I invest in great companies with long growth runways trading at reasonable prices.

How to get URL link on X (Twitter) App

Spoiler: I’m addressing in depth the power dynamics between IWG and office owners and draw parallels with the hotel industry, where value creation at management companies (Hilton/ Marriott) has far outpaced returns to hotel owners or hotel REITs.

Spoiler: I’m addressing in depth the power dynamics between IWG and office owners and draw parallels with the hotel industry, where value creation at management companies (Hilton/ Marriott) has far outpaced returns to hotel owners or hotel REITs.

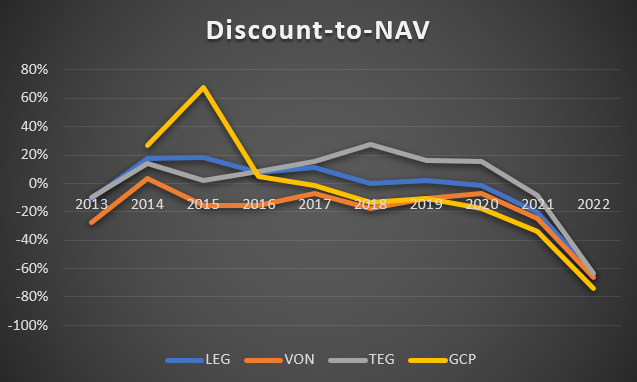

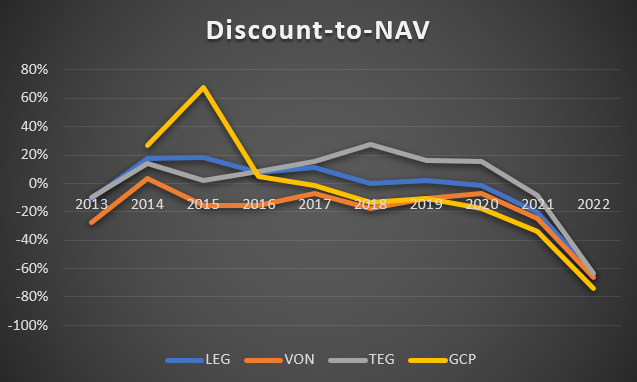

2/ Key stocks to watch: Vonovia, LEG Immobilien, TAG Immobilien, and Grand City Properties. They're trading at deep discounts to NAV, providing an attractive entry point for investors.

2/ Key stocks to watch: Vonovia, LEG Immobilien, TAG Immobilien, and Grand City Properties. They're trading at deep discounts to NAV, providing an attractive entry point for investors.

This banking crisis will not end before the FED pivots hard

This banking crisis will not end before the FED pivots hard https://twitter.com/value_invest12/status/1635017815727181824

Banks borrow short term to lend out long term. This transformation of maturities relies on the stickiness of customer deposits.

Banks borrow short term to lend out long term. This transformation of maturities relies on the stickiness of customer deposits.

Meta should return to significant revenue growth next year, overcoming temporary macro-, IDFA-, and short video challenges.

Meta should return to significant revenue growth next year, overcoming temporary macro-, IDFA-, and short video challenges.

Not only does Zillow’s (traditional) IMT segment throw off substantial free cash flow, it also brings them closer to the transaction in terms of finding potential buyers and sellers.

Not only does Zillow’s (traditional) IMT segment throw off substantial free cash flow, it also brings them closer to the transaction in terms of finding potential buyers and sellers.