co-founder + partner @ Lux Capital | Trustee @SfiScience Santa Fe Inst | Founding Chair @CiPrep (Brooklyn) | Co-Founder of Carson, Quinn & Bodhi w/ @ltwolfe

87 subscribers

How to get URL link on X (Twitter) App

2/ We first teamed w/ @alexrives cofounder of EvolutionaryScale ~10yrs ago

2/ We first teamed w/ @alexrives cofounder of EvolutionaryScale ~10yrs ago

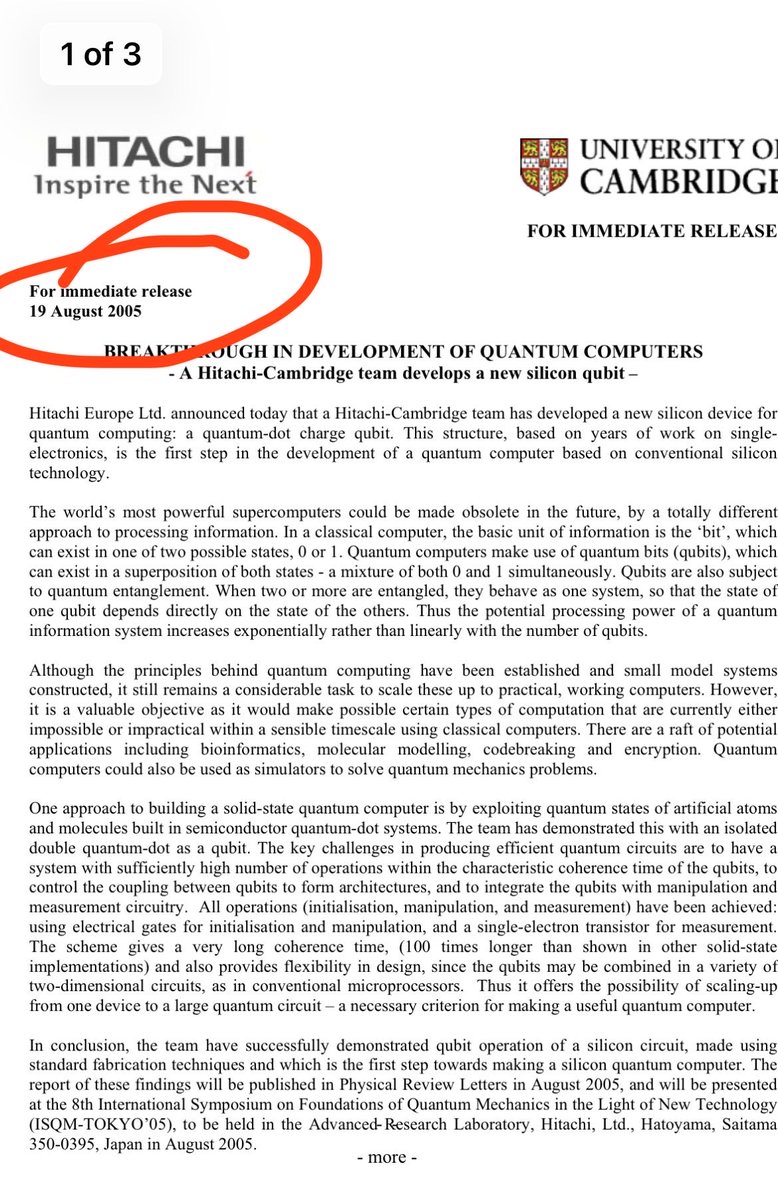

https://twitter.com/sundarpichai/status/19810137466981008112/ I could start in the 90s. But let's just go thru 20yrs of BULLSHIT

2/ THE BIG IDEA?

2/ THE BIG IDEA?

2/ Their new foundation model (WBM) trained not on noisy low-level sensor data––but on derived behavioral metrics via wearables

2/ Their new foundation model (WBM) trained not on noisy low-level sensor data––but on derived behavioral metrics via wearables

2/

2/

2/ Trump a few days ago

2/ Trump a few days ago

2/

2/

https://twitter.com/lux_capital/status/19209018695949026552/ The 🇨🇳CCP “2035 Science & Technology Vision” states unapologetically “original innovation is the sharpest blade.” coupling that declaration w/ vast subsidies, talent visas + procurement guarantees which have helped them take lead in 37 of 44 critical and emerging technologies!

https://twitter.com/ignacioaal/status/18654827243512874202/ this technical paper from Apple published year ago not widely discussed was the breadcrumb clue and the inspiration I have shared with many friends since....

