to be a thread on trading strategies, backtesting advice, etc

This is not going to be a thread on trading strategies, backtesting advice, etc

1. “Risk 1% per trade”

1. “Risk 1% per trade”

1. Strategy hopping

1. Strategy hopping

1. Take your time

1. Take your time

1. My risk management plan

1. My risk management plan

1. FX Replay

1. FX Replay

1. Spend less time on the charts

1. Spend less time on the charts

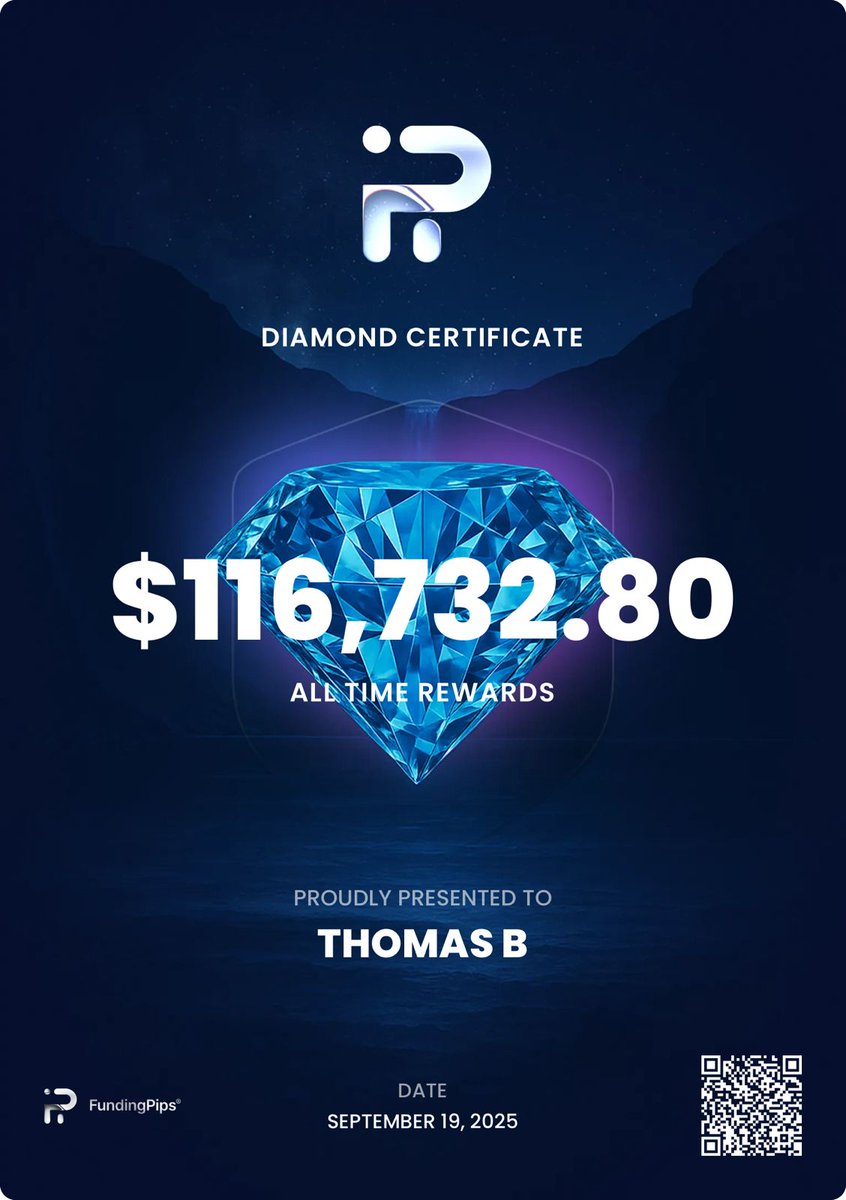

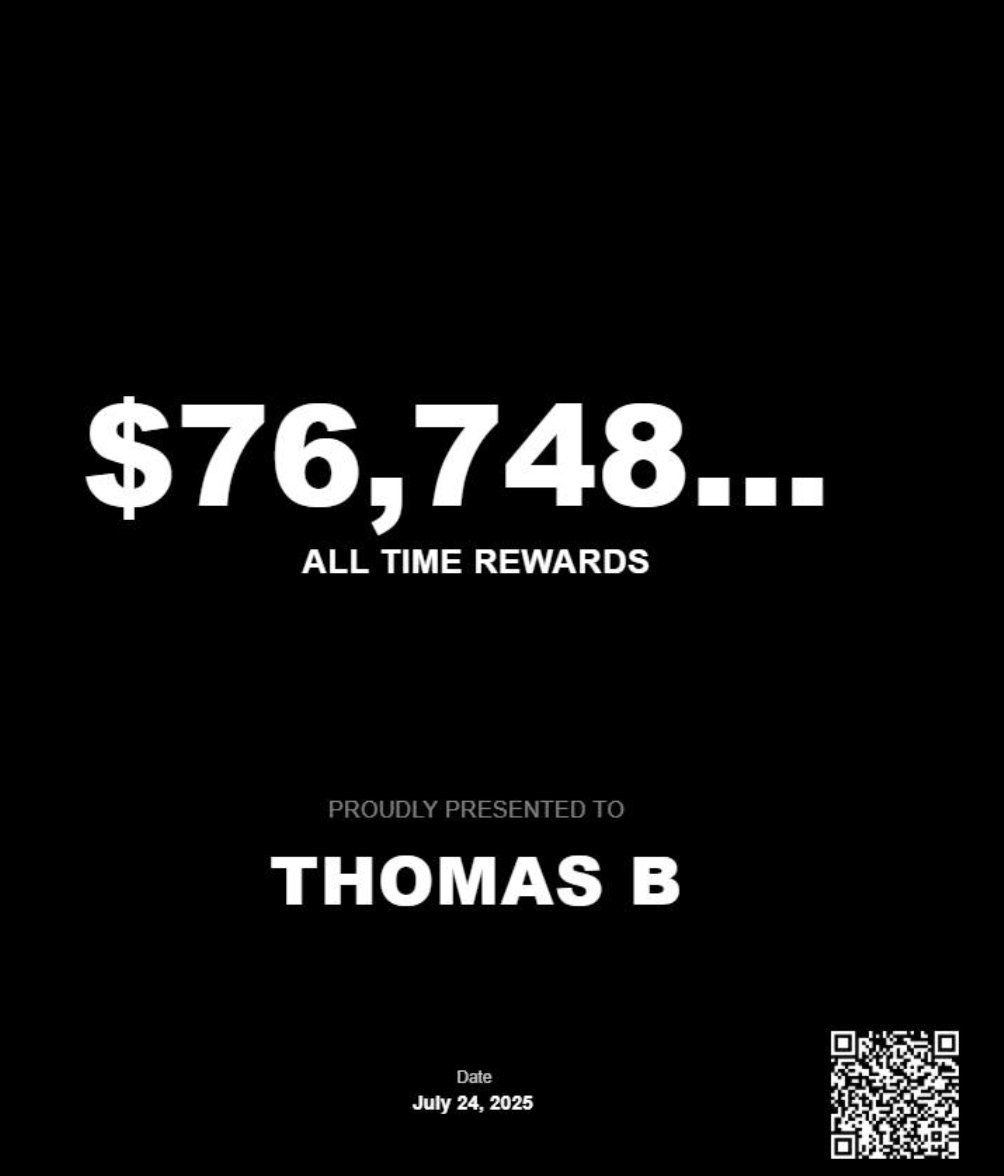

As I’ve stated before, I’ve made just over $350k from prop firm payouts in the last year and a half

