Bakersfield. Petroleum Engineer CA PE. Economics & Business. Colorado School of Mines Grad. Views are solely my own & unaffiliated with any organization.

How to get URL link on X (Twitter) App

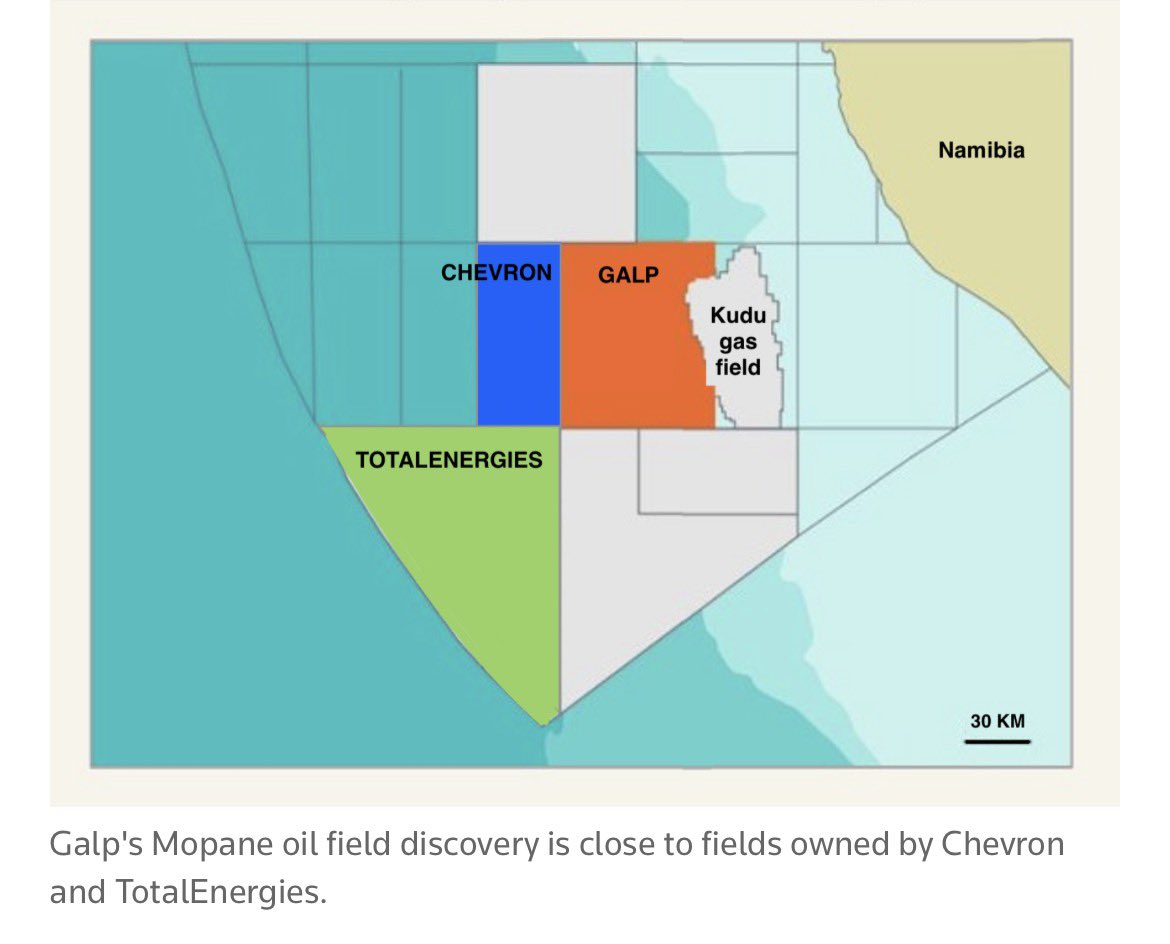

It could also lead to a deal up in PEL87 where Pancontinental $PCL.AX $PCOGF & Sintana $SEI.V $SEUSF have been looking for an operator.

It could also lead to a deal up in PEL87 where Pancontinental $PCL.AX $PCOGF & Sintana $SEI.V $SEUSF have been looking for an operator.

Basics

Basics

Basics

Basics