Senior mining/energy reporter | Energy Evolution podcast host | S&P Global Commodity Insights | taylor.kuykendall@spglobal.com | https://t.co/wIUmcedpLa

How to get URL link on X (Twitter) App

https://twitter.com/taykuy/status/1356964406219993092For one, it probably isn’t going to happen really soon on its own. There are plenty of new-ish coal plants out there that are likely to hang on a few more years and compete with other forms of power generation. But opposition is varied and quite strong.

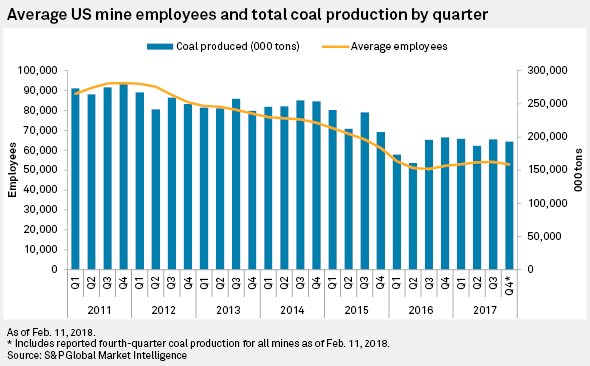

First arrow points to rise in employment. This was a bounce off of some huge cutbacks as supply tried to catch up with coal plant retirements. About the same time, export demand picked up. This sustained that small bounce and covered up some of the impacts of more retirements. 2/

First arrow points to rise in employment. This was a bounce off of some huge cutbacks as supply tried to catch up with coal plant retirements. About the same time, export demand picked up. This sustained that small bounce and covered up some of the impacts of more retirements. 2/

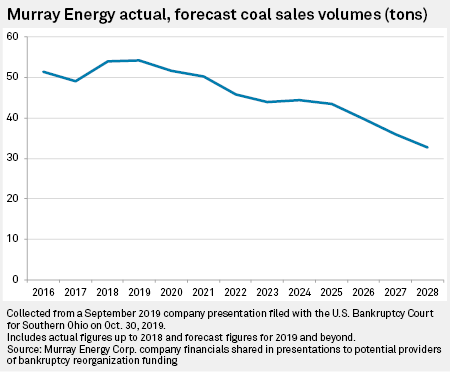

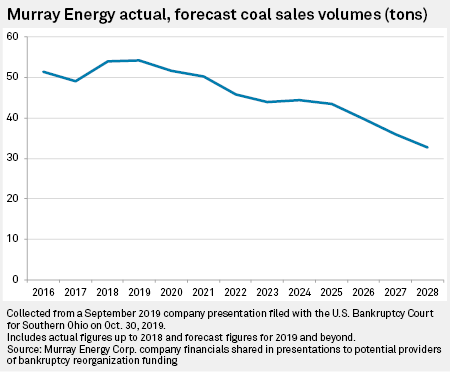

Murray Energy is expecting 39.9% drop in coal volume by 2028 while revenue is expected to fall from $2.32B to just $1.34B in the same period.

Murray Energy is expecting 39.9% drop in coal volume by 2028 while revenue is expected to fall from $2.32B to just $1.34B in the same period.

First things first. What’s general public sentiment around coal and coal investments right now? Bad. Only some niche investment in metallurgical coal producers among pro and pro-am investors. That’s not a good sign, but hey, maybe I’m smarter than the market... /2

First things first. What’s general public sentiment around coal and coal investments right now? Bad. Only some niche investment in metallurgical coal producers among pro and pro-am investors. That’s not a good sign, but hey, maybe I’m smarter than the market... /2

For example, in the second half of 2016, we produced about 1.4% more coal than we did in the second half of 2017. 2/

For example, in the second half of 2016, we produced about 1.4% more coal than we did in the second half of 2017. 2/