President @bitwiseinvest. Bitcoin, Markets, Crypto, ETFs, startups, cured meats, pastries.

How to get URL link on X (Twitter) App

https://twitter.com/teddyfuse/status/1976973083992027461

https://x.com/diogenes/status/1976947177520808270

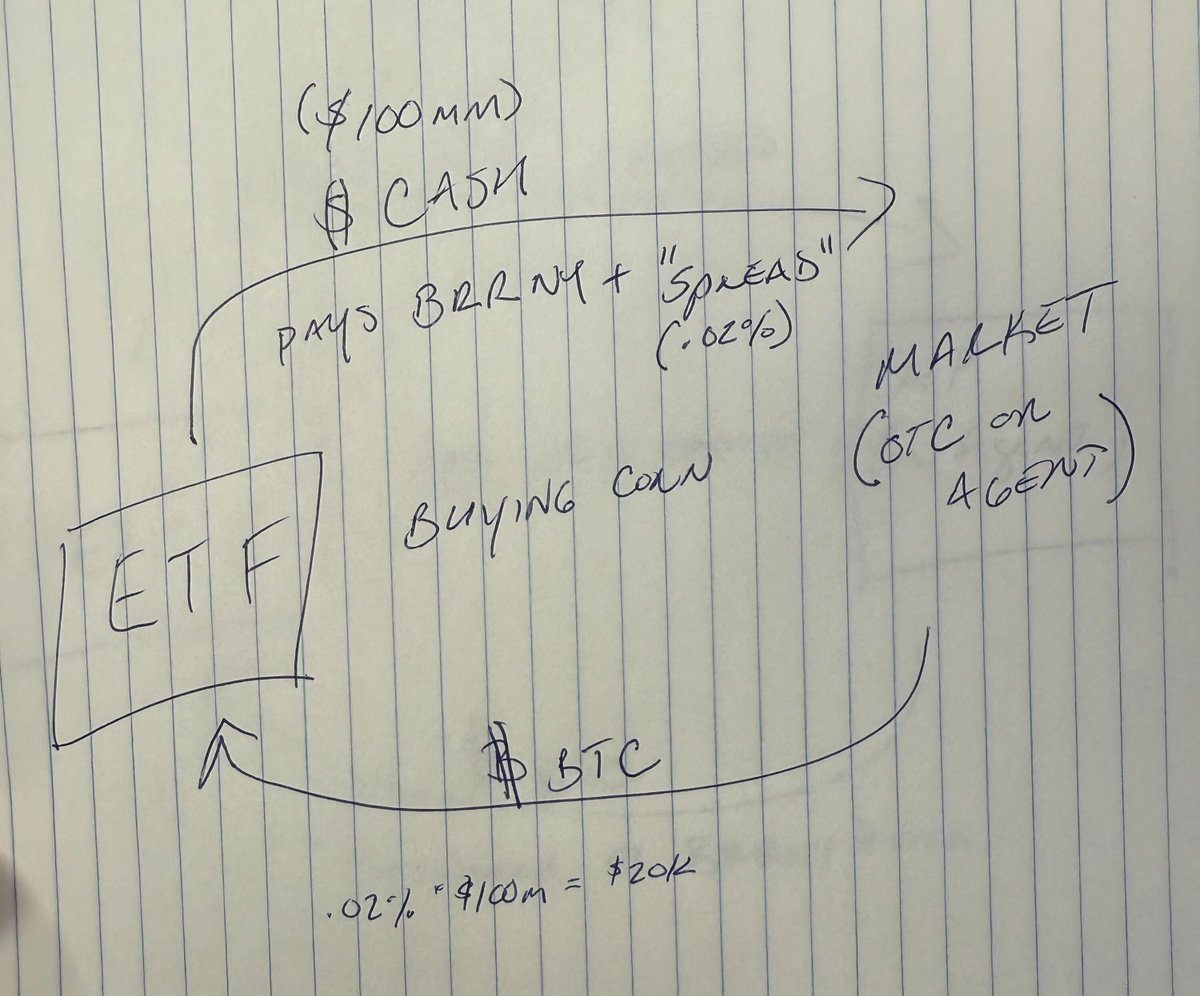

https://twitter.com/EricBalchunas/status/1950298621473091864Let's break down how it works now.

https://x.com/teddyfuse/status/1763583355994456295

https://twitter.com/sashahodler/status/1800238174528000240First, need to grok the account-architecture at Coinbase and differences between how the two settle.

https://twitter.com/TylerDurden/status/1790941726544478602First need to understand how the account-architecture at Coinbase works.

https://x.com/teddyfuse/status/1763577899506921632

https://x.com/teddyfuse/status/1763583355994456295?s=20

https://x.com/teddyfuse/status/1760287707018793420?s=20