DFW Housing & Economic Analyst. As seen on Fox Business and Bloomberg. Boston Marathon Qualifier. Media Inquiries: amynixonmedia@gmail.com

How to get URL link on X (Twitter) App

But what if it’s not a bomb this time?

But what if it’s not a bomb this time?

Stubborn sellers were holding out, there was a large upcoming young demographic, and supply was lagging demand

Stubborn sellers were holding out, there was a large upcoming young demographic, and supply was lagging demand

For more details on this crazy story, follow @BowTiedBroke

For more details on this crazy story, follow @BowTiedBroke https://twitter.com/bowtiedbroke/status/1766190969110626805

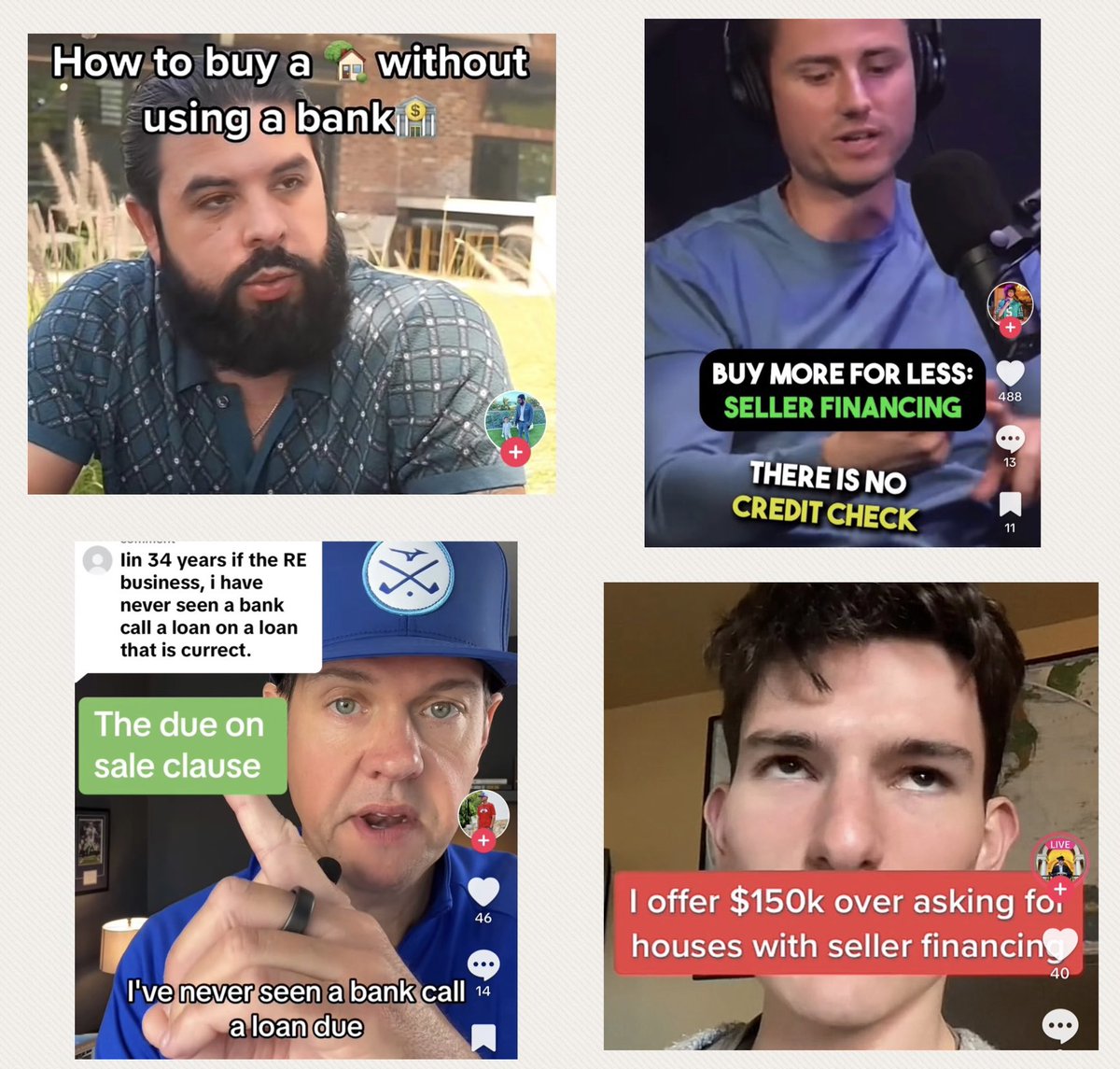

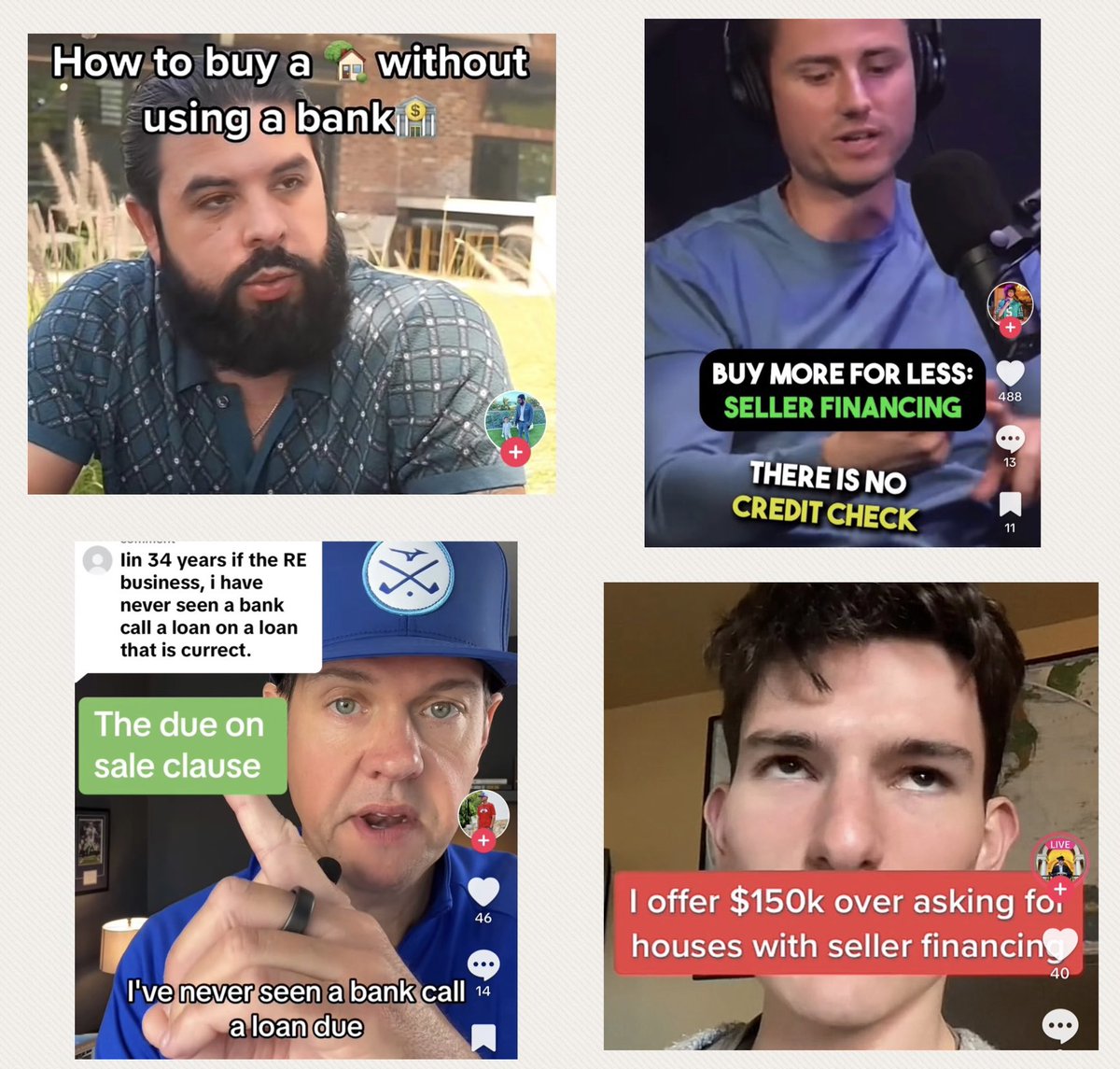

What is Seller financing?

What is Seller financing?

Data sourced from Zillow and Inside Airbnb

Data sourced from Zillow and Inside Airbnb