Chief Economist, First Trust LP. The Antidote to Conventional Wisdom. Eagle Scout. Former Chief Economist, Joint Economic Committee of the US Congress.

How to get URL link on X (Twitter) App

Companies make payroll, employees pay rents, mortgages, car payments, etc, etc. We’ve invented Zelle, Venmo and PayPal. Do you really think people are living monetary life more slowly? I don’t. Remember, velocity is a mathematical calculation M*V=GDP, or V = GDP/M2

Companies make payroll, employees pay rents, mortgages, car payments, etc, etc. We’ve invented Zelle, Venmo and PayPal. Do you really think people are living monetary life more slowly? I don’t. Remember, velocity is a mathematical calculation M*V=GDP, or V = GDP/M2

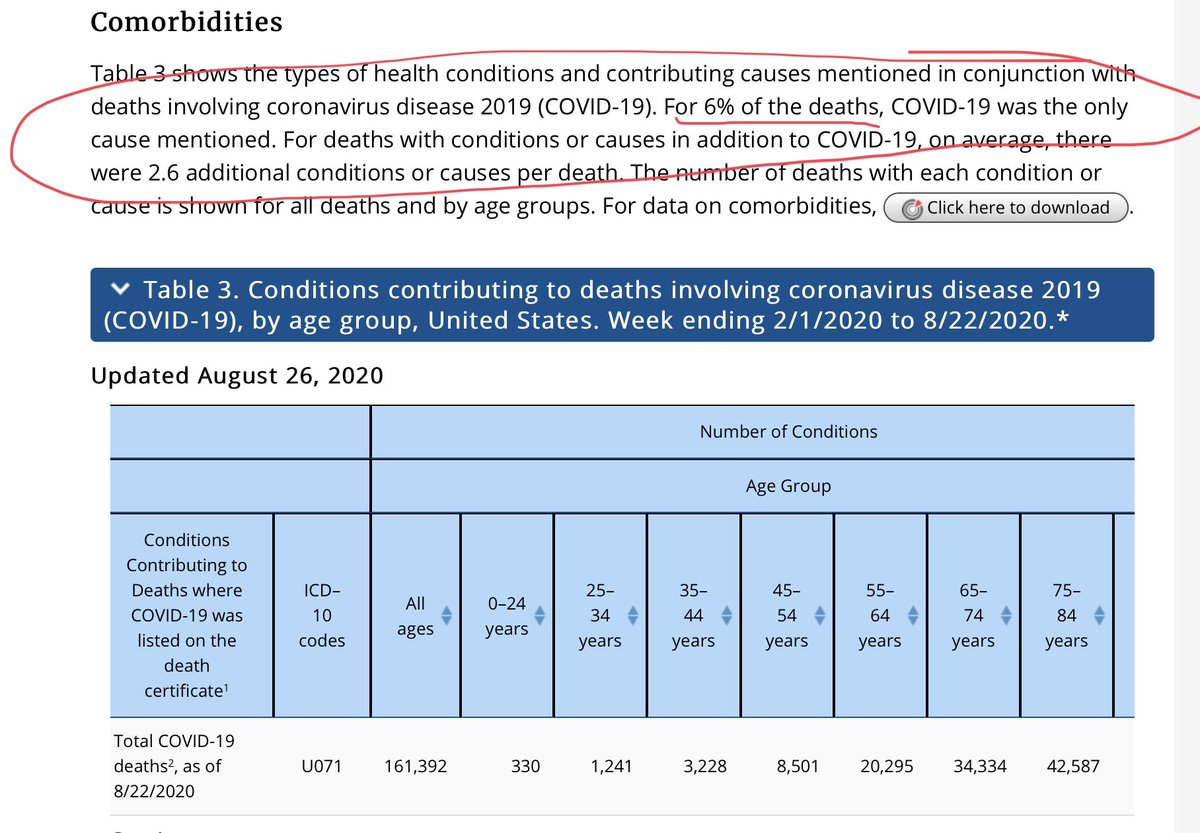

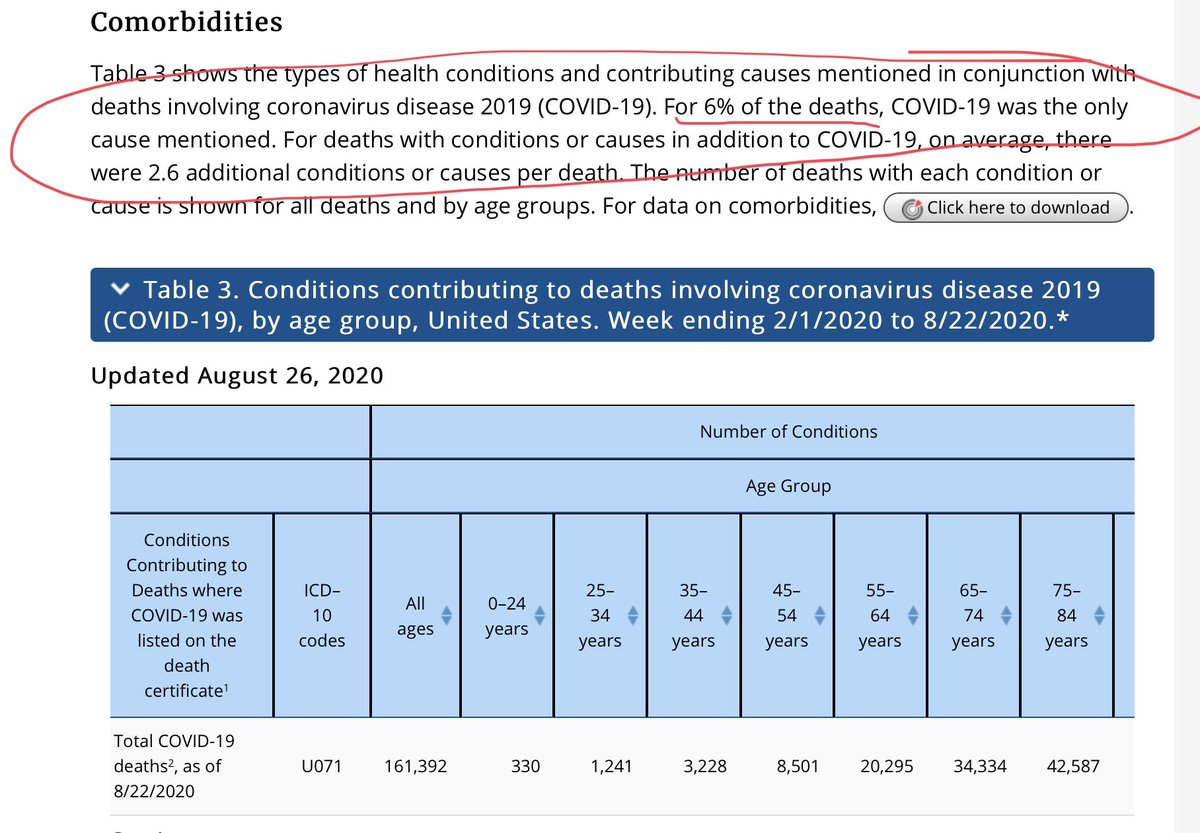

What this means is that someone with Alzheimer’s, Sepsis and a Cardiac Arrest was counted in COVID-19 death totals just because they tested positive. Even if they showed no symptoms of COVID or even if it was a “false positive.” 9,684 deaths is 0.16% of “confirmed” COVID cases.

What this means is that someone with Alzheimer’s, Sepsis and a Cardiac Arrest was counted in COVID-19 death totals just because they tested positive. Even if they showed no symptoms of COVID or even if it was a “false positive.” 9,684 deaths is 0.16% of “confirmed” COVID cases.