I am the founder and CIO of Verdad Advisers and author of The Humble Investor. Views are my own. Join our email list: https://t.co/QMgjwSLMeW

4 subscribers

How to get URL link on X (Twitter) App

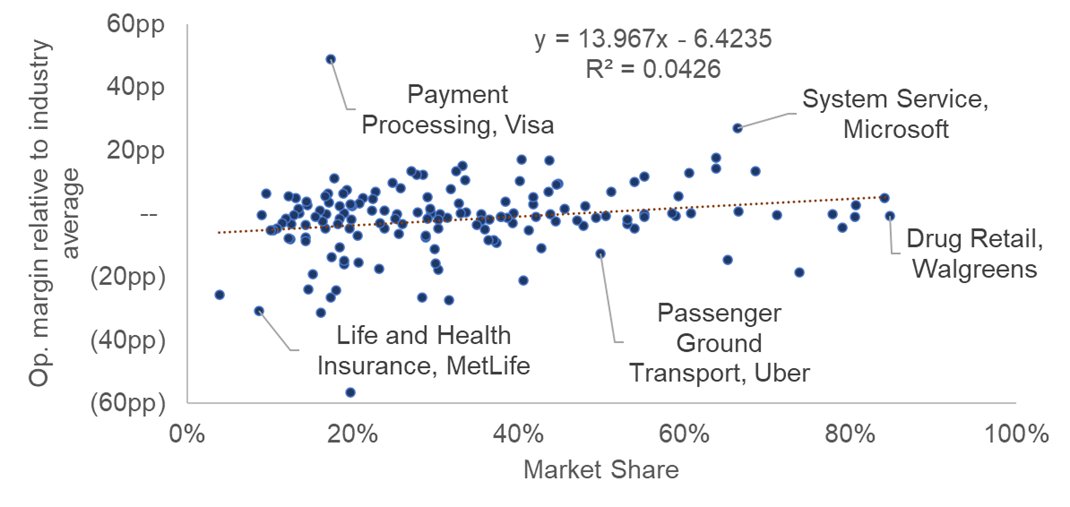

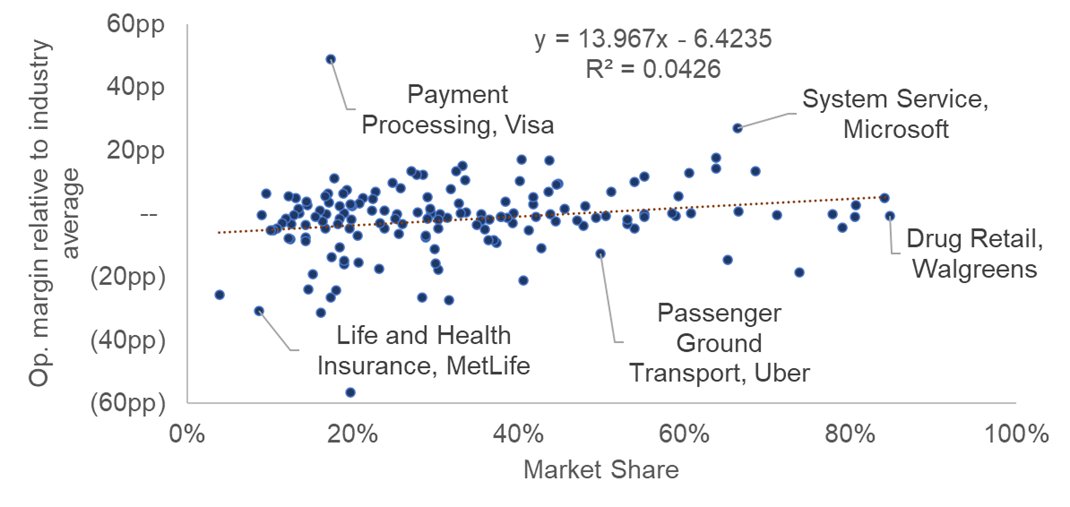

market share is not a consistent indicator of firm performance. And this finding holds true across industries, with many illustrating a negative relationship between market share and profitability - like retail:

market share is not a consistent indicator of firm performance. And this finding holds true across industries, with many illustrating a negative relationship between market share and profitability - like retail:

The level and direction of spread also predict returns across the full range of asset classes most investors trade. (Note the remarkable outperformance of small value equities (+39.3% annualized return!) in the recovery phase, when spreads are wide and falling (quadrant 1)

The level and direction of spread also predict returns across the full range of asset classes most investors trade. (Note the remarkable outperformance of small value equities (+39.3% annualized return!) in the recovery phase, when spreads are wide and falling (quadrant 1)

But growth has not always been so stable nor inflation so tame. And when those key economic drivers have behaved differently, results have been very different. Building on work by @RayDalio and @KeithMcCullough we can think of four quadrants of economic conditions.

But growth has not always been so stable nor inflation so tame. And when those key economic drivers have behaved differently, results have been very different. Building on work by @RayDalio and @KeithMcCullough we can think of four quadrants of economic conditions.