How to get URL link on X (Twitter) App

1. First off, why does the first 2 weeks matter

1. First off, why does the first 2 weeks matter

1. First off, what is Price's Law?

1. First off, what is Price's Law?

1. First off

1. First off

1. First off, here is how to orient yourself to it.

1. First off, here is how to orient yourself to it.

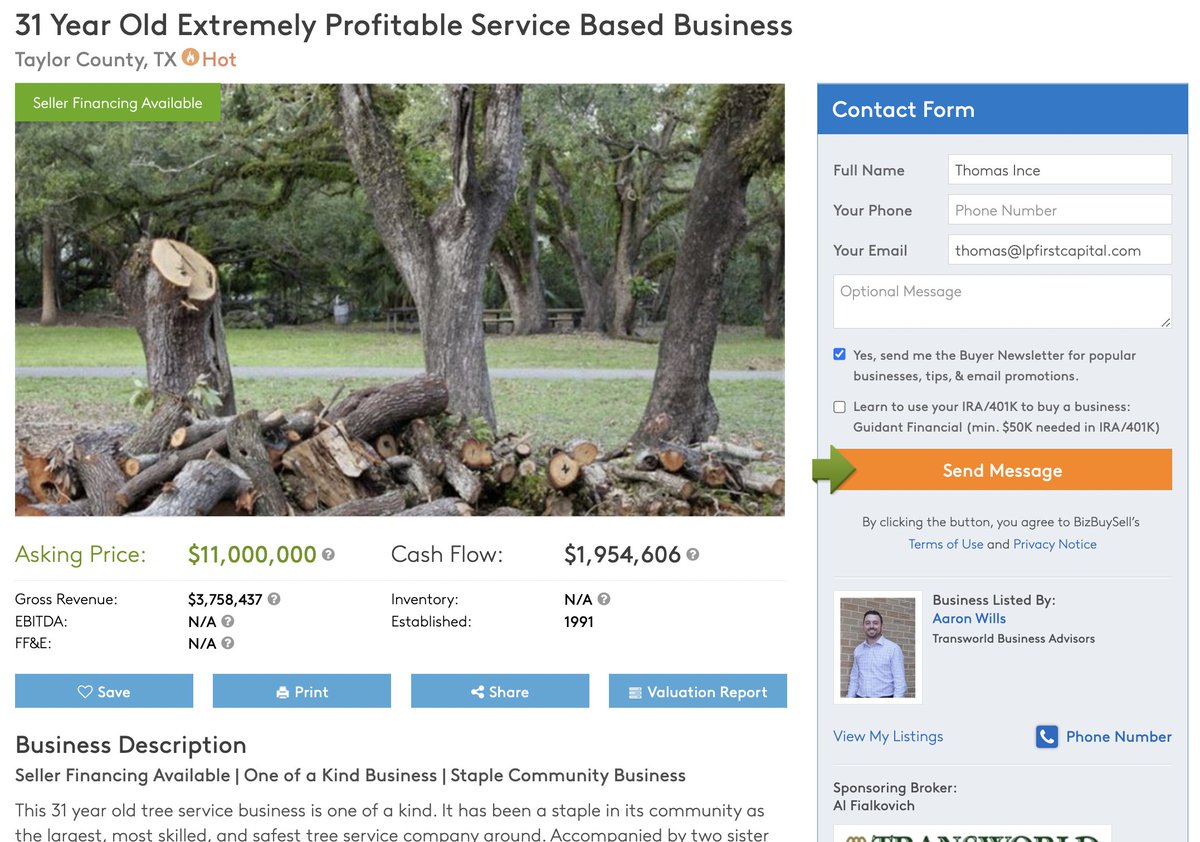

First off, I'm not a debt guy nor expert. We have all-stars on our team that have worked on the lending side, and I lean on them. My perspectives here are for the SMB guys looking to scale and starting graduate from SBA lenders

First off, I'm not a debt guy nor expert. We have all-stars on our team that have worked on the lending side, and I lean on them. My perspectives here are for the SMB guys looking to scale and starting graduate from SBA lenders

Tweet is to just show that it takes a lot of travel and sacrifice . We all try to be home at 5 for dinner /family, but there are times we have to sacrifice

Tweet is to just show that it takes a lot of travel and sacrifice . We all try to be home at 5 for dinner /family, but there are times we have to sacrifice

1. Dry Powder

1. Dry Powder

2. Commercial Plumbing with a focus on Sewers and Backflow

2. Commercial Plumbing with a focus on Sewers and Backflow

First off, I don't know John. Met him once briefly.

First off, I don't know John. Met him once briefly.

Here is the creator, good work!

Here is the creator, good work!

Winning Moves is great book on value creation useful to anyone buying a business. Especially micro PE and searchers

Winning Moves is great book on value creation useful to anyone buying a business. Especially micro PE and searchers

1. High Gross Margins

1. High Gross Margins

1. You are willing to take action b/c you know that you don't have many weeks left. Why not make it the life that you want to live.

1. You are willing to take action b/c you know that you don't have many weeks left. Why not make it the life that you want to live.