As I’ve stated before, I’ve made just over $350k from prop firm payouts in the last year and a half

Before people say “of course you don’t have problems Tom, you have influencer privilege”

Before people say “of course you don’t have problems Tom, you have influencer privilege”

1. Test multiple strategies

1. Test multiple strategies

1. Get max funded with one firm at a time

1. Get max funded with one firm at a time

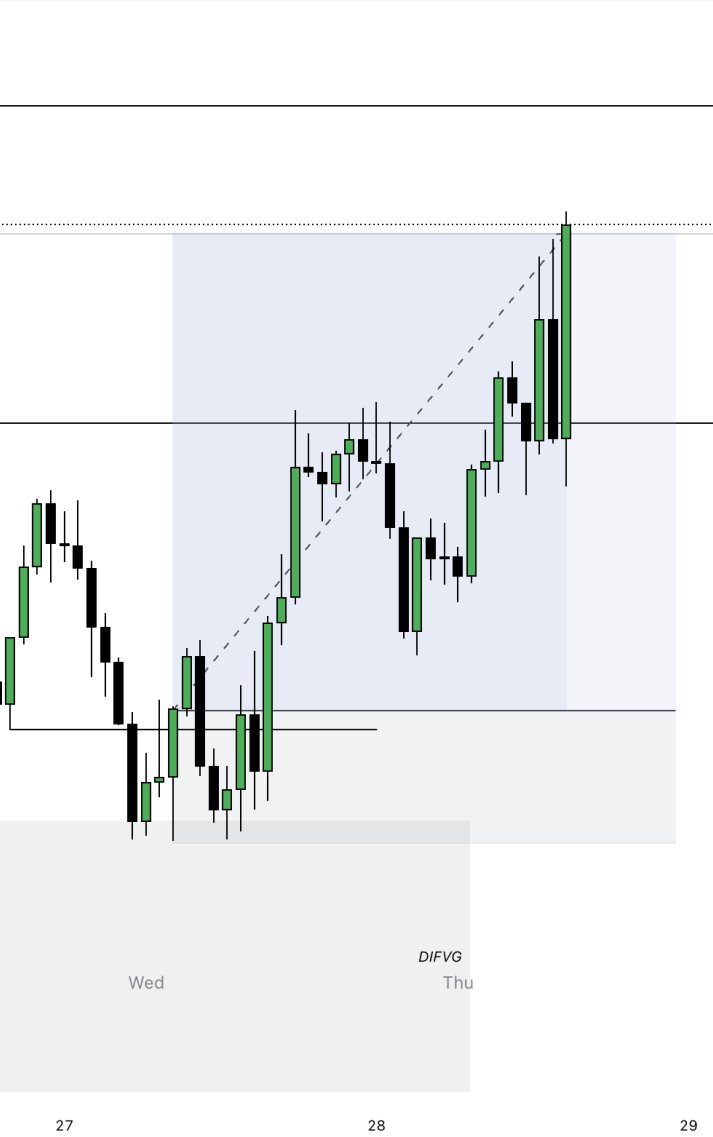

1. I stopped forcing daily setups

1. I stopped forcing daily setups

1. Strategy hopping

1. Strategy hopping