the people’s gambling champion

https://t.co/Ne6Mr6Sg7q

105 subscribers

How to get URL link on X (Twitter) App

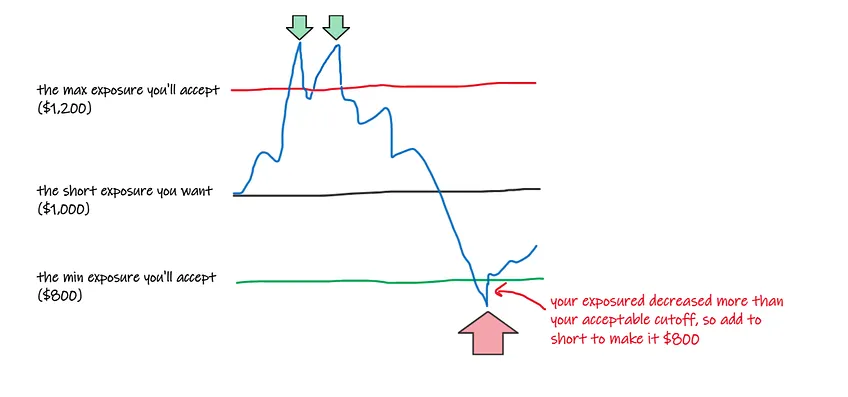

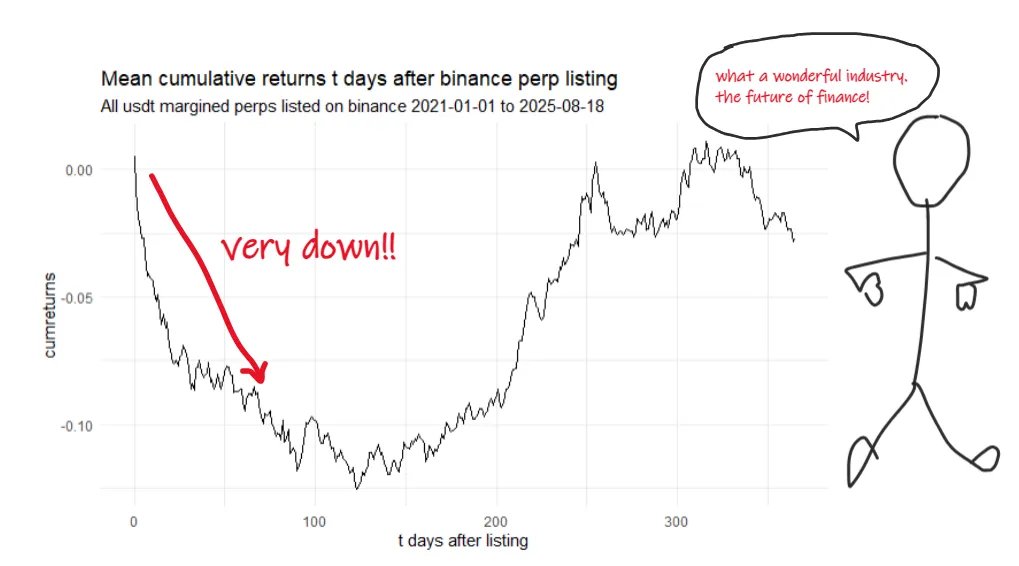

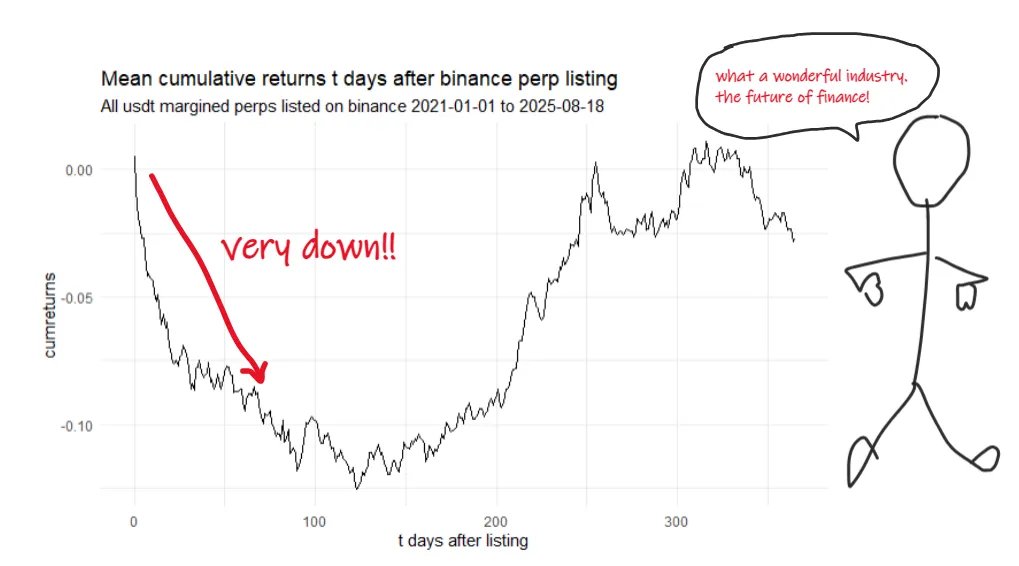

