If your enemy is superior, evade him. If angry, irritate him. If equally matched, fight, and if not split and reevaluate.

How to get URL link on X (Twitter) App

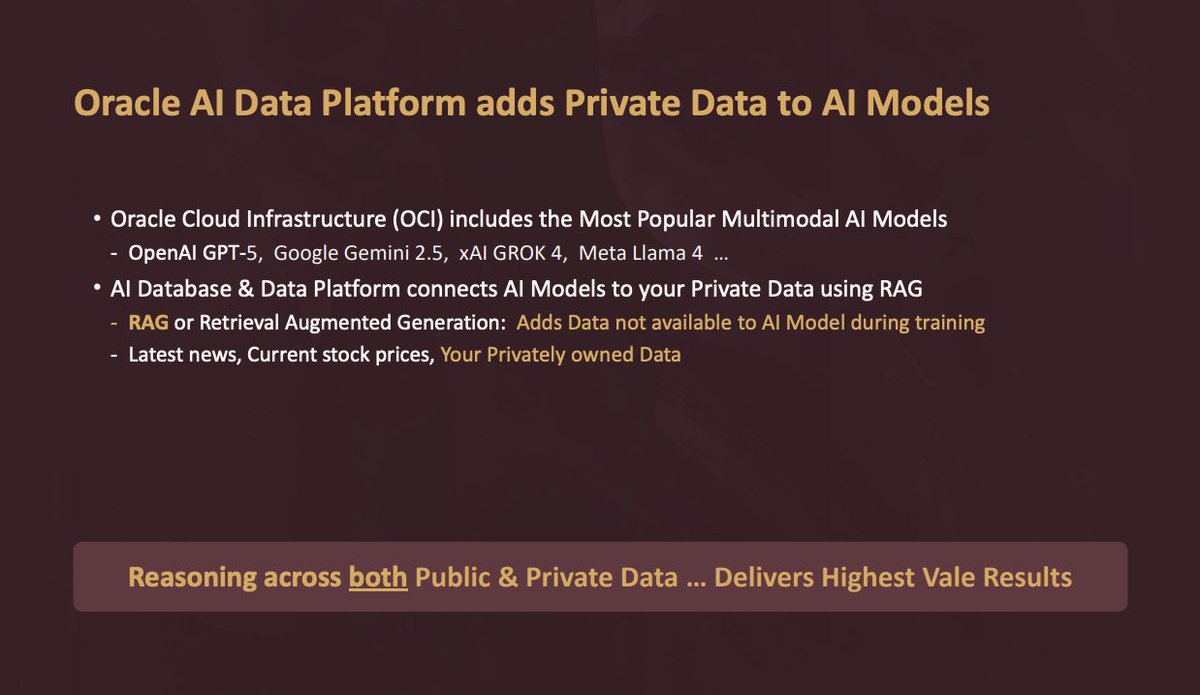

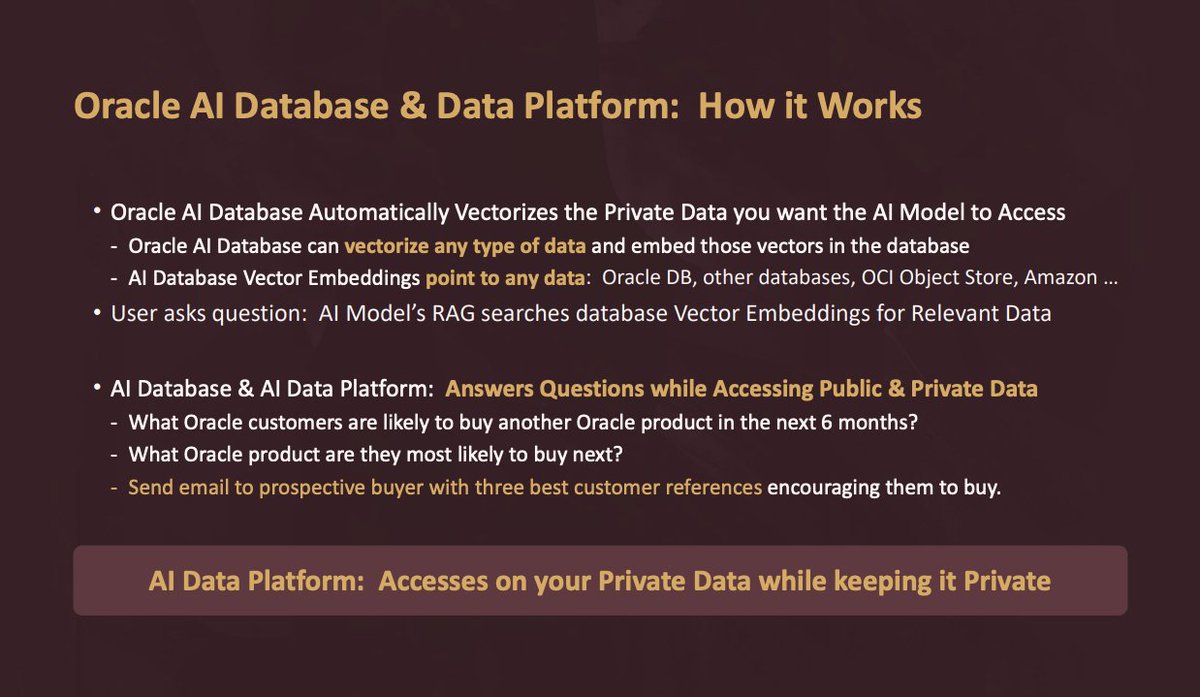

2/ RAG and why it changes where AI value accrues ⚙️

2/ RAG and why it changes where AI value accrues ⚙️

2/ RAG and why it changes where AI value accrues ⚙️

2/ RAG and why it changes where AI value accrues ⚙️

Investor Type I: Fear of Technology

Investor Type I: Fear of Technology

1/ 📡 Snapshot – What is $ADTN?

1/ 📡 Snapshot – What is $ADTN?

1/ 🌱 Snapshot: $FMC is a global leader in crop protection, offering:

1/ 🌱 Snapshot: $FMC is a global leader in crop protection, offering:

https://x.com/victor_privin/status/1603432510284861440

1️⃣ Let’s start with uranium.

1️⃣ Let’s start with uranium.

1/

1/