@UofGlasgow @UCL economics alum | Eurozone economist @OxfordEconomics | Views & typos mine (who else's?)

tomdvorak on the blue app

How to get URL link on X (Twitter) App

Konkrétně carryover - tedy o kolik by ekonomika vyrostla oproti loňskému roku, i kdyby celý letošek mezikvartálně stagnovala - je 0,9 p.b.

Konkrétně carryover - tedy o kolik by ekonomika vyrostla oproti loňskému roku, i kdyby celý letošek mezikvartálně stagnovala - je 0,9 p.b.

Podobně jako většina měsíců v letošním roce, i srpen byl nebývale špatný. Nárůst počtu nezaměstnaných byl - s výjimkou pandemického roku 2020 - druhý nejhorší za posledních 20 let po roce 2009, kdy probíhala finanční krize.

Podobně jako většina měsíců v letošním roce, i srpen byl nebývale špatný. Nárůst počtu nezaměstnaných byl - s výjimkou pandemického roku 2020 - druhý nejhorší za posledních 20 let po roce 2009, kdy probíhala finanční krize.

We find that monetary policy has a very different impact across sectors. In an ideal world, the ECB would be able to target its policy to sectors that are driving underlying inflation. But with a relatively blunt tool in the policy interest rate, this isn't possible.

We find that monetary policy has a very different impact across sectors. In an ideal world, the ECB would be able to target its policy to sectors that are driving underlying inflation. But with a relatively blunt tool in the policy interest rate, this isn't possible.

https://twitter.com/EU_Eurostat/status/1664195084336652288First thing to note is that employment really did outpace its historical relationship with GDP by some margin, particularly the upside Q1 surprise. Employment rebounded quickly after the pandemic and has been going from strength to strength since.

Retail sales remain barely above the pre-pandemic levels and way below pre-pandemic trend.

Retail sales remain barely above the pre-pandemic levels and way below pre-pandemic trend.

But it's the uniform weakness across essentially all breakdowns that's worrying. For the eurozone aggregate, food & beverages and non-food goods posted a large monthly decline. Only fuel sales - a small part of the headline - picked up, helped by easing fuel prices.

But it's the uniform weakness across essentially all breakdowns that's worrying. For the eurozone aggregate, food & beverages and non-food goods posted a large monthly decline. Only fuel sales - a small part of the headline - picked up, helped by easing fuel prices.