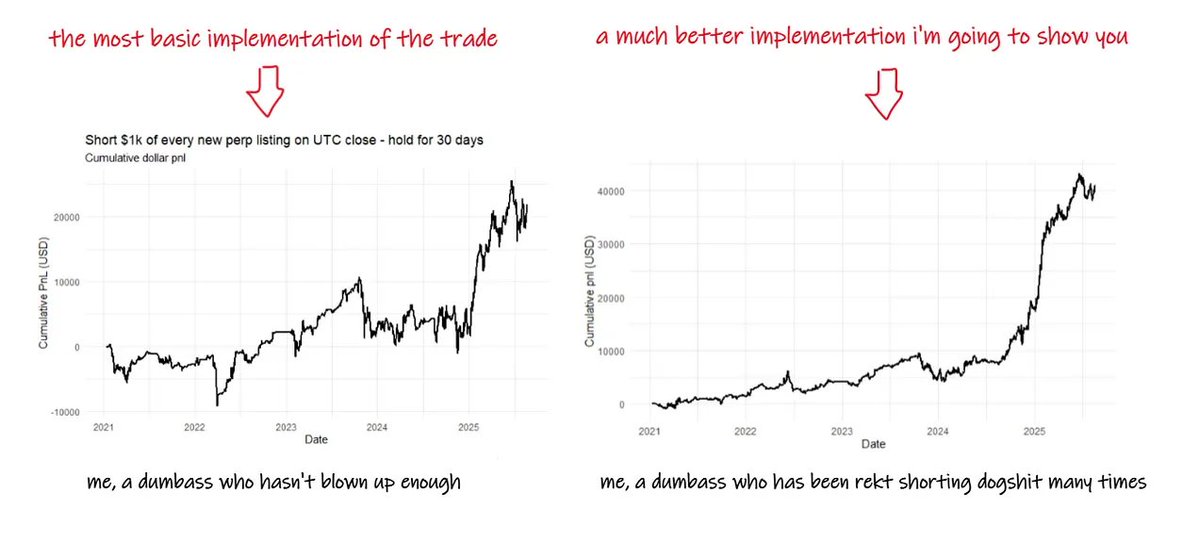

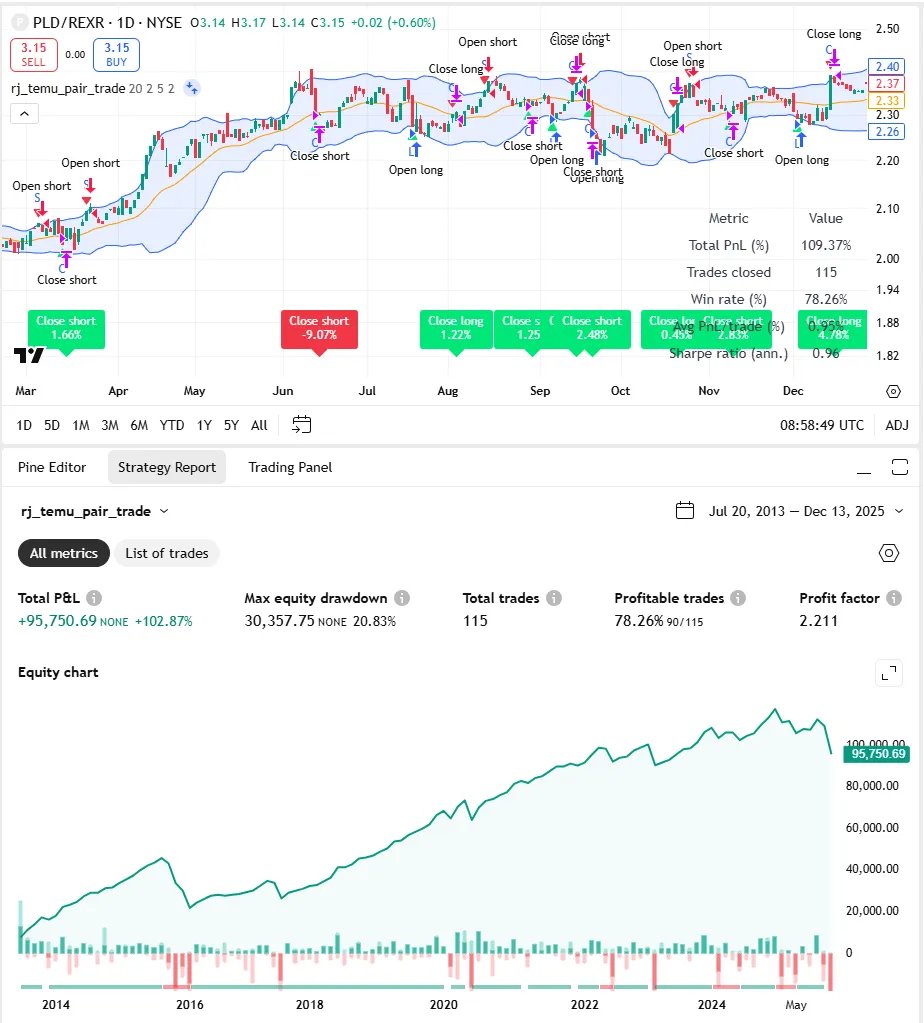

in this article i show you how a naive approach to trading this kinda works, but is strewn with blow up risk.

in this article i show you how a naive