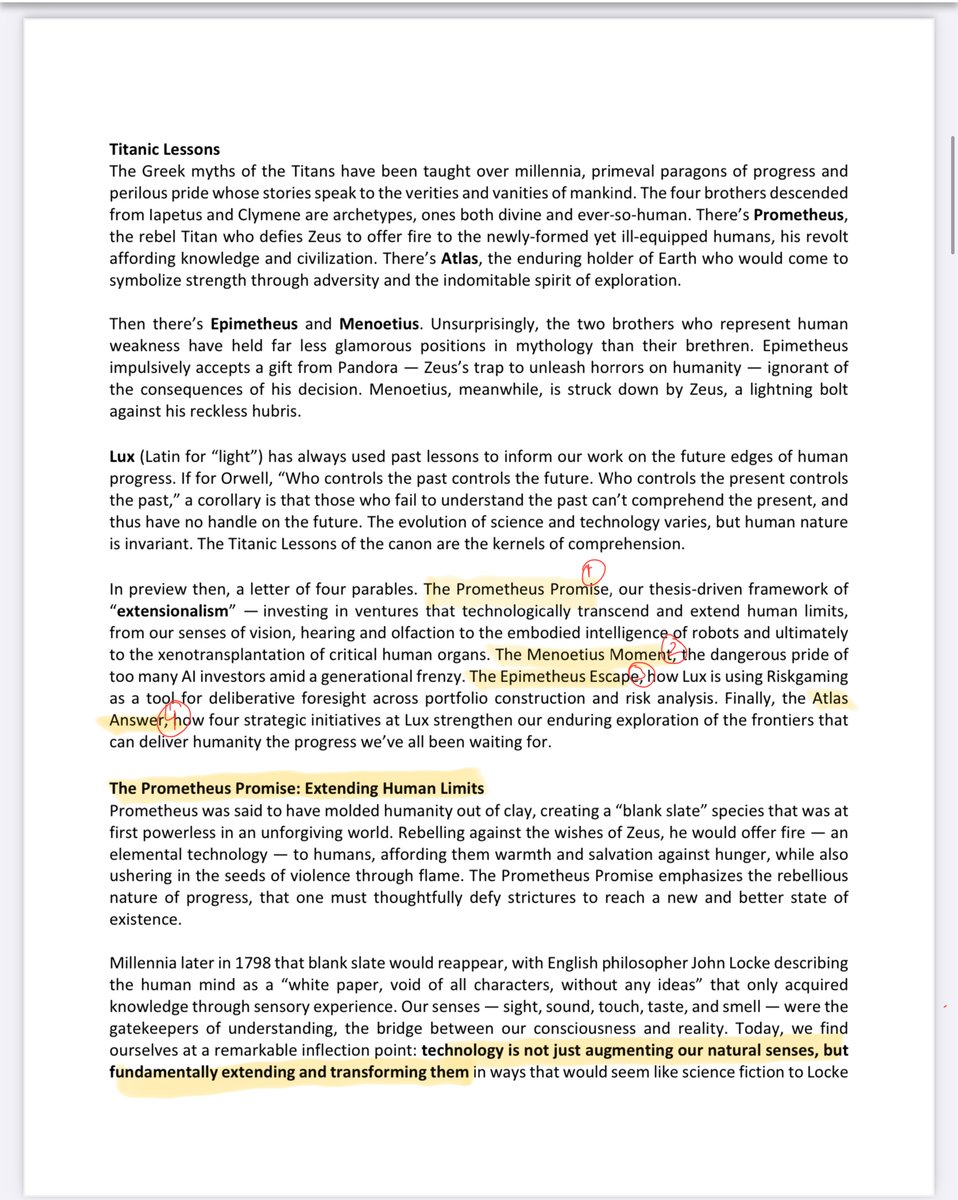

2/ The The Prometheus Promise––is Extending Human Limits what we call extensionalism

2/ The The Prometheus Promise––is Extending Human Limits what we call extensionalism