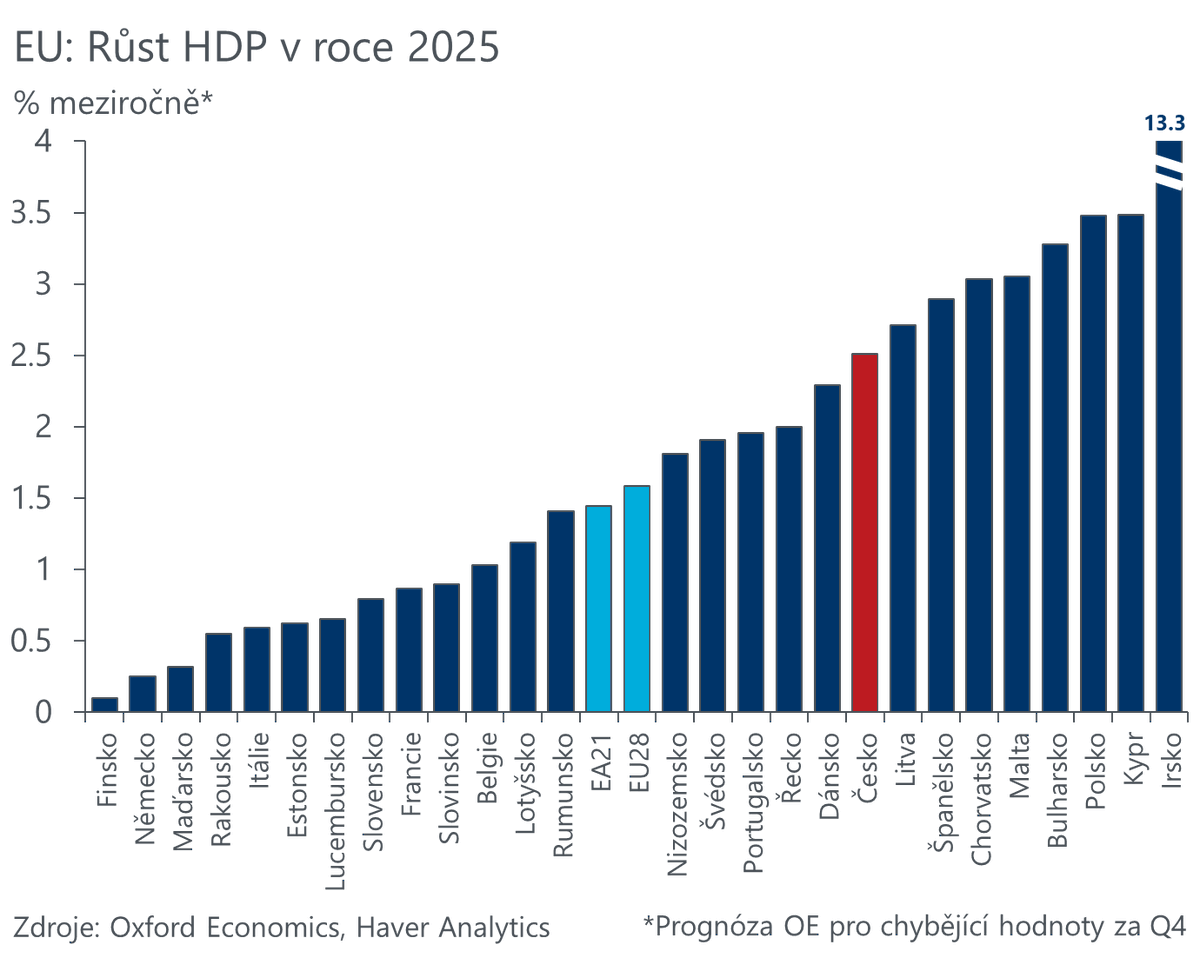

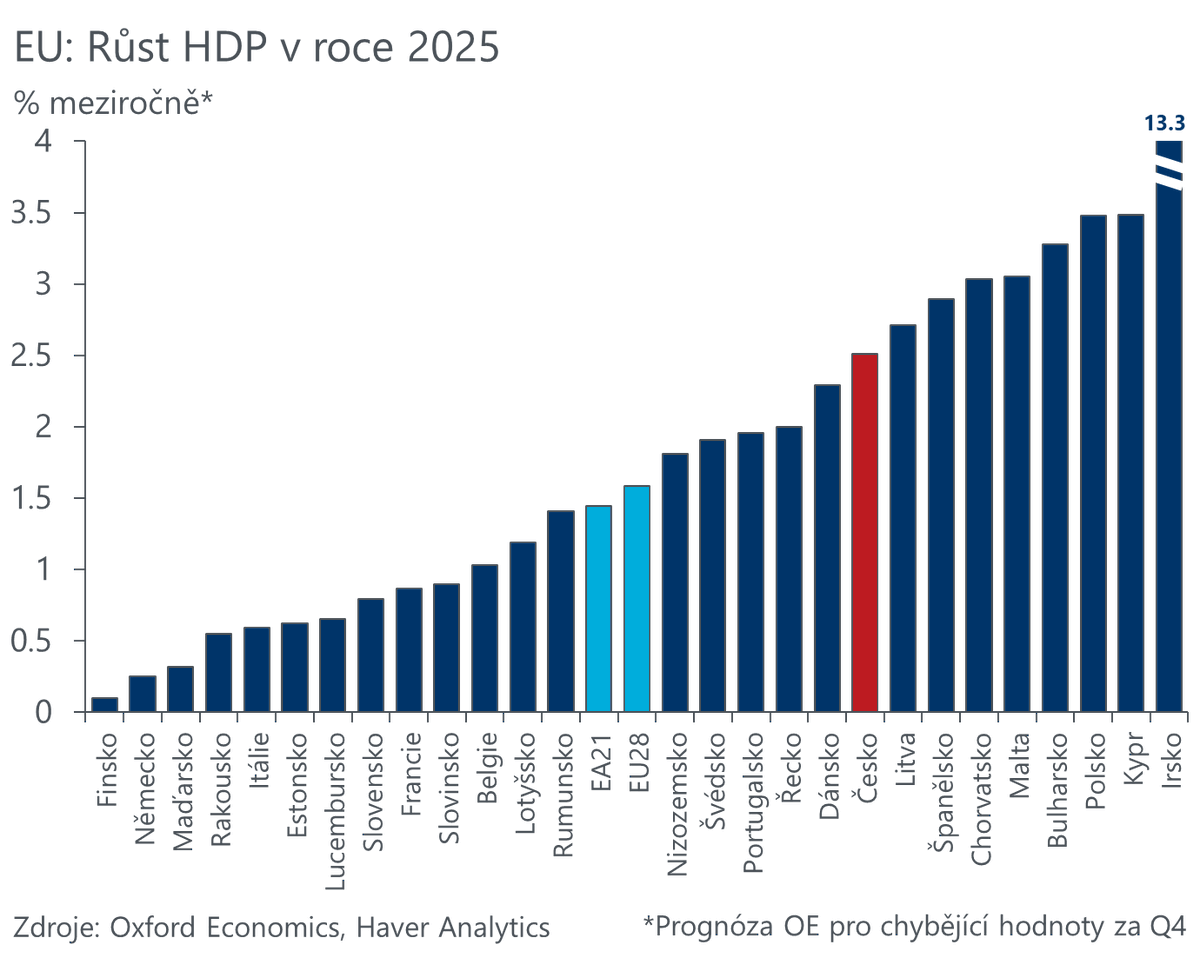

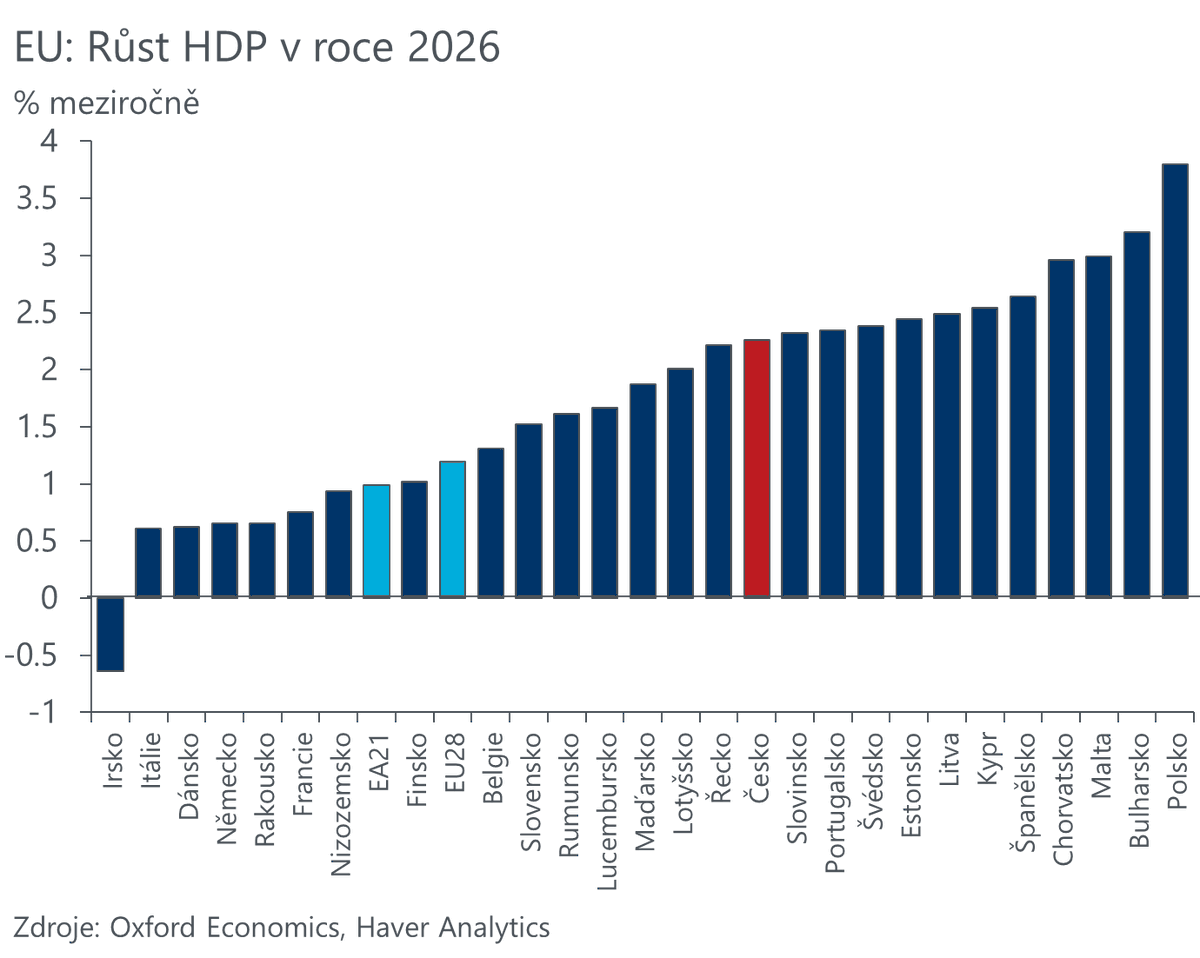

In Autumn, most forecasts moved to expect recession over the winter. But recent positive data prompted upwards revisions. Flash Q4 GDP gave little clarity – ex. Ireland, it showed output stagnant & overall likely flattered by trade prices, while domestic demand weakened.

In Autumn, most forecasts moved to expect recession over the winter. But recent positive data prompted upwards revisions. Flash Q4 GDP gave little clarity – ex. Ireland, it showed output stagnant & overall likely flattered by trade prices, while domestic demand weakened.