approach to trading this kinda works, but is strewn with blow up risk.

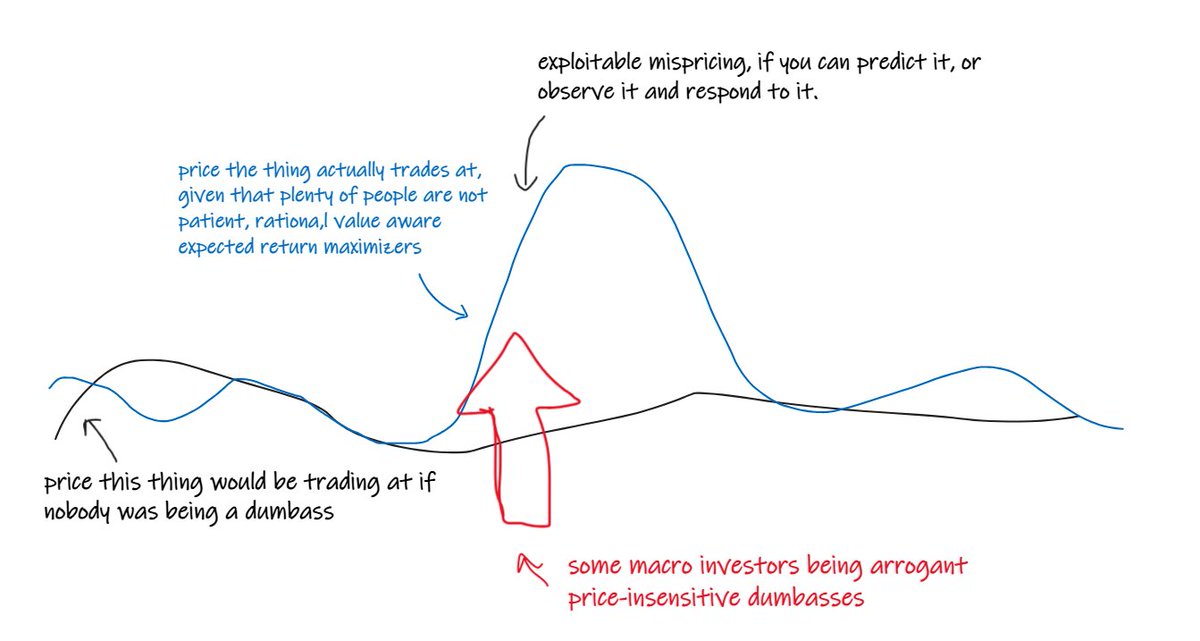

when the proverbial excrement really hits the proverbial fan, a lot of shit starts dislocating in very clear and obvious ways.

