UK economy. Trade. Brexit.

Associate Professor @LSEEcon. Trade programme @CEP_LSE. Research Fellow @cepr_org.

3 subscribers

How to get URL link on X (Twitter) App

We study the period between referendum in June 2016 & UK leaving EU in 2020

We study the period between referendum in June 2016 & UK leaving EU in 2020

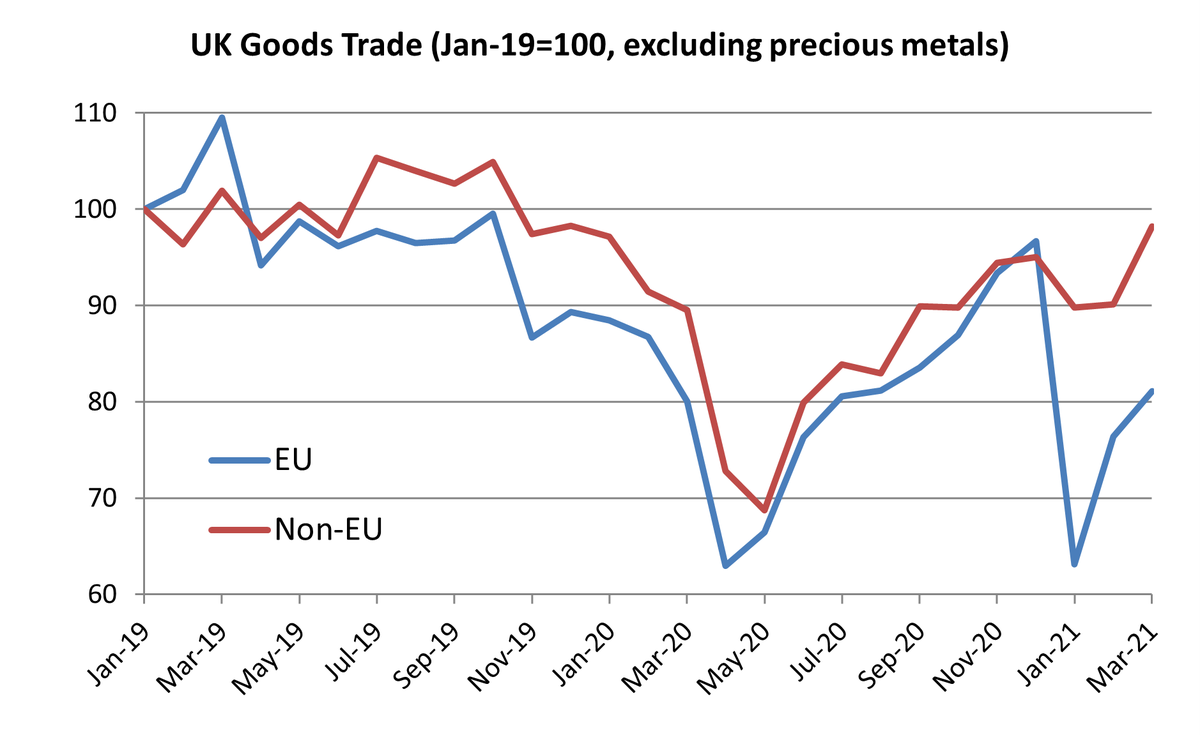

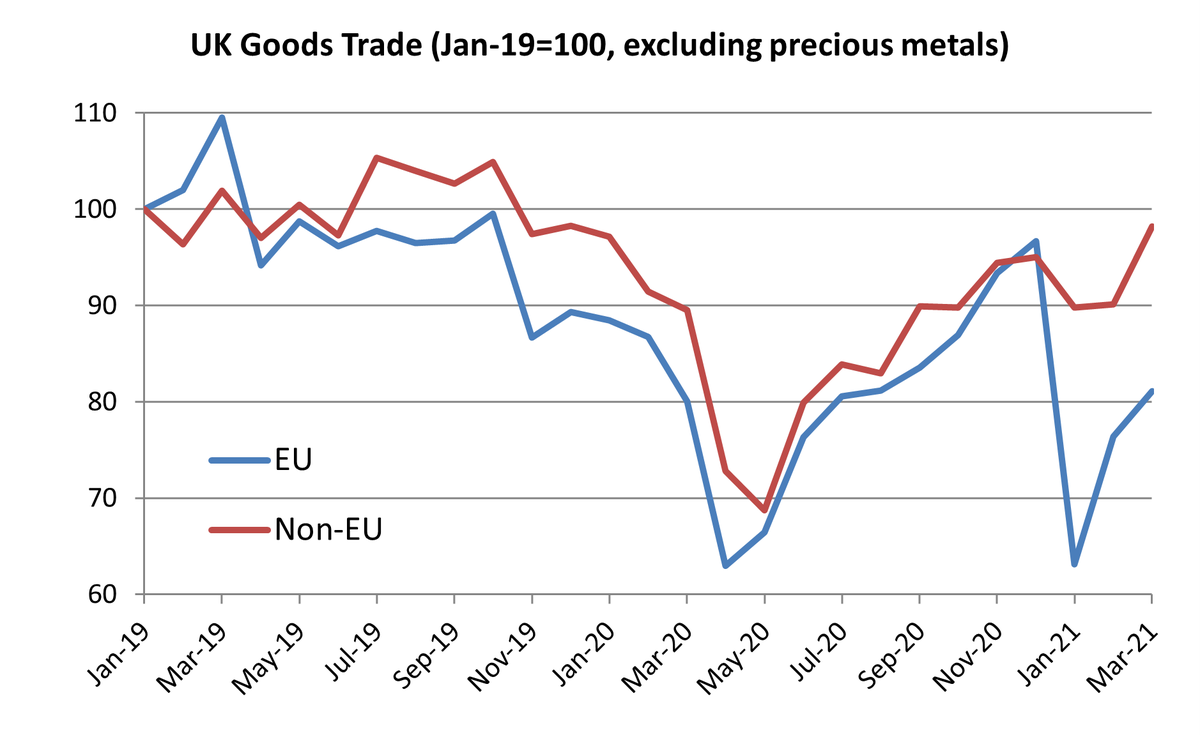

And, surprisingly, this fall has happened before UK introduces customs checks on EU imports

And, surprisingly, this fall has happened before UK introduces customs checks on EU imports

Exports are lower than pre-TCA and pre-Covid, but the decline is similar for EU and non-EU exports

Exports are lower than pre-TCA and pre-Covid, but the decline is similar for EU and non-EU exports

As Covid-19 has similar effects on EU & non-EU trade, comparing changes with EU vs non-EU gives a rough estimate of the Brexit effect.

As Covid-19 has similar effects on EU & non-EU trade, comparing changes with EU vs non-EU gives a rough estimate of the Brexit effect.

https://twitter.com/jdportes/status/1234253114682880001

Using techniques from computational linguistics, paper measures whether firms are positive or negative about Brexit (which the paper calls 'Brexit Sentiment') and how much risk firms face because of Brexit 2/

Using techniques from computational linguistics, paper measures whether firms are positive or negative about Brexit (which the paper calls 'Brexit Sentiment') and how much risk firms face because of Brexit 2/