when the proverbial excrement really hits the proverbial fan, a lot of shit starts dislocating in very clear and obvious ways.

i’m going to tell you what pairs trading is.

i’m going to tell you what pairs trading is.

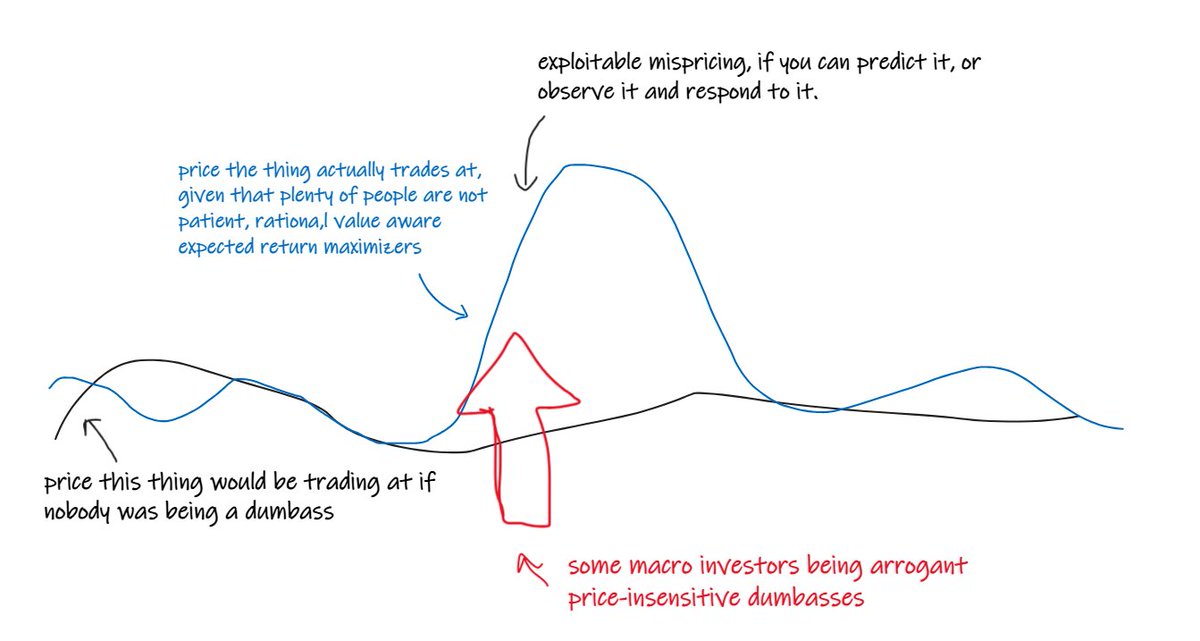

your job as trader, operating in an efficient, competitive market, is to tell yourself that your idea about that is probably bullshit.

your job as trader, operating in an efficient, competitive market, is to tell yourself that your idea about that is probably bullshit.

highlighly scientifically, i looked at etfdb and picked 15 active / tactical ETFs based on their name and category.

highlighly scientifically, i looked at etfdb and picked 15 active / tactical ETFs based on their name and category.

https://twitter.com/dampedspring/status/1790834572743073947

that the median case is to fail straight away should be self-evident.

that the median case is to fail straight away should be self-evident.https://twitter.com/TaschaLabs/status/1782123826685382930seasonal regularities do exist in markets but you ain't gonna find them like this.

https://twitter.com/AgustinLebron3/status/1770094306583536035the main reason for this is luck.

if you approach trading in a gung-ho manner, it's basically like playing in a tennis competition with djokovic.

if you approach trading in a gung-ho manner, it's basically like playing in a tennis competition with